One of the more exciting sectors to track since 2020 has been the full-service dining and fast-casual restaurant chains. In-person dining collapsed in 2020, leading to widespread failure of many restaurants and significant financial stress for virtually all in the industry. These businesses had to lay off many employees and have yet to recover previous employment levels entirely. These strains were exacerbated from 2021 to last year as inflationary factors pushed operating costs up, creating difficulties for some to push those costs forward without losing customers.

Despite these challenges, most publicly traded restaurant stocks have increased since 2020. The Dow Jones US Restaurants & Bars Index is up 34% over the past five years, which is not strong but does not indicate widespread financial strain. To a large extent, fast-casual chains like Chipotle (CMG) and Cava (CAVA) are performing well as more people have shifted toward takeout or quick service chains “QSR.”

Companies focused on dine-in have struggled more. Darden (DRI) is under pressure as Red Lobster files for bankruptcy. However, others, like Texas Roadhouse (TXRH), have marched to consecutive all-time highs. Most, like First Watch (FWRG), have had immense volatility as companies battle for market share in a rapidly changing industry.

A notable example is Brinker International (NYSE:EAT), which generates over 80% of its sales from Chili’s (secondly Maggiano’s) and has had excellent performance over the past year, doubling in value. However, the company crashed by 16% (backing up to -10%) on Wednesday after reporting a large miss in its earnings, with a non-GAAP EPS of $1.61, $0.11 below estimates. However, its sales were slightly above the target by $40M at $1.2B. To be fair, all of its data was strong on a YoY basis. However, because its stock has risen so dramatically, it failed to meet seemingly excessive expectations set forth by its higher valuation, with a forward “P/E” of 18.5X. Most alarmingly, short interest on the stock is 19%, signaling many are calling a bluff on its recent bull market.

Economic Changes Fueling Competition

The restaurant market, as a whole, is highly exposed to economic changes, particularly regarding consumer sentiment and financial stability. Dining in is always a more expensive choice than cooking at home (for those who know how), so it will always be in the luxury economic category. Of course, some restaurant chains, like Red Lobster, are in a tough spot because they’re more expensive but do not necessarily fall into the high-end category (which is not usually made up of chains).

On the other hand, Chili’s is squarely in the middle-class market, focusing on its bar and family dining. In my view, its business model gives it relative stability from competition, as it is not operating in a niche and caters to a broader middle-income market.

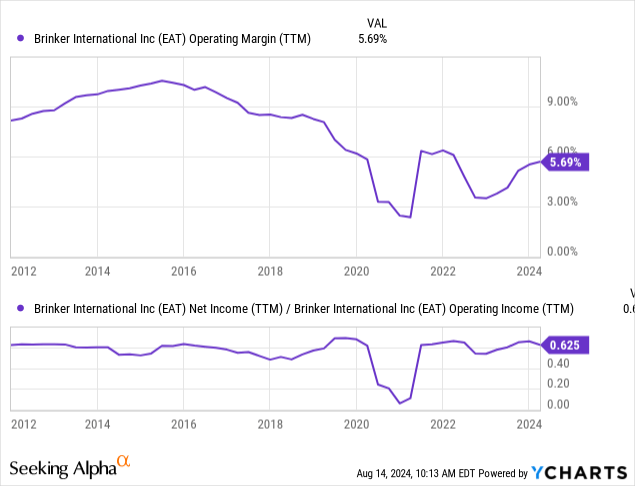

Like most restaurants, its strains pre-existed COVID but were exacerbated by it. The company’s operating margins were slipping from 2016 to 2019 and have been stuck at volatile lows since 2020. The conversion of its operating income to net income is relatively stable at ~62%, accounting for taxes and its manageable debt load. See below:

The first shock to its operating margins was the 2020 lockdowns, followed by difficulties raising prices to match growing costs. However, its operating margins appear to be back near “normal” levels. Its operating margin in Q2 (its “Q4 fiscal year 2024”) was 6.1%, indicating a continued positive trend.

Last quarter, it reported 13.5% comparable restraint sales growth, with 14.8% for Chilies and 2.5% for Maggiano’s. It highlighted the launch of the “Bid Smasher” burger as an advertising target that drew more traffic in and allowed for increased menu pricing. It reported a 5.9% traffic increase, indicating positive developments beyond higher prices. No doubt, all of these metrics are objectively strong, even if not as positive as most investors hoped for.

That said, some may be overlooking one key fact: Chili’s is likely seeing some improved traffic due to the failure of many of its competitors. Since 2020, restaurant closures have dramatically increased, with a massive skew toward independently owned restaurants. However, the data on this issue is not accounted for well and can be difficult to measure given independent restaurants often close. Still, I think many may have seen a trend toward fast-casual and chain restaurants in their communities, which had much greater access to pandemic stimulus capital than smaller family-owned restaurants.

This year, we’re seeing more chain closures. Red Lobster, Applebees, and Hooters are facing tremendous closures due to severe financial issues in those brands. IHOP, TGI Friday, Denny’s, Outback, and others are all facing closure levels that will likely alter market share for surviving competitors. Chili’s has had some closures, but fewer than most, with under 20 closed locations since 2023 out of 1500 still operating.

If this trend has created growth for Brinker, which I believe it has, it still tells us Brinker has a competitive edge and that its growth may be transitory. I think the dine-in restaurant market is cannibalizing, and Chili’s is better positioned. That is positive for the company but also obfuscates underlying economic issues that likely impact it, as seen in its volatile and low operating margins.

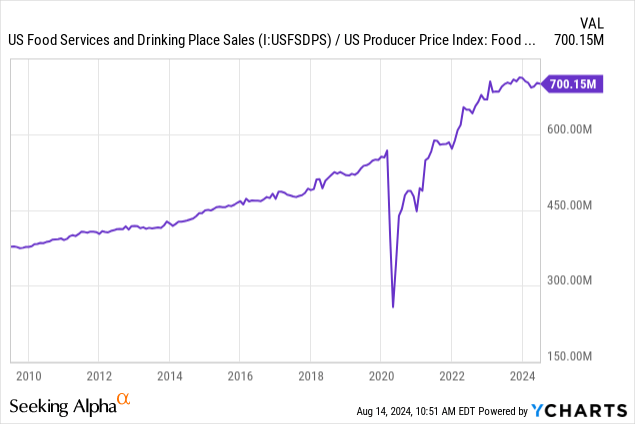

I believe the broad macroeconomic outlook for restaurants has turned decidedly negative. Comparing total food and drink service sales to the producer price index for such, we can see a clear positive trend coming out of 2020 that has shifted toward stagnation this year. See below:

I believe the trend in this data is more important than its overall level because certain key factors, like tips, are not accounted for. Indeed, robust economic data is more difficult to find in the restaurant sector, particularly as the fundamental business model changes toward fast-casual QSR. Given the “real” sales metric is flat, I estimate the underlying trend may be harmful, though that cannot be known without tip data and other metrics. Still, when we see many strong historical economic indicators point to a recession, with particularly troubling consumer metrics, I think it’s reasonable to assume people may pull back on restaurant spending.

What is Chili’s Worth Today?

I believe the full-service restaurant industry will likely face more significant pressure over the coming two years than over the past two. The past two years have seen relatively strong consumer demand mixed with surging costs for food and labor. In the future, I expect consumer demand will decline, as the data seemingly indicates, while operating expenses may not abate. The Agriculture Price Index surged earlier this year but has erased some gains since, which still likely indicates some persistence in food inflation.

Without a doubt, Brinker has proven resilient to the first innings of this slowdown. The company managed to raise prices without compromising traffic. To me, that is a testament to a solid managerial focus on maintaining happy customers. However, I believe it is also a result of the more widespread closures amongst many of its competitors, namely independent full-service restaurants. This trend may continue, but I do not expect it will last forever. Indeed, its disappointing quarterly report may signal that this transitory edge is slipping. In my view, as restaurants face more significant economic pressure on demand overall, Chili’s will, too.

EAT currently has a TTM “P/E” ratio of 18X. Darden’s (DRI) is 16.2X, Denny’s (DENN) is 16.6X, Pollo Loco’s (LOCO) is 16.4X, BJ’s (BJRI) is 20X, and Texas Roadhouse’s (TXRH) is 27X. Their “EV/EBITDA” ranges are closer, with EAT at 12X, DENN at the lowest at 9.9X, and TXRH’s the highest at 20X. Denny’s has the worst YoY sales growth at -3.65 %, while Texas Roadhouse’s is the highest at 13.8%, indicating valuation spreads are tied to differing growth rates. Though my outlook on Texas Roadhouse has failed to prove correct, I remain very bearish on it and expect that its valuation cannot remain so high, particularly as the economic impact on restaurants becomes clearer.

Compared to Texas Roadhouse, Brinker may seem a good deal today. Its valuation is more reasonable, but like TXRH, it has shown some resilience against broader restaurant woes. Still, I believe these companies’ gains are primarily transitory and are associated with reduced competition. In the long run, independent restaurants or other chains should open to absorb some of that lost market share Chili’s may benefit from.

The Bottom Line

Overall, I am slightly bearish on EAT today. To me, its stock price has risen too quickly compared to merely decent fundamental improvements. Yes, its fundamentals are better than its peers, but not so much better that its surge can be entirely justified, particularly when these benefits may not last long-term. Its valuation is high, but not so high that I’d call EAT overvalued; only conditionally overvalued in the event of a consumer-driven recession that I expect, whereas I feel TXRH is absolutely overvalued.

In other words, if consumer demand for restaurants remains decent, EAT may suffer no losses, but I do not expect it to continue rising. Thus, although I believe its downside risk is more significant than its upside potential, it appears to be a poor opportunity. Indeed, based on its 20% short interest level, the stock may have too much negative positioning.

Read the full article here

Leave a Reply