Mastercard (NYSE:MA) (NEOE:MA:CA) is one of the most important companies in the world, facilitating nearly $10 trillion in payments a year, nearly 10% of global GDP.

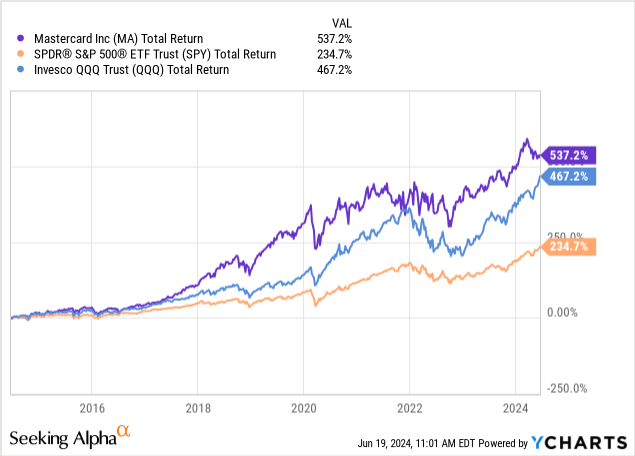

The company’s extraordinary growth rewarded long-term shareholders with exceptional returns, with the stock up almost 100x since its IPO.

That said, the drivers that brought Mastercard to where it is today aren’t necessarily the same drivers that will continue to lead the stock to success in the future.

Still, Mastercard is perceived by most investors as a cash-to-card play. Let’s explain why that is far from being correct.

Revisiting The Three-Legged Investment Thesis

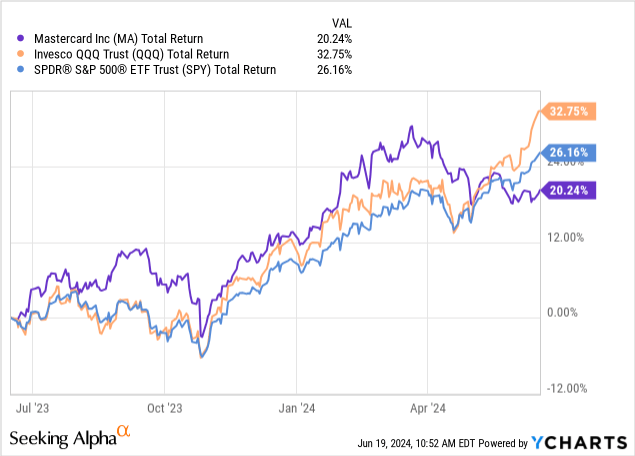

I’ve been covering Mastercard on Seeking Alpha since April of last year, maintaining a bullish rating throughout the period.

The company seems to be out of favor lately, as its resilient double-digit growth is being outshone by the AI-driven bull run.

Still, a 20% return over a 12-month period is nothing to complain about. If we take a step back, Mastercard is still outperforming both the Nasdaq 100 and the S&P 500 over the past decade.

It’s true that during the past decade, Mastercard and its long-time competitor Visa (V) have seen an increase in competitive pressures, as ambitious fintech companies and big tech are trying to get a bite from their pie. Still, none of these up-and-coming competitors are providing a true replacement for their trustworthy rails, and they end up becoming partners in most cases.

So, in short, my investment thesis in Mastercard is based on three key factors. One, cash-to-card is still an ongoing trend, it might be getting closer to saturation, especially in developed markets, but there’s still a significant runway left. This is what many investors believe is the entirety of Mastercard’s business.

Two, new flows, which we’ll discuss in detail later. It’s Mastercard’s (and Visa’s) attempt to enter new payment categories besides consumers.

Three, value-added services, which we’ll also dive into later. These are adjacent services, primarily digital, that Mastercard provides for risk, security, marketing, data, and more.

Today’s Mastercard Is Different Than What Many Think

If you ask a random person what is Mastercard’s business, they’ll probably say it is a credit card company that charges a hefty fee to facilitate payments.

This very familiar business is still Mastercard’s main source of revenue. However, with the shift from cash to digital reaching maturation, the future growth of this business will naturally be lower than in the past.

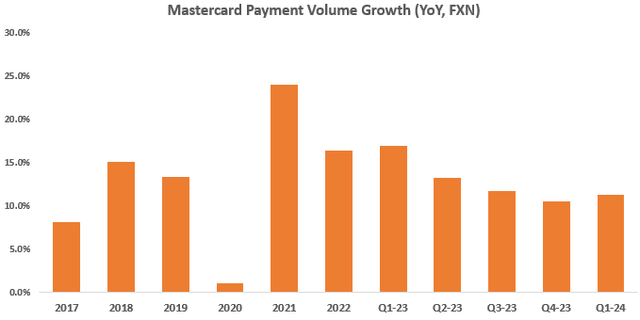

Created by the author based on data from Mastercard financial reports.

Don’t get it twisted, though, payment volumes are still growing at a double-digit pace, and Mastercard’s related revenues are still growing at a high-single-digit pace.

This is a highly profitable part of the company, with still decades of runway left. However, Mastercard’s growth, as well as stock performance, is becoming increasingly dependent on its new businesses.

Interestingly, just like investors underestimated the company’s opportunities in consumer payments, I believe they are making the same mistake with New Flows and Value Added Services.

New Flows

Mastercard (and Visa) defines New Flows as all transactions it facilitates that are not the regular consumer-to-merchant. Mastercard does not provide estimates for the size of those markets, but Visa does.

According to Visa, the consumer payments market is sized at $40 trillion (in payment volumes), while New Flows is a $200 trillion opportunity. New Flows include business-to-business, business-to-consumer, government-to-consumer, and many more.

Mastercard doesn’t break down its revenues from this vertical, but management did say on the Q1’24 call that new flow transactions increased 40% Y/Y.

Value Added Services

These services are a set of diversified solutions across fraud, data, analytics, consulting, marketing, loyalty, identity, and open banking. Interestingly, just like Visa and Mastercard built essentially identical consumer payments businesses, it seems like they are building very similar service businesses as well.

It’s important to keep in mind that many of these separate businesses leverage Mastercard’s presence in the payments value chain, its relationships with financial institutes, and its extremely valuable data.

So while there’s less differentiation and higher competition here, the competitive advantage of cross-selling and the actual capabilities, as well as the quality of the service, aren’t that easy to replicate.

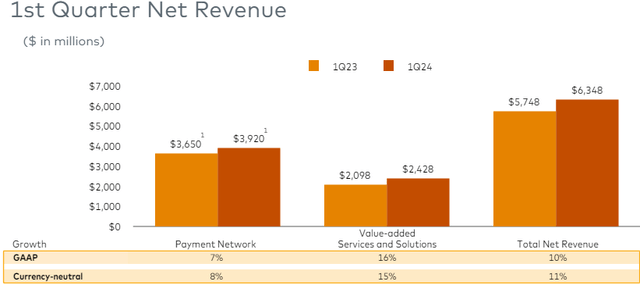

Mastercard Q1’24 Presentation

In Q1’24, value-added services accounted for 38% of Mastercard’s revenues, growing 16%, much faster than the rest of the business.

Two Important Metrics Investors Should Be Familiar With

Mastercard’s revenues have a lot of complexity underlying them. It’s not the typical transaction between a service provider and its customer. That is even more true regarding the payment business.

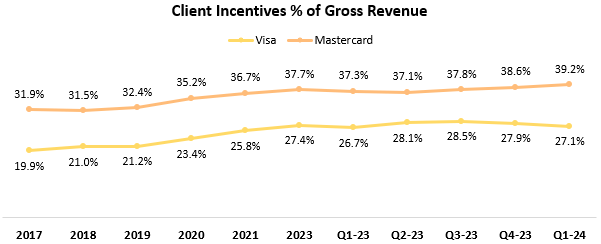

The first key metric I think not enough investors understand is client incentives, which should be measured as a percentage of gross revenue.

Both Mastercard and Visa have arrangements with their clients, which are generally card issuers, under which they pay them rebates to incentivize them to use their networks.

Generally speaking, Mastercard and Visa offer solutions that are essentially identical, and therefore, much of the competition comes down to the financial incentives.

Created by the author based on data from Visa and Mastercard financial reports; Periods are on a calendar basis.

As we can see, Mastercard is much more aggressive with its incentives, reaching nearly 40% of gross revenues in Q1’24. This is a strategic decision made by Mastercard’s management, who is willing to sacrifice profits to win clients. Still, this doesn’t result in a huge discrepancy in the companies’ growth, and this is a key reason why I prefer Visa over Mastercard.

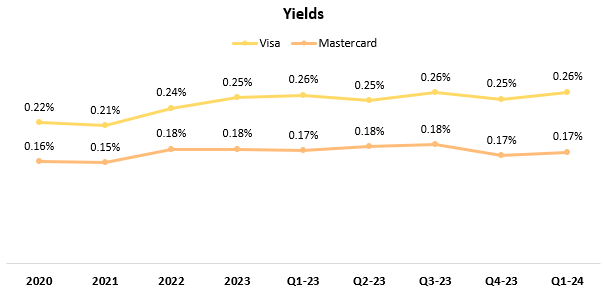

Created by the author based on data from Visa and Mastercard financial reports; Periods are on a calendar basis.

Another key metric to look at is yields. The yields reflect the amount of payment processing revenue Visa and Mastercard generate per payment. For instance, Mastercard facilitated $2.3 trillion in total volume in Q1’24, and its payment network revenues were $3.9 billion, reflecting a 0.17% yield.

As we can see, this compares badly to Visa, which has a significantly higher yield.

Valuation & Growth Trajectory

Investing in Mastercard today is investing in three separate but intertwined businesses.

There’s the core consumer payments business, which should continue to grow at a high-single-digit pace for the foreseeable future, and there are New Flows and Value Added Services, which should grow at a mid-teens pace for a long time.

All these businesses are exceptionally profitable, with Mastercard showcasing profit margins in the high forties.

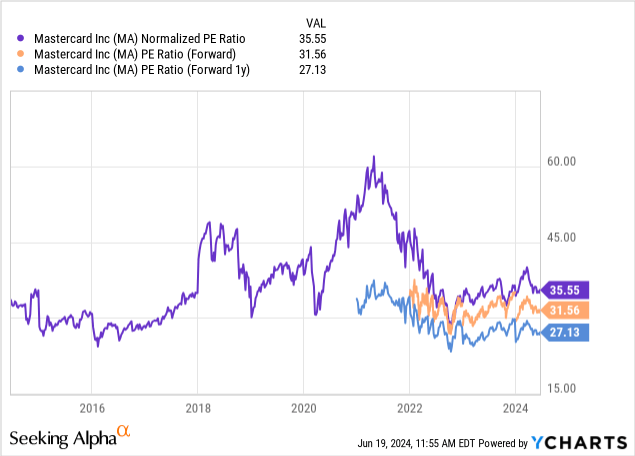

Mastercard is currently trading at a historically low valuation, with its multiples ~15% below their 5-year average. Visa is trading at a similar discount.

There are several reasons the market seems to become a bit less optimistic about these two giants. One, cash-to-card in developed markets is reaching a more mature stage, which means the “easy” growth is now over.

Two, the regulatory landscape isn’t too convenient, with a large settlement currently under debate, and allegations of lack of competition constantly resurfacing.

Three, growth is much more reliant on businesses that are not as immune to competition.

Still, Mastercard is one of the strongest double-digit growth stories in the market, and I see a low probability for the company’s multiple to continue to compress. Even if it does, the mid-teens EPS growth should very easily lead to market-beating returns (unless the market continues to rise 50% every year).

I do prefer Visa over Mastercard (which I’ll discuss in my Visa article), but I estimate Mastercard’s fair value at $500 a share, based on a 30x multiple on 2025 EPS.

Conclusion

Mastercard is trading at a historically low valuation, unlike the market, which is trading at peak levels.

In my view, the market is making the same mistake it did many years ago when it underestimated the consumer payments opportunity.

Mastercard is the strongest player (alongside Visa) across all the verticals it participates in, and the opportunities in each of those are huge.

I expect the company to continue to grow EPS at a mid-teens pace for the foreseeable future.

As investors become increasingly confident about the new flows and value-added services businesses, I estimate a multiple expansion as well.

Therefore, I reiterate a Buy rating, expecting 12% upside by early 2025.

Read the full article here

Leave a Reply