iShares Core Dividend Growth ETF (NYSEARCA:DGRO) is a flawed dividend growth fund. Because of this, I deem it unsuitable as an allocation for my dividend growth investing.

The DGRO Pitch

iShares offers a few reasons why investors should buy DGRO

- Low-cost exposure to dividend growth

- Diversified industries

- Companies with sustained dividend growth

- Suitable at the core of an income-seeking portfolio

They passively track the Morningstar Dividend Growth Index. Let’s dig into the index methodology.

Morningstar Dividend Growth Index

To be included in the index, it must pass the following rules and filters:

- Not a REIT

- Not in the top 10% of dividend yield

- Forward expected payout ratio less than 75%

- 5 years of dividend growth with a current payout

- Dividends can stay the same provided there is a net share buyback Positions are dividend-dollar weighted

At first glance, this looks like a sensible and easy-to-understand dividend growth strategy. What are the specifics I don’t like?

Sustainable Dividend Growth

In my books, there are two types of dividend growth – sustainable and unsustainable growth.

Sustainable growth is one that closely follows long-term fundamental growth such as sales, cashflows, and profit. If dividend growth is exceeding this, chances are it is unsustainable.

High unsustainable growth is usually the result of a stock starting with a microscopic dividend and bumping up the payout ratio. But this can also occur with larger blue-chip stocks trying to mask anemic long-term fundamental growth. Take General Dynamics as an example.

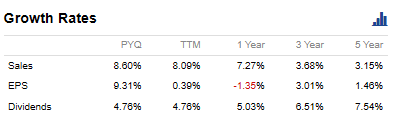

Look at the compound annual growth rates of General Dynamics (GD). In particular, the 5-year CAGR of sales, EPS and dividends.

Portfolio123

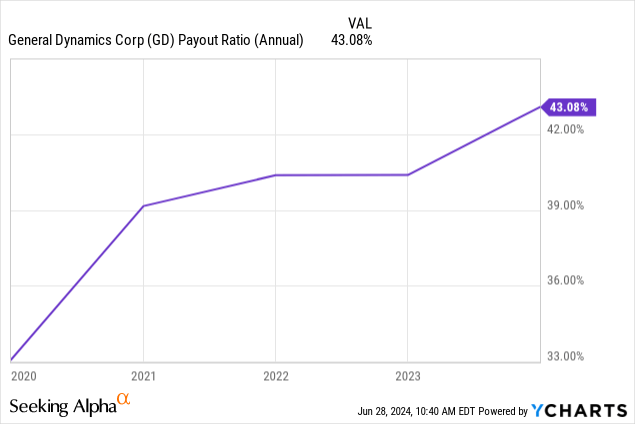

The dividend growth exceeds the sales and EPS growth. The only way that is possible is if they are steadily increasing the payout ratio to manage the dividend. Below is the annual payout ratio of GD.

Unless something changes with GD, the dividend growth associated with it is not sustainable long-term. Now, GD isn’t an extreme case. They can carry on for many years in the same fashion, and maybe fundamental growth will pick up to match the dividend growth. The dividend growth is still modest.

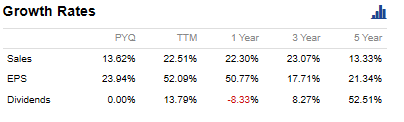

A more extreme example found in DGRO is Quanta Services (PWR). Here we have a 5-year dividend growth rate of 52.5%. Let’s quickly compare the 5-year growth rates.

Portfolio123

This is not sustainable dividend growth. The dividend yield is a measly 0.13%. This makes it easy to raise the dividend for a flashy 5-year dividend growth rate. But is 0.13% yield even an income stock that should be included in a dividend fund? It seems like the company is gaming the system to be included in various dividend funds where it doesn’t fit.

And herein lies the problem with transparent, rules-based passive index funds. Everyone knows the rules in advance. It is possible for companies to manage their dividends and gain exposure to a large fund when they do not fit the profile of what many income investors want.

Too Many Tiny Yields

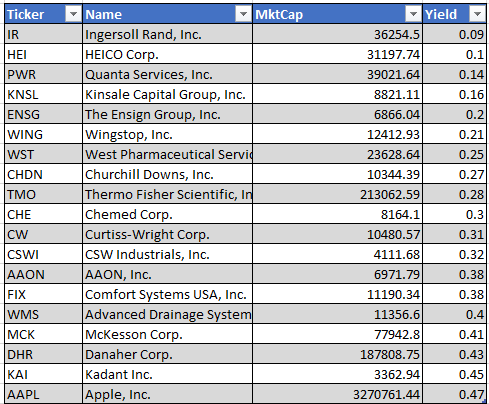

Here is just a sample of some of the stocks which have very small dividend yields in DGRO.

Portfolio123

DGRO spent a lot of time and effort removing potentially high and unsustainable dividends with a yield and payout filter. But why didn’t they add some minimum rules as well? Screen out the bottom 10 – 20% of dividend yields and payout ratios?

There are far too many companies that pay small dividends with tiny payout ratios in the fund. Yes, these firms do pay dividends. But shouldn’t the index have a yield threshold to be labeled a ‘dividend stock’ to prevent companies from paying a ridiculously small dividend and somehow be allowed induction to income funds?

Dividend Growth or Dividend Size?

DGRO is labeled as a dividend growth fund. One would expect that the weighting methodology would also favor dividend growth. But it doesn’t. The positions are dividend-dollar weighted.

What this means is that the companies paying the largest total dividend receive the largest weighting. Naturally, the largest firms will be paying the largest dividends. This gives the fund a size tilt. The effect of the size tilt without any other filtering process is that you will have more mature stocks, many with so-so dividends, and with mediocre to low dividend growth.

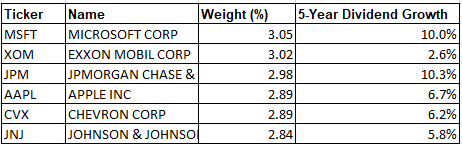

These are the largest holdings in DGRO.

iShares

The highest-weighted positions have dividend growth of 10% and under. This isn’t a recipe for high dividend growth going forward.

DGRO vs SCHD

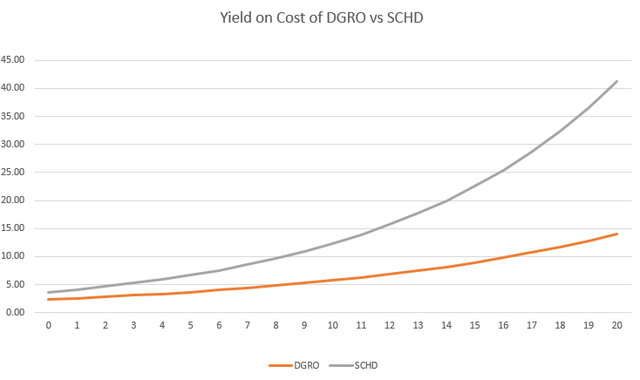

Let’s compare two dividend funds: DGRO and SCHD. We will take the portfolio dividend growth and the portfolio dividend yield and project a future yield on cost if these metrics are maintained.

DGRO

- 5-year dividend growth rate 9.3%

- Current yield 2.37%

SCHD

- 5-year dividend growth rate 12.88%

- Current yield 3.66%

Yield on Cost Projections of DGRO vs SCHD (Portfolio123)

In 20 years, your yield on cost for SCHD could be at 41.3%. This means that $100,000 invested today might be producing $41,300 in annual income by 2044. This same investment in DGRO might only produce $13,970 in dividend income.

Nobody knows what the future holds, and this doesn’t take into consideration capital gains. Still, the numbers don’t look very promising for DGRO which is purported to be a dividend growth fund.

Conclusion

DGRO is not a suitable dividend growth fund for me. It allows in too many low-yielding stocks, which I don’t feel belong in a dividend fund. The fund makes great efforts to screen out higher yields but allows very low yields to be present. As well, the size tilt gives added weight to many large companies where the best dividend growth cycles are well behind them.

There are far better options for income investors wanting to grow their dividends for retirement. While I cannot speak about the price return of DGRO and its potential, I can say that for dividend investing, this one is a hard pass for me.

Read the full article here

Leave a Reply