Investment Thesis

Rob Mionis, Celestica’s (NYSE:CLS) Chairman and CEO, has a lot on his plate, running 42 manufacturing facilities around the world. But perhaps what he wishes for most is some well-deserved respect from his customers.

Celestica’s net margins, which typically stand at mid-single-digit rates (4%-6%), barely compensate for the amount of risk and frankly, the effort that Celestica undergoes to keep its customers’ products on the shelves and their business models running.

Paying on time would be a great start, sparing Mr. Mionis the hassle of having to sell Celestica’s accounts receivables to banks to unlock cash liquidity to fund its working capital. Keeping him in the loop of future needs would be very helpful, allowing him to better optimize production lines, workforce levels, and employee schedules in order to increase efficiency and returns. Currently, Celestica would be lucky if it receives a call 30 days ahead of an order.

Not all is lost for the 60-year-old Canadian national, who next year will mark his ten-year tenure as CEO. As the head of Celestica, his annual compensation stood at $12 million last year (mostly stock-based compensation) to run Celestica’s manufacturing facilities – worth $661 million (including 188 in ROUs) – that house 26,500 employees worldwide.

Other than the comfy paycheck, Mr. Mionis spends his time juggling inventory risk, optimizing ROIC, worrying about collecting Accounts Receivables, and asking for cash deposits to help the company maintain inventory, all while negotiating contracts with his 10 customers who represent two-thirds of Celestica’s revenue, often from a position of weakness.

There is a lot to like in the recent revenue surge. For investors, it fueled a spectacular market run. But for Mr. Mionis, it means much more. Most of the revenue growth is attributed to one hyperscaler AI cloud customer who brings a fresh, collaborative approach to supply chain management, working closely with Celestica to manage production levels and optimize operations. This customer, whose name is kept secret, is also building a joint production facility with Celestica in Thailand.

Still, while this is a welcomed change, I don’t think that Celestica fits my growth portfolio. Its recent revenue surge and rally don’t mirror a fundamental change in its market position, the main criteria of my growth-oriented investments.

Company Profile

Celestica is an Electronic Manufacturing Service ‘EMS’ company. They design, build, and test electronic components, in addition to providing supply chain services to their customers.

The company is known for its reliability and low cost, attracting the business of top-tier Original Equipment Manufacturers ‘OEMs’. They list Cisco (CSCO), Dell (DELL), Hewlett Packard Enterprise (HPE), Alcatel, EMC Corp, and IBM (IBM), its once parent company, as their customers.

Embarrassing Bargaining Power

Inventory risk at Celestica is so serious that it chooses its customers based on the chances of their success. The company purchases materials and components based on customer demand forecasts. If the customer cancels, delays, or reduces their orders, Celestica ends up with excess inventory. This is a big problem in light of the customized nature of their offering.

On the negotiation table, the company often sits in a weak position, unable to force its customers to commit to minimum purchases and when they do, it is no more than 30 to 90 days in advance. Yet, Celestica has to compete with other manufacturers on price, pushing it to commit to minimum orders from its own suppliers.

A lot of time and effort is spent on trying to keep manufacturing lines operating at full capacity to achieve that leverage that all industrial companies seek. And the risks are exacerbated for new customers with no history or record to help Celestica manage its working capital or capacity optimization.

This is one of the reasons why Celestica only has 10 customers, accounting for two-thirds of its sales.

But truth be said, Celestica offers that perfect balance between cost and quality. Photos of their facilities show precision equipment that helps them serve high-tech end markets, including aerospace & defense, semiconductors, surgical and measuring equipment.

Their focus now is to enhance their design and engineering capabilities to land more of those lucrative Joint-Design Manufacturing ‘JDM’ contracts, which differentiates them as an end-to-end EMS from the traditional Original Design Manufacturers ‘ODMs’ competing with Celestica for manufacturing contracts.

The company’s weak bargaining position and moat are evident in its balance sheet. Celestica’s quick ratio, defined as cash over short-term funding obligations, leaves some to be desired. Historically, it financed working capital by selling its accounts receivables, having little leverage over its clients to speed up payments, while its vendors command minimum purchase volumes and speedy payments to necessary price discounts that make Celestica competitive in a cut-throat industry with laser-thin margins. On average, Celestica waits 70 days to collect customer bills, as of Q1 2024. That’s up from 60 days in Q2 2024. On the other hand, Days Accounts Payable, which measures the number of days Celestica takes to pay its bills, went down from 68 days to 58 days as of June 2024. The company’s cash balance stood at $434 million, weighed against 2.2 billion in short-term obligations.

So, it is clear that the company suffers from working capital issues. But truth be said, beyond that, Celestica is well-capitalized, with long-term debt standing at a mere $680 million, weighed against TTM EBIT of $500 million.

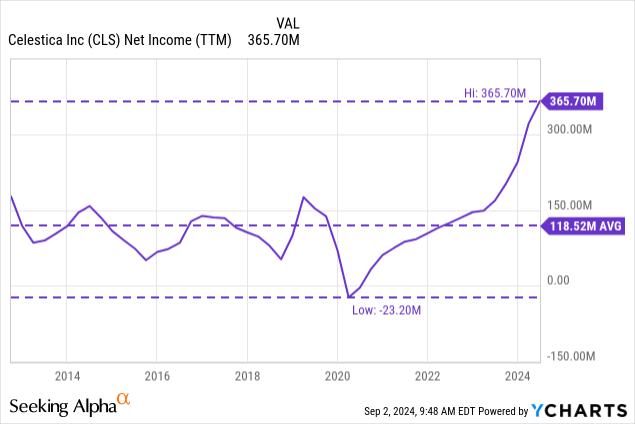

Zigzagging Net Income

Celestica’s earnings are tied to the fluctuating order volumes of its customers, which in turn are influenced by customer inventory levels and products life cycles. Sometimes they are blessed with robust volumes and/or high-margined product mix, sometimes they aren’t. This is mirrored in their zigzagging net income chart below.

Current Product Mix – High Growth

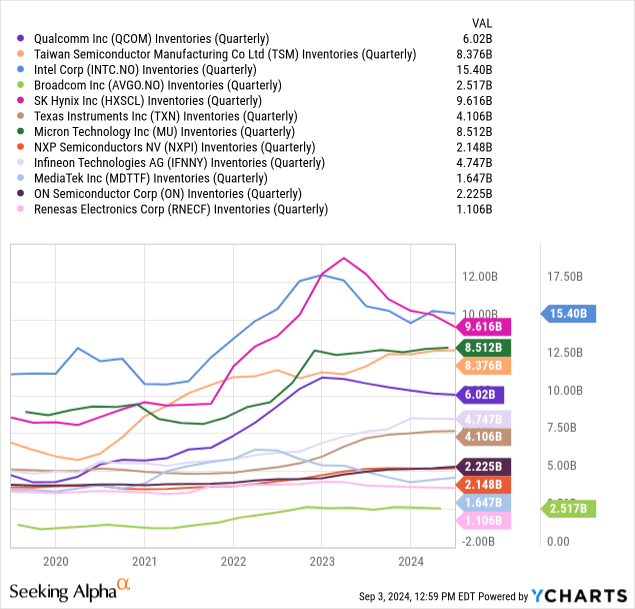

Revenue from the ATS segment – which includes healthcare, Aerospace & Defence, and semiconductor end markets – will likely go down in the second half of 2024, based on the soft start of the year. Other than AI chips, semiconductors for various applications have been sitting in warehouses awaiting orders. While we’ve seen inventory levels easing down, they’re still at historically high levels. Until this backlog is cleared, new orders will be subdued.

The EV charging programs that lifted Celestica’s sales in 2022 and early 2023 aren’t showing signs of a rebound either. That also puts a wet towel on the ATS segment’s sales projections this year.

The communications segment is poised to grow significantly in 2024 on the back of extraordinary demand for high-performance 400G and growing market penetration of the 800G switches used in data centers. Management is also preparing for a newer platform to manufacture 1.6T switches.

| Segment – Million $ | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 Forecast |

| ATS segment | $2,286 | $2,086 | $2,315 | $2,979 | $3,320 | $3,071 |

| % change | -9% | 11% | 29% | 11% | -7% | |

| Communications | $2,346 | $2,435 | $2,260 | $2,865 | $2,676 | $3,398 |

| % change | 4% | -7% | 27% | -7% | 27% | |

| Enterprise | $1,256 | $1,227 | $1,060 | $1,406 | $1,966 | $2,731 |

| % change | -2% | -14% | 33% | 40% | 39% | |

| Total Revenue | $5,888 | $5,748 | $5,635 | $7,250 | $7,961 | $9,202 |

| % change | -2% | -2% | 29% | 10% | 16% |

The enterprise segment is showing no signs of slowing either, with sales set to grow by 39% this year, based on annualized projections of revenue in the six months ended June 2024.

Overall, I think that we’re looking at a 16% total sales growth this year.

Valuation

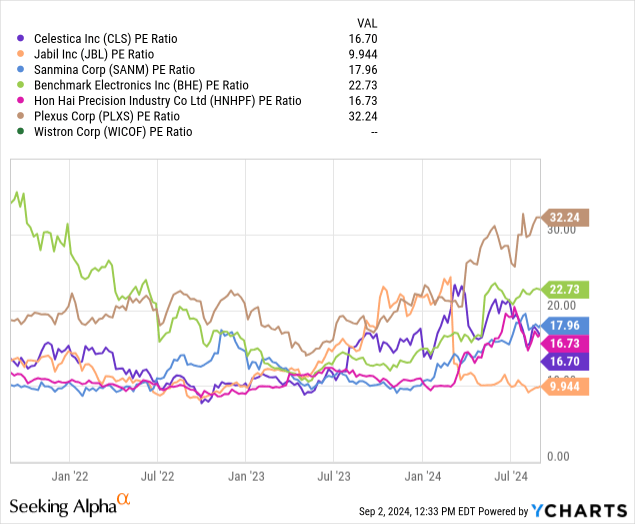

The EMS market is inherently volatile, with fluctuating earnings impacted by customers’ product life cycles. Add to that the thin gross margins barely exceeding a single-digit rate, and the indefinite number of things that can go wrong operationally and from a macroeconomic perspective.

Historically, the company’s PE ratio stood at 9x forward PE, thanks to an aggressive share buyback program that sustains EPS figures. Today, Celestica trades at 14x (16X TTM), which is within the industry average.

Final Thoughts And How I Might Be Wrong

What prompted me to research Celestica was my first impression that this is a cheap stock that is undergoing fundamental change that prompted its recent revenue and earnings surge. That’s not the case. The company is benefiting from the exceptional increase in demand from data center hyperscalers pouring cash into cyclical capital projects.

The primary risk to our hold rating is the possibility that what we’re seeing now in terms of revenue growth is more sustainable than what is implied in this piece. For example, one can argue that the USA is witnessing a fundamental industrial wave prompted by a change in the way the government implements subsidies, with the Inflation Reduction Act and Chips Act emphasizing Made in USA for government benefits eligibility. While capex is cyclical, a wider customer base for Celestica means higher average earnings going forward.

In my view, while Celestica’s data center hyperscale customer that drove the recent revenue growth is only sourcing from Celestica at this point, I believe that the broader trend has more to do with OEMs diversifying their supply chain, allocating some manufacturing contracts to the likes of Celestica as opposed to relying solely on traditional ODMs, having learned their lesson from the post-pandemic supply chain crunch.

Our hold rating is anchored in the comparability of Celestica’s forward PE with its peers. Even if Celestica’s future earnings settle on an average of $4 per share, which is about three times its historical average before the AI bonanza, its valuation is still comparable to peers.

Read the full article here

Leave a Reply