Introduction

I rarely assign companies a “Sell” rating. I use that rating as selling short, and considering the costs of short selling, I think one either needs to find out non-public information that indicates fraud or structural weakness, or there must be a large short-term catalyst that is not priced in yet.

In September 2023, I was convinced that Axcelis Technologies (NASDAQ:ACLS) would struggle, and this wasn’t priced in yet. So, I gave it a “Sell” rating. The stock is down 29% while the S&P 500 is up 32% since that analysis. Although I turned my rating to a “Hold” due to valuation, the company continued to disappoint its investors.

It is a semiconductor company that doesn’t benefit from the surge in artificial intelligence. There are no immediate catalysts for the upside. Exposure to electric and hybrid vehicles and consumer electronics is not exciting when consumers are trying to trade down and save more. A recession is still probable. In this environment, I find no reason to invest in Axcelis Technologies.

I reiterate my “Hold” rating with this quarterly follow-up article.

Business Description

I don’t like writing articles without a proper business description. However, I have already explained Axcelis’ business several times, so this will be brief. Please refer to one of my older articles for a more detailed description.

There are many processes required to manufacture semiconductors, which enable various electronic products from personal electronics to automobiles and sensors. One major process is designing and engineering, which is what Nvidia (NVDA) does. The company doesn’t manufacture these chips itself but outsources that to companies specializing in manufacturing, called foundries.

The foundry business is capital-intensive. Companies need a lot of equipment and services to produce the final product. Axcelis is one of the major suppliers to these foundries, providing ion implementation and other processing equipment. These products help modify a semiconductor’s electrical properties.

Developing these complex technologies and establishing relationships with large foundries take time. Once established, it is costly for foundries to look for alternative products. That is why existing players like Axcelis and Applied Materials (AMAT) enjoy high barriers to entry.

Recent Developments and Stock Performance

My first article on Axcelis was published on September 26, 2023. It has nearly been a year. During this period, Axcelis’ stock significantly underperformed the broader market. The stock is down 29%, while the S&P 500 is up 32%.

S&P Capital IQ

This poor performance is due to fundamental underperformance, which we will discuss further in the outlook section.

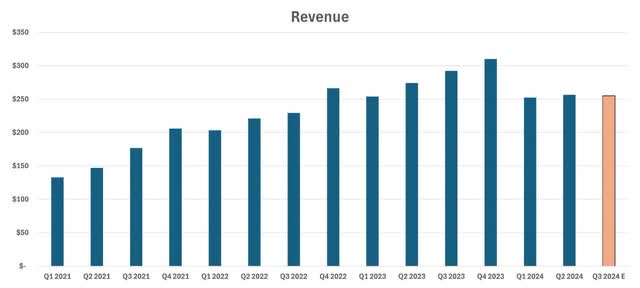

Although the company beat EPS and revenue estimates in Q2 2024, a quick look at financials shows that inventory turnover has been declining over the last two quarters, and revenue is significantly lower than where it was in 2023. Management guidance for Q3 2024 is not promising either, implying only a slight improvement over Q2 2024.

S&P Capital IQ

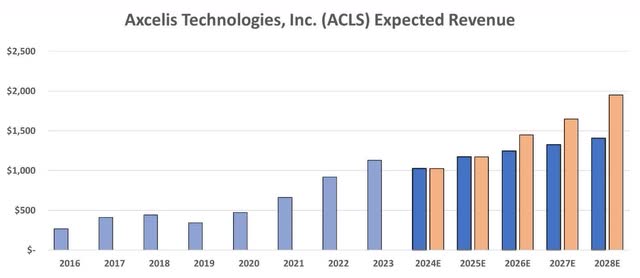

Compared to when I published my previous follow-up last quarter, revenue expectations have declined considerably. In the chart below, dark blue bars represent revenue expectations as of now, while light orange bars represent revenue expectations as of May 31.

S&P Capital IQ

This change in revenue expectations is the main reason behind the recent stock price decline. The reason behind these changing expectations can be understood better by assessing end market strength in the following section.

Outlook For The Near Future

My last article outlined the three main growth areas for Axcelis Technologies: electrification, communications, and artificial intelligence. This article will merge that analysis with the market segments shared during the most recent investor presentation.

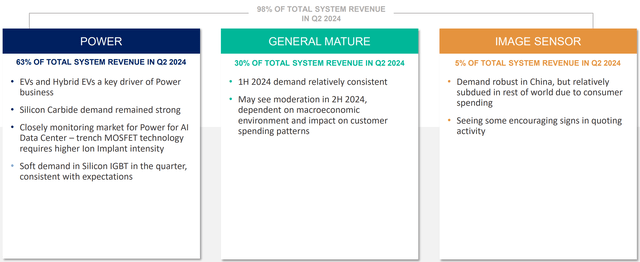

Q2 2024 Investor Presentation

In Q2 2024, 63% of sales were generated under the “Power” segment. The key driver for this end market is the demand for electric and hybrid vehicles. This is the electrification story we discussed last quarter. Not only has vehicle sales growth stagnated, but the transition to EVs appears to have lost its pace. Tesla is still struggling against its cheaper Chinese competitors and seems to be losing, especially in Europe. As the pioneer of the industry, this may hurt the capital the company allocates to research and development, hurting innovation. The Fed cutting rates in September could be a catalyst for higher vehicle sales, but I believe it will take longer until the rates are significantly down.

Management states that they are closely monitoring the market for Power for AI data centers. However, as quarterly sales show, the company has not been able to benefit from it to the extent that others have. Axcelis seems to have failed to become a major supplier for AI technology so far.

The second largest end market was “General Mature” with 30% of total system revenue. This is another end market that struggles due to its consumer exposure. I have discussed the weakness of the US consumer in some of my recent articles. According to studies, the average US consumer has spent its pandemic savings, has a lower real wage compared to two years ago, and is trading down to save more money. This includes postponing purchases and buying cheaper alternatives. In the case of consumer electronics, trading down mostly means postponing purchases if consumers don’t have to.

In such an environment, demand for consumer electronics and therefore parts that go into them decreases. This affects the General Mature part of Axcelis’ business. That is why the company is waiting for the recovery of the macroeconomic environment and customer spending. I believe it is difficult to bet on this recovery in the short term. Recessions often occur right after the Fed begins cutting rates, and we are currently in that phase.

Although it was insignificant compared to the first two end markets, “Image Sensor” contributed 5% of total revenue. Management states that the demand is robust in China but is subdued everywhere else due to consumer weakness. As discussed above, I don’t think right now is the best time to bet on this end market exposure.

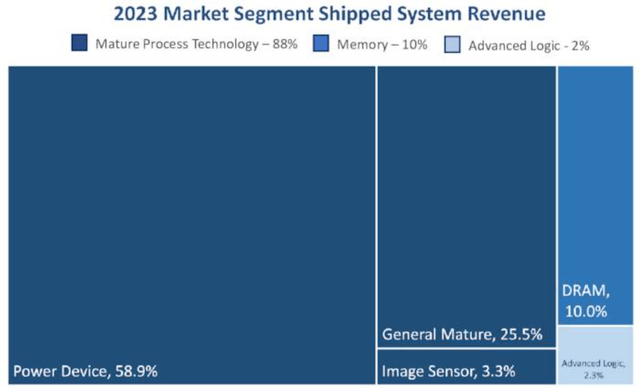

In addition, the company sells memory chips and advanced logic, which contributed 12% of sales in fiscal year 2023. However, in Q2 2024, advanced logic contributed 2% of total revenue, and the memory business generated no revenue. This is remarkable to me and shows how much Axcelis has struggled to become a supplier in the artificial intelligence space. Management expects a recovery in Q4 in the memory space, but with continued data center investments and subdued but existing consumer electronics manufacturing, the company should have generated some earnings from the memory business. This result makes me think that this business has become very unsuccessful, and I have no desire to predict when sales will surge back. It would be very speculative if I tried to predict.

The market segment shipped system revenue below from fiscal year 2023 shows how much the sales mix has changed since then. Memory declined from 10% to 0%, while advanced logic was relatively flat.

May 2024 Investor Presentation

Valuation

As discussed, long-term revenue expectations have been declining, and so do expectations for free cash flow. My initial target share price was $107 and I updated my target price to $113 last quarter. This target price will be impacted by declining expectations.

My target price in my initial short thesis was $107. In the follow-up article, I maintained that target but closed the short position with a hold thesis as the macro environment seemed to be improving. The stock actually fell below that target price, and now slightly recovered to $113 at the time of this article’s writing. The target price has only slightly changed since the last analysis.

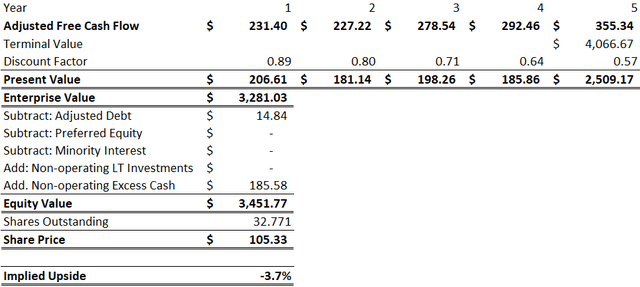

Updating my previous model with new expectations, I now expect the company to generate an adjusted free cash flow of $231 million in 2024, which has not changed since last quarter, and $355 million in 2028, which is lower than what I used last quarter. I use a terminal growth rate of 3% and calculate WACC using a long-term risk-free rate of 2%, a market risk premium of 5.7%, and the stock’s 5-year equity beta.

As a reminder, I separate cash and short-term investments into operating and excess in my calculations. Operating cash is what the company uses for day-to-day operations. The rest is excess cash. This excess cash can be claimed by the shareholders, but not the operating one, as the business needs it.

Using these numbers and methods, we find an equity value of $3.45 billion, which means a target share price of $105.33. This is a 3.7% downside over the current share price at the time of this article’s writing.

Author

Conclusion

I value that companies have a long-term opportunity, but there needs to be at least one strong short-term catalyst for a company to be a “Buy” for me. In the case of Axcelis, only short-term catalysts that exist are for the downside.

Weaker consumers are affecting the business, while Axcelis continues to show that it failed to take a piece of the huge artificial intelligence market. Demand for end markets including vehicles and consumer electronics is declining, and Axcelis is not signaling a quick recovery.

With a stock price that appears fairly valued, I reiterate my “Hold” rating.

Read the full article here

Leave a Reply