Liberty All-Star Equity (NYSE:USA) is a compelling investing vehicle for investors that want to combine tech exposure with a high dividend yield.

USA is a closed-end equity fund that owns some of the largest names in the tech industry in its portfolio and that has achieved attractive, double-digit returns in the last decade. The closed-end equity fund provides investors with a 10% dividend yield as it distributes capital gains dividends and is a compelling investment option, in my view, for investors that want to be exposed to the artificial intelligence theme.

Diversification, high passive income, and tech exposure are the three main reasons why investors might want to consider the Liberty All-Star Equity Fund for their passive income portfolios.

Portfolio And Investment Objective

The Liberty All-Star Equity Fund invests in both growth and value stocks in large companies, mostly in the U.S. Information Technology sector. The fund’s main objectives are capital appreciation and income distribution to USA’s shareholders.

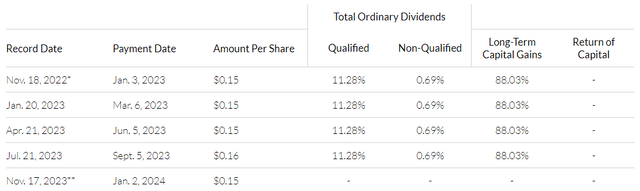

The Liberty All-Star Equity Fund specifically seeks to pay distributions on its shares equal to approximately 10% of its net asset value per annum, which makes USA primarily a passive income vehicle for investors. The fund’s distributions are primarily paid out of realized long-term capital gains, and the fund’s quarterly dividends are taxed as ordinary dividends.

Long-Term Capital Gains (Liberty All-Star Equity Fund)

The most recent distribution is $0.18 per share per quarter, which equates to a 10.4% leading dividend yield. The Liberty All-Star Equity Fund is, like I said, predominantly comprised of large cap U.S. investments and manages approximately $2.0 billion in assets. The fund’s current expense ratio sits at 0.93%.

The interesting thing about Liberty All-Star Equity Fund is that the closed-end fund combines tech exposure and diversification with recurring dividend income. The fund presently pays investors a 10% yield, paid quarterly, and investors could potentially profit from the fund’s explicit focus on the artificial intelligence theme.

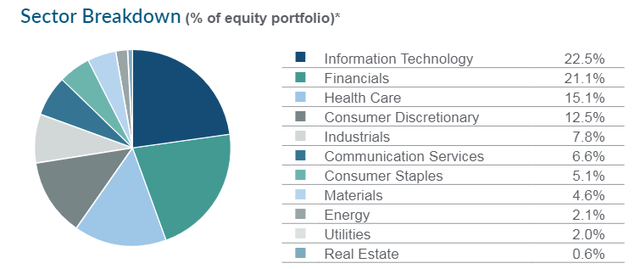

The majority of investments in the company’s portfolio are part of the Information Technology sector which had a portfolio weighting of 22.5% which includes a number of stocks that are poised to profit from growing AI investments. The second-biggest sector was Financials (21.1%), followed by Health Care (15.1%).

Sector Breakdown (Liberty All-Star Equity Fund)

Performance History

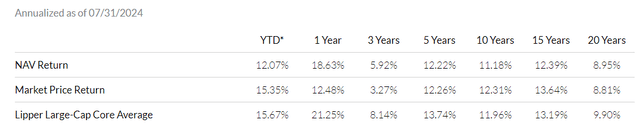

Liberty All-Star Equity Fund profited in the last year from a strong performance record of technology investments, resulting in an 18.6% return on net asset value.

The long-term return is also attractive, as the fund achieved 11.2% NAV returns in the last decade. The benchmark for the Liberty All-Star Equity Fund is the Lipper Large-Cap Core Mutual Fund Average.

NAV Return (Liberty All-Star Equity Fund)

Top Holdings Breakdown And AI Focus

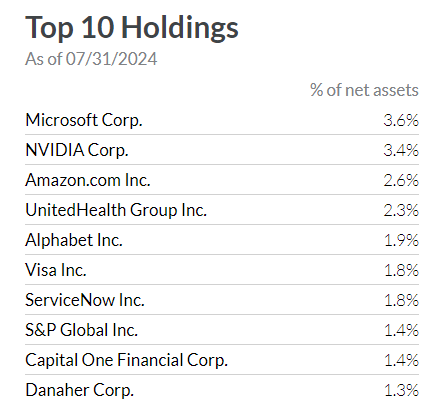

Liberty All-Star Equity Fund is primarily focused on the information technology industry, as I just highlighted. NVIDIA Corp. (NVDA), Microsoft Corp. (MSFT), Amazon.com (AMZN) and Alphabet Inc. (GOOG) are top holdings for the closed-end fund and Microsoft was USA’s largest holding with a portfolio weighting of 3.6% as of July 31, 2024.

The Liberty All-Star Equity Fund contains a considerable number of investments that have exposure to the artificial intelligence theme. Companies like Nvidia and Alphabet have been big winners last year as they profited from the corporate sector’s spending spree on GPUs that are specifically geared towards AI applications.

Nvidia recently clarified, to name just one example, that it expects its latest Blackwell chips to ship out to customers at the end of the year and that it expects billions of sales from its latest GPU.

Since Nvidia has a 3.4% weighting in Liberty All-Star Equity Fund’s portfolio, an ongoing outperformance of AI stocks could support the fund’s net asset value growth moving forward.

Top 10 Holdings (Liberty All-Star Equity Fund)

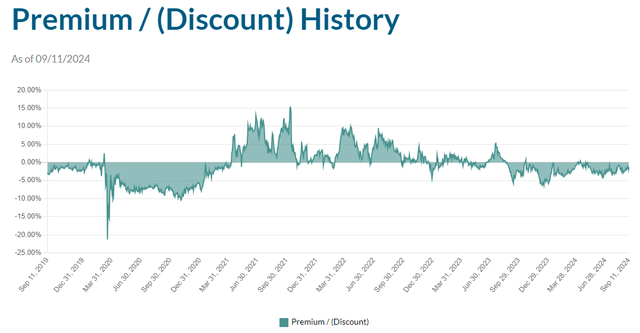

Discount To NAV

The Liberty All-Star Equity Fund, as of 09/11/2024, was $6.96 whereas the fund’s market price was $6.87 which implies a discount to net asset value of 1.29%.

The Liberty All-Star Equity Fund has historically sold both at a premium and at a discount to net asset value, at varying times, making it hard to make a generalized statement about the fund’s valuation history.

In the long-run, I anticipate the Liberty All-Star Equity Fund’s net asset value to grow and to sell at or near net asset value as the portfolio is made up of highly liquid stock investments in the large cap market. The prospects for NAV growth are very good, in my view, as the company owns market leaders in the dominant Information Technology sector.

Discount To NAV (Liberty All-Star Equity Fund)

What Risks Do Investors Have To Account For

Obviously, the Liberty All-Star Equity Fund is focused on technology companies and includes some of the most notorious names in the technology world, Nvidia, Microsoft and Alphabet. Thus, investors must recognize that the USA closed-end equity fund is primarily allocating investment funds to the cyclical technology sector which exposes investors to considerable risks in case investor capital rotates into other sectors, for instance in case tech moves out of favor with investors.

Furthermore, the Liberty All-Star Equity Fund is invested primarily in procyclical companies, so USA is probably not going to be a great choice for investors during a recession.

My Conclusion

Liberty All-Star Equity Fund is a compelling choice for passive income investors because it combines diversification, income and appreciation potential related to the most dominant names in the technology industry.

In addition, the Liberty All-Star Equity Fund has produced attractive, double-digit returns in the long-term while it expense ratio is below 1%.

The Liberty All-Star Equity Fund may be an attractive investment option for passive income investors that want to gain exposure to the rapidly evolving information technology industry, particularly because it includes explicit leaders such as Alphabet or Nvidia.

In addition, Liberty All-Star Equity Fund is a compelling investment vehicle for investors that want to ramp up their exposure to the artificial intelligence theme, which has captured the imagination of investors in the last year. Buy.

Read the full article here

Leave a Reply