(Advantage Energy (TSX:AAV:CA, OTCPK:AAVVF) is a Canadian company that reports using Canadian dollars unless otherwise noted.)

For a long time, the market was fairly strict about debt, shareholder returns, and living within means. But there was an allowance made for growth by acquisition. Therefore, we have seen a lot of acquisitions. Now, that acquisition game appears to be bending the rules somewhat on debt for industry insiders. Advantage Energy (AAVVF) is the latest company to test those limits with its latest acquisition. The last article had the details of the acquisition. Now comes the growth and the deleveraging (starting with the next quarter). Mr. Market and the debt market like the deleveraging.

But the growth is another matter. Risk is clearly elevated. However, the trend of insiders leveraging up for the future is also clear. Now the leverage is nothing close to the “good old days”. But it is still more than what was “allowed” just a few years back. Note that management has issued convertible debt that may help the situation by converting when the time comes.

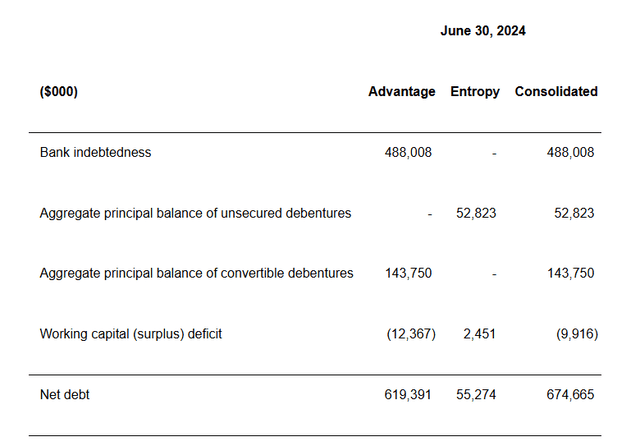

Net Debt

The acquisition closed on June 24, 2024. That means that the debt is on the balance sheet, but there is not much earnings contribution from the acquisition. Most lenders allow borrowers to use the previous 12 months of acquisition earnings in figuring out debt ratios. But it can be a challenge for investors to do the same.

All of us remember how the debt market requirements changed “overnight” as the covid challenges ended the very challenging years of 2015-2020. A lot of companies were financially stressed out and many reorganized. Now it seems like financial leverage is slowly coming back into vogue. Whether the industry will be smarter about it remains to be seen.

Advantage Energy Debt Position Second Quarter 2024 Earnings Press Release (Advantage Energy Second Quarter 2024, Earnings Press Release)

The gross proceeds from the overallotment were more than C$200 million. The resulting debt balance is shown above.

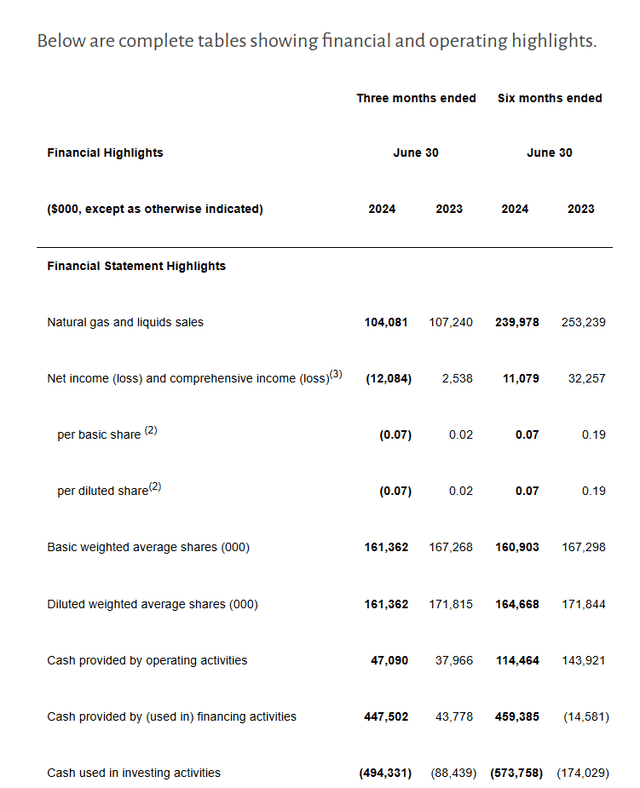

Earnings

The acquisition only had a few days of contribution to the earnings of the quarter. Therefore, some of the results will appear to make the debt ratio higher than it really is.

Advantage Energy Summary Of Second Quarter 2024, Financial Results (Advantage Energy Second Quarter 2024, Earnings Press Release)

On the bright side, management noted that the acquired acreage production is running higher than expected. The weighted average diluted shares would also have a very minimal contribution to the new number of shares outstanding at the end of the quarter.

It is not unusual for net income to be distorted by the acquisition expenses. Therefore, the comparison with the previous year is somewhat problematic using the GAAP numbers shown above.

Cash provided by operating activities is anticipated to make a big jump in the third quarter because the acquired properties have a good deal more liquids production as a percentage of production than does the existing production.

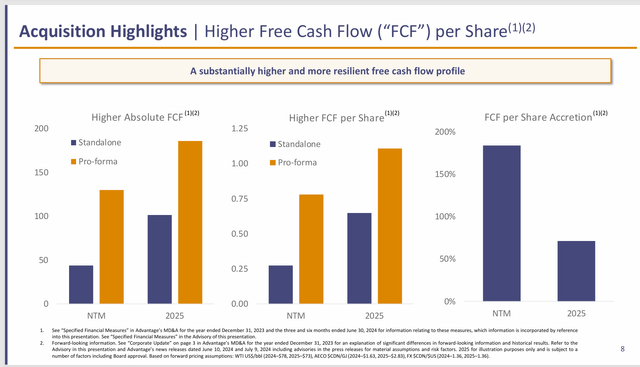

Cash Flow Benefit

The acquisition should translate into a big cash flow benefit over the next twelve months (NTM) as well as for the next fiscal year. However, there is also an underlying expectation for commodity prices that needs to be noted as well in the notes underlying the acquisition.

Advantage Energy Benefits Of Acquisition To Adjusted Funds Flow (Advantage Energy Corporate Presentation Second Quarter July 2024)

Some of the anticipated benefits will come from drilling. The risk is reduced because the acreage is very close to the legacy company operations. Therefore, there is a very good chance that the company knows this acreage fairly well.

“Bolt-on” or at least close to “bolt-on” acquisitions often have much lower risk than is the case for similar acquisitions because management knows the area.

Benefits Of Closing Now

Even though Charlie Lake has a much higher liquids percentage of production, there is still a very significant portion of production that is natural gas. That portion of the production benefits from closing now because the company will be reactivating all the idled resources from Spring Breakup to drill the most profitable areas first. Those areas will get a boost from the heating season higher natural gas prices provided the company gets started on those wells now.

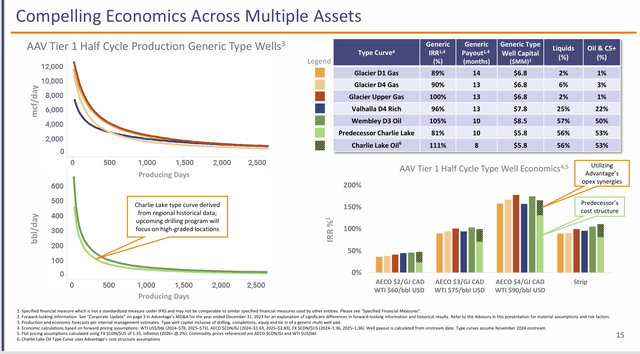

Advantage Energy Portfolio Returns By Area (Advantage Energy Corporate Presentation Second Quarter July 2024)

Management likely believes, as shown above, that they can raise the returns on the acquired acreage. One of the easiest ways of doing that is to follow the industry wide practice of bringing natural gas production online in the fall for seasonally stronger natural gas prices due to the heating season. That is a no-brainer low risk strategy that has usually worked for decades.

Even if this is the year it does not work, clearly management has some well design and operational ideas to improve results or they would not put in on a slide.

Well Profitability

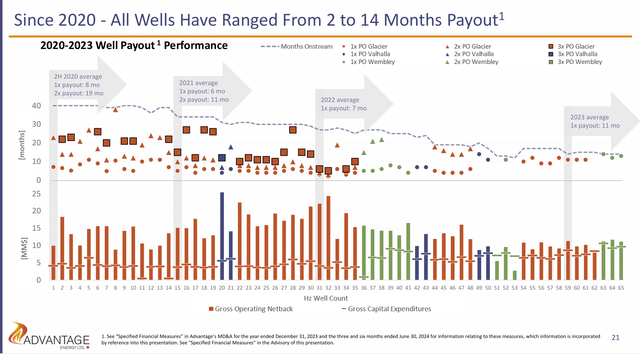

Despite this company’s main business being firmly in the dry gas business, the profitability of the wells shows with some of the best breakeven points despite weak natural gas prices.

Advantage Energy Well Breakeven Trend (Advantage Energy Corporate Presentation Second Quarter July 2024)

The above are some of the best payback numbers of any company I follow and would indicate a very low breakeven point for natural gas. In fact, this company may well have some of the lowest breakeven points in North America for its dry gas wells.

Nonetheless, the move towards more liquids production would seem to indicate that management wants more flexibility for decent profits under a wider variety of industry pricing conditions.

Most investors know that the “game” a company like this plays is to keep as much of the dry gas costs as possible while moving towards liquids rich production in an effort to boost the margin. This company plays that game rather well. Now let’s see how that translates to the liquids production for the latest acquisition.

Summary

The latest quarterly earnings will not help much with what the next two quarters will look like because the composition of the production will change significantly with the acquisition. Investors have yet to see the promised cash flow that the acquisition will produce. Therefore, there could be a period of time where the stock “wobbles” until a quarter or two of results calms any anticipated result fears of future quarters.

The company remains a strong buy although clearly the financial risk rose for the time being with the acquisition. There is also the elevated business risk of the Entropy division that is now basically a joint venture.

That risk is mitigated somewhat by management experience with the acreage.

For those that can accept some elevated debt levels for a while, this may be an investment to consider.

Risks

Any upstream company is subject to the low visibility and high volatility of future commodity prices. The acquisition with raised debt levels increases that risk despite management’s plans to hedge some of the production to assure a minimal amount of cash flow to service the debt. Any sustained and severe downturn could materially change the outlook covered in the article.

The Charlie Lake acquisition appears to be off to a good start. But the necessary record of operation is far from complete. Management has to establish a record with the acquisition before investors can be sure the anticipated benefits will materialize. Anything can happen in this low visibility industry.

The loss of key personnel could set back this company materially or even prove to be fatal to the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply