Introduction

I wanted to revisit Global Payments (NYSE:GPN) as it has been well over a year since I last covered the company when I gave it a buy rating. The company’s share price is back to where it was a year ago, which prompted me to see what has driven the company’s underperformance in the broader markets. The company has been growing at a steady pace while improving its margins across the board, so the drop doesn’t seem to be justified in my opinion. The acquisitions may not be helping its margins yet, but I am expecting improvements over the next year or two. This pessimism towards the company is why I am reiterating my buy recommendation and expect this to pass in the next 12 months, unless we are going to enter into broad market issues and see profit-taking occur.

Briefly on Financial Performance

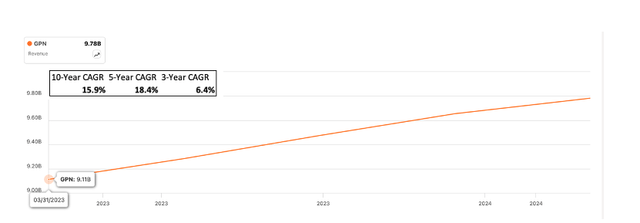

Over the last year, the company continued its steady top-line growth. The company averaged around 7% in the previous 5 quarters, which is in line with its 3-year CAGR, but much slower than its 5 or 10-year CAGR. It makes sense, since the customer may be less inclined to spend in such a tough macroeconomic environment, plagued with high interest rates and sticky inflation, so even such growth is commendable.

Seeking Alpha, Author

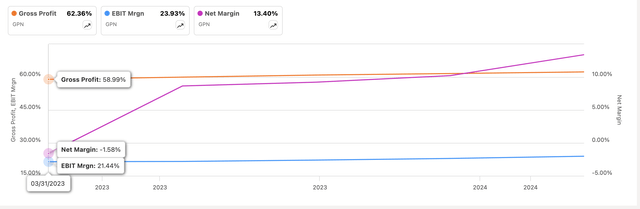

In terms of margins (GAAP), we can see a vast improvement on the bottom line, while gross and EBIT margins only a slight improvement. GAAP metrics distort some of the numbers slightly, especially the bottom line, which we can see was heavily affected in Q1 ’23 by the loss on business disposition regarding the sale of Netspend business. Nevertheless, a positive trend is apparent in the company’s profitability and efficiency, even in what many would consider a tough environment for consumers.

Seeking Alpha

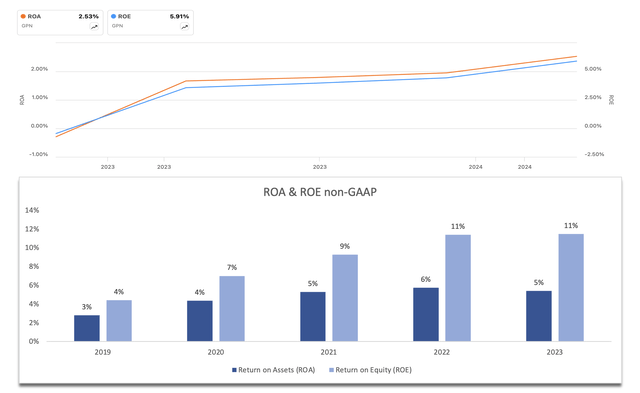

Continuing with efficiency and profitability, the company’s ROA and ROE are exhibiting a similar trend to the company’s bottom line growth, however, on GAAP terms, these are quite low. I would like these to be at least double, if we take the very adjusted non-GAAP metrics, we do get around double what the company’s GAAP ROA and ROE are.

Seeking Alpha, Author

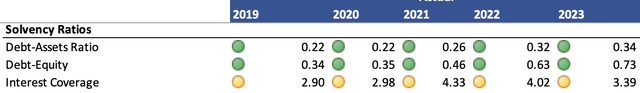

In terms of the company’s overall financial health, as of Q1 ‘24, which was filed on May 1st ’24, GPN had around $2.2B in cash and equivalents, against a rather large pile of debt of around $15.6B, which increased by around $130m y/y. This amount of debt would put off many investors, especially if that debt is posing some risks. The way I like to check if it is an issue or not is by looking at a few solvency ratios. Here, the company gets a pass for 2 out of three, while the third one is kind of pushing it but still not an issue in my opinion.

Author

So, when looking at the debt against assets and equity, the company is within a reasonable range, but when looking at the interest coverage ratio, it comes back as a yellow flag. Now, this is only because I like to be a bit more conservative. Many analysts consider an interest coverage ratio of 2x to be healthy, while I like to see at least a 5x, therefore the above numbers are flagged yellow. Overall, the company’s debt pile shouldn’t be posing any risks of insolvency, but caution is warranted if EBIT drops considerably over the next year, to the point where it cannot cover annual interest expense on debt.

Overall, the company has performed rather decently in 2023. A steady yet slowing revenue growth is a little concerning, but not unexpected, and an improvement across the board in terms of margins offsets my worries about top-line growth somewhat. I would like to see the large debt come down over the next while, which I’m sure would attract many investors if the outlook for the company improves.

Comments on the Outlook

In terms of the company’s outlook, I think the company made some great acquisitions recently that in the long run will be adding to the company’s profitability and efficiency. So far, the acquisition of EVO payments has not added positively to the margin expansion, however, it is still quite early in the integration phase. The management expects this to change within the next year or so when the expense synergies should bring in around $135m in cost savings. These cost-cutting measures should be margin-accretive in the future according to the management.

The company is also planning to leverage its existing customer base to sell EVO’s solutions, in areas like e-commerce and payment technology. So, there is a good possibility of cross-selling here, which could bring in a new revenue stream, but that is yet to be seen. Early results of such initiatives are already showing signs of working out as they are seeing good results from bringing their products to EVO’s European customer base. This will also help GPN to bring such solutions to LatAm, as this is the region that seems to be performing very well and is a “bright spot”, especially in countries like Mexico and Chile that are benefiting from “strong secular payment trends”. Recently, GPN signed a few decent-sized contracts with prominent companies in Mexico like Citibanamex, Qualitas, and Game Planet.

In LatAm, cash is still king even during the pandemic, which means that there is still a lot of growth left in this region as more and more people transition to digital payments. Mexico and Brazil are leading the way, with Mexico having a 14% growth in 2023. The younger the population becomes, the more digitized the economy will become, and cash use will start to see a material decline. That will also depend on the countries themselves. Many places in Mexico, especially the local small businesses do not accept digital payments and strictly accept cash only. The government needs to intervene and promote digitization. The Mexican government has been a lot more active recently in promoting digital payments, with initiatives like expanding internet access, so it is only a matter of time before these initiatives start to bear fruit. The country is big and of course, will take time and a lot of government help.

In my first article last year, I expected the Asian region to perform well, however, it seems that this region is experiencing quite the softness right now and has underperformed. This could happen in the LatAm region too but I am expecting digitization to continue pushing forward in the long run, while Asia will eventually recover also.

In short, I believe this acquisition will help the company accelerate its top-line growth in the years to come, as long as the LatAm region continues its fantastic growth in countries like Mexico and Brazil. I would like to see over the next few quarters how the company’s margins are going to be affected, and whether the EVO acquisition will finally be accretive.

Valuation

It has been over a year since I last did a model of the company’s financials. A lot has changed in terms of the economy and the company itself. As always, I will approach the model with a conservative mindset to give myself decent room for error. I am also going to do two separate models mainly because the company likes to rely on adjusted numbers to show the “true value of the company”. Firstly, below you’ll find the company’s forecast with the adjusted margins, while revenue growth will stay the same for both models.

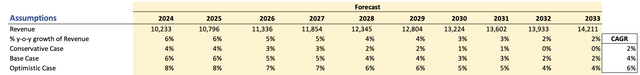

For revenues, I went with around 4% CAGR for the next decade, which I think is on the more conservative end given the potential of countries that still are very early in their digitization efforts. This way, I’m also getting some margin of safety when it comes to my calculated intrinsic value, and it accounts for a big drop in sales due to some unexpected event like a recession. Furthermore, I am modeling a more conservative outcome and a more optimistic one. Below are those assumptions.

Revenue Assumptions

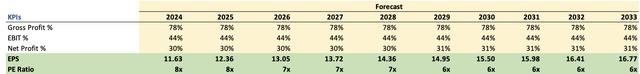

For margins, I am modeling the company making $11.64 a share for FY24, which is around what the company is guiding. For the rest of the model, I am going to keep these margins as they will be at the end of FY24 because we don’t know if there will be any improvements on already great adjusted margins. This way, the company’s EPS growth is around 5% CAGR, which is much lower than what GPN managed to achieve earlier, and much lower than what analysts are expecting, which only benefits me if I use more pessimistic estimates.

Non-GAAP Margins and EPS Assumptions (Author)

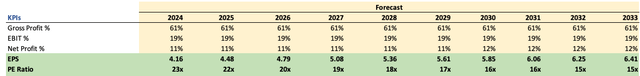

For the GAAP estimates model, I am going with a similar margin profile to the company attained at the end of FY23 and keeping it static for the rest of the model. Here, the company’s EPS growth is slightly higher at around 6% CAGR.

GAAP Margin and EPS Assumptions (Author)

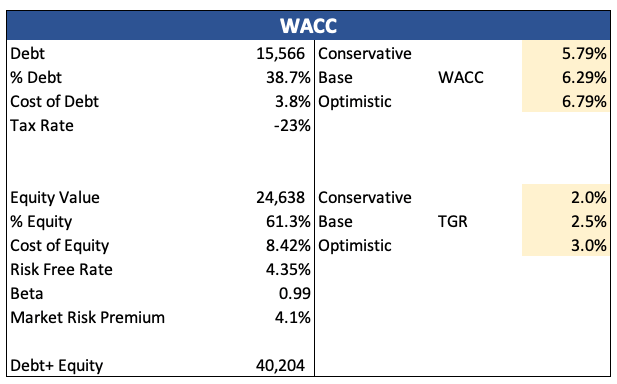

For both models, I am using the company’s WACC of 6.3% as my discount rate, and 2.5% as my terminal growth rate.

Author

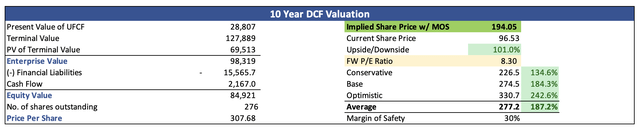

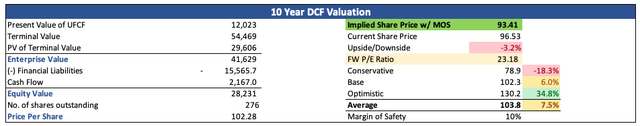

Furthermore, for the non-GAAP model, I am going to add even more margin of safety in the form of a discount to the final intrinsic value of 30%, and a 10% discount to the GAAP model just to give myself even more room for error in estimates. The two models give a very different value to the company. With the non-GAAP estimates, the company is trading at a massive discount to its fair value, while the GAAP model shows that the company currently trades close to its fair value.

Non-GAAP Fair Value Estimate (Author) GAAP Fair Value Estimate (Author)

Closing Comments

So, it all depends on the way you like to look at the company’s numbers. I like to look at the numbers as reported on the company’s 10K reports, but analysts and the company like to rely on and push the adjusted numbers, which are much more attractive. For the sake of both models, the easiest thing to do is take the midpoint of the two, and we get a fair value price of around $143 a share, which is what many sites believe the company’s worth. MarketWatch has a median price of $148.50 a share, Tipranks has around $142 a share, and MarketBeat is around $145 a share. Who knows what methodologies these analysts are using but we all seem to come up with a similar price.

I am maintaining a buy rating for GPN because to me it does seem rather undervalued currently, and the outlook in the longer term seems very promising given the growth of LatAm and further integration of EVO Payments. I wouldn’t be surprised if the company continues its acquisition strategy and buys up more companies to expand its global footprint and cement itself as the leader. In the short run, we may see further price declines to due uncertainty and a frothy broad market that will affect most of the companies, however, I am confident that over the next 3 years, the company is going to be worth much more than now, and will outperform the broader market, granted it hasn’t done so this year around so far.

Read the full article here

Leave a Reply