Apple Hospitality REIT, Inc. (NYSE:APLE), incorporated in 2007 and headquartered in Richmond, VA, owns and manages hotels all over the country.

This is a well-diversified REIT with a sustainable dividend as far as its dividend coverage and the market outlook goes. However, the shares are not undervalued on either a peer-relative or absolute basis and I don’t think it’s going to move up much from this level to meaningfully offset a potential opportunity cost. One of its peers seems to be a better bet on lodgings.

Business & Portfolio

The hotel industry is largely dependent on the growth of disposable income and international travel. Though hotels make for more volatile sources of income than other properties, they can provide higher returns on capital because of how the market prices them. For this reason, I believe that exposure to hotels makes sense in the context of a well-diversified REIT portfolio in general.

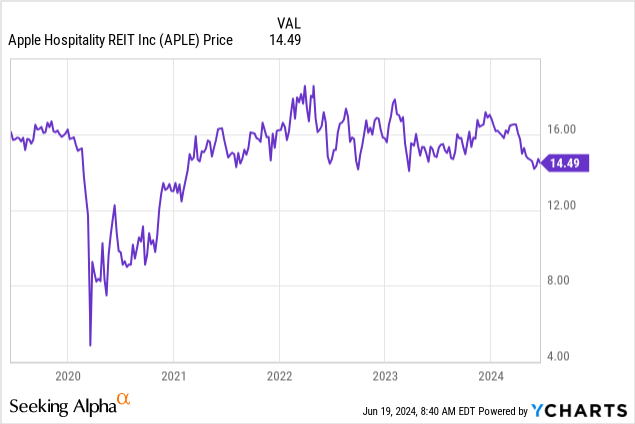

It also made sense to get exposure before the industry recovered from Covid as it was hit harder than other real estate classes. However, APLE seems to have recovered:

This, in combination with the low-growth expectations for 2024, makes investing in APLE particularly risky. CBRE expects RevPAR growth of only 3% this year which is fueled by a 40bps growth in occupancy and a 2.3% increase in ADR. And I think that APLE is a good proxy for the industry.

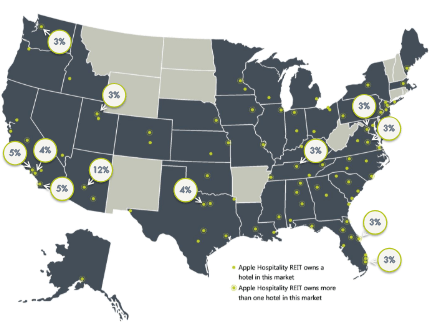

The REIT’s portfolio consists of 224 hotels that aggregate 29,886 rooms and are spread across 37 states and the District of Columbia:

Investor Presentation

While this makes for a very well-diversified portfolio, the mostly equal weighting here based on revenue seems like a good way to capture average returns. I usually don’t like high concentration in a specific market, but if the expectations for that market are obviously better than the broader industry, I find this attractive. Here, the outlook for the hotel industry could be most relevant to Apple Hospitality.

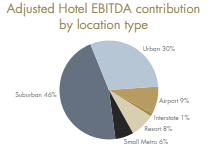

The portfolio is also 54% concentrated in Suburban and Resort markets based on EBITDA:

Investor Presentation

Based on the same report by CBRE, resort and suburban hotels are expected to underperform those located in urban markets.

Leverage & Liquidity

What makes this hotel REIT stand out from the pack, however, is its low leverage and very strong liquidity that, first, make this REIT a good way to get long-term exposure to the industry if the focus is to diversify and, second, make me want to monitor APLE for a potentially lower price.

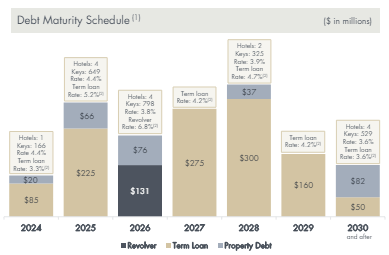

With only 32% of its assets being funded with debt and a debt/EBITDA ratio of 3.67x, this seems like the better hotel REIT to hold during downturns if it comes to that. Its interest coverage of 5.8x is also a product of the generally low cost of debt, represented by a weighted average interest rate of 4.71%.

Plus, APLE has access to a $1.2 billion credit facility, consisting of a $650 million revolving credit facility that matures in 2026, a $275 million term loan coming due in 2027, and another $300 million term loan with a maturity date of January 31, 2028. The facility has a one-year extension option and costs the one-month SOFR, plus a 0.10% spread and a 1.35%-2.25% margin. As of the end of the first quarter, APLE had $519 million available to withdraw.

Looking forward, there are also debt maturities that the REIT will probably face no problems dealing with, given the relatively low amounts involved and the liquidity it has:

Investor Presentation

Performance

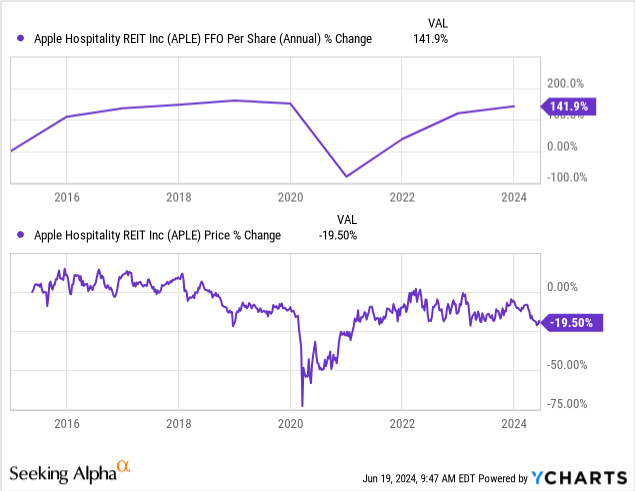

Since the REIT’s IPO in 2015, FFO per share has grown substantially, but the price performance hasn’t followed before Covid:

Although, as you can see, the market has appreciated the recovery back to profitability and more recent results reflect the growth since Covid; below are the changes from the average figures (room revenue, cash NOI, and AFFO) in the past 3 fiscal years to the corresponding most recent ones (Q1) annualized:

| Room Revenue Growth | 10.75% |

| Cash NOI Growth | 6.08% |

| AFFO Growth | 7.49% |

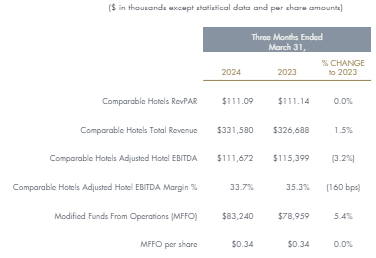

After zooming in, however, the most recent results don’t reflect much growth. RevPAR was flat, occupancy decreased by 10bps to 71.9%, and modified FFO stayed flat at $0.34 per share.

Investor Presentation

Management has forecast RevPAR to realize an increase of 2% to 4% this year. Since the 3% growth that the broader hotel industry is expected to witness falls within the range, the assumption that this REIT is a good proxy is not only supported by the portfolio’s diversification level anymore. Therefore, those who want to capture market returns may find APLE attractive, but the rest of us will need to look elsewhere.

Dividend & Valuation

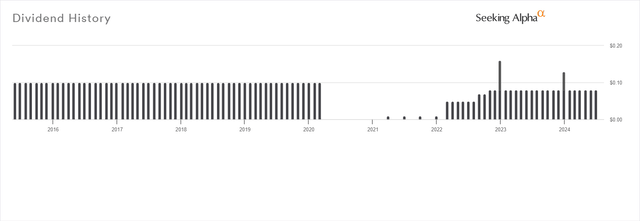

APLE currently pays a monthly dividend of $0.08 per share, resulting in a forward yield of 6.62%. Though the payout ratio is low at 69.87%, I don’t like the fact that management hasn’t been growing it in the past before Covid hit:

Seeking Alpha

For some, just the fact that the distribution is nearly at the pre-pandemic level may be enough, but I think that the yield isn’t high enough given the absence of significant upside potential.

And though the 9.48% AFFO yield appears to be quite attractive here, on a peer-relative basis, APLE does not look as cheap, trading at an FFO multiple a bit higher than the average of other hotel REITs:

| Stock | P/FFO |

| APLE | 8.86 |

| PK | 6.83 |

| SHO | 11.2 |

| DRH | 8.49 |

| PEB | 8.85 |

| XHR | 8.42 |

| Average | 8.75 |

Coupled with a 7.33% premium to tangible book value per share, I don’t think APLE is undervalued here.

Risks

Therefore, the most significant risk comes from a lack of a margin of safety. Another one comes from the potential underperformance of other hotel REITs. The yield is not high enough to sufficiently offset an opportunity cost.

A less APLE-specific risk involves a potential dividend cut. Hotel REITs are very dependent on leisure travel and anything that can negatively affect it like Covid did is a threat to the company’s bottom line.

Verdict

I think that the risks outweigh the benefits presented by this REIT when it comes to a dividend portfolio in the current high interest rate environment. The yield seems to be sustainable here, but it would be more attractive if there was a strong chance for long-term dividend growth or a margin of safety with a case for a meaningful short-term price upside.

Therefore, I rate APLE a hold and recommend that you read my other article about Park Hotels & Resorts (PK); the payout ratio leaves a greater margin for growth, the shares are undervalued, and the portfolio concentration could help the REIT outperform its peers.

What do you think? Do you own this REIT or intend to? Let me know and I’ll get back to you soon. Also, please leave a comment if you found this post useful; it means a lot! Thank you for reading.

Read the full article here

Leave a Reply