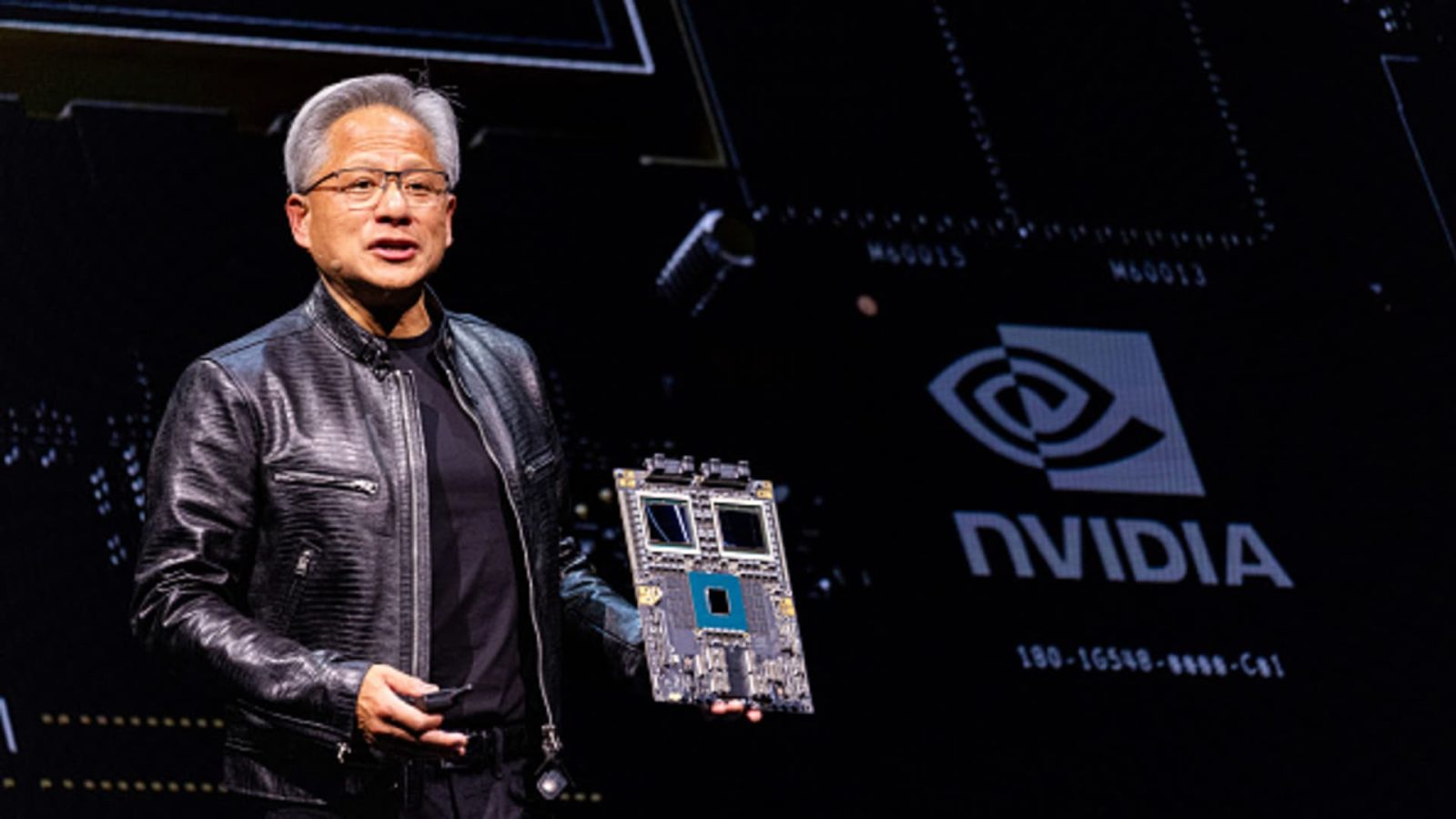

Asian chipmaking heavyweights extended Wall Street’s rally as Nvidia CEO Jensen Huang made bullish comments about the AI darling’s outlook.

The founder of the artificial intelligence chip powerhouse discussed his views on the company’s moat, its rivals and supply chain at Goldman Sachs Communacopia + Technology Conference in San Francisco. Nvidia shares rallied 8% Wednesday as Huang described the demand for the company’s products as “so great” that it “is really emotional for people.”

“We have a lot of people [on] our shoulders, and everybody’s counting on us,” he said.

Stocks tied to Nvidia suppliers and semiconductor related companies rallied in Asia as the bullish investor sentiment spilled over.

Contract chip manufacturer Taiwan Semiconductor Manufacturing Corp jumped as much as 5% and Hon Hai Precision Industry — known internationally as Foxconn — gained over 4%.

Huang also gave credit to supplier TSMC for Nvidia’s success, calling it “the world’s best” and “not by a small margin.”

Japanese chip-related stocks also soared, including semiconductor testing equipment supplier Advantest which gained over 9%. Tokyo Electron and Renesas Electron rose 4.6% and 3%, respectively.

Japanese technology conglomerate SoftBank Group, which owns a stake in chip designer Arm, jumped over 7%.

The investor optimism also extended to South Korea, namely, Samsung Electronics and SK Hynix — the world’s two largest memory chip makers — soared 2% and 7.5%, respectively.

Nvidia dominates the AI chip market, but Huang said Wednesday that the rise of artificial intelligence is broader than just semiconductors.

“The first thing is to remember that AI is not about a chip. AI is about an infrastructure,” Huang said, adding that computing today is far more complex than just making a chip and putting it in a computer, “that’s really kind of 1990s.”

He explained that Nvidia is part of an ecosystem that includes cloud service providers and developers in this “first wave of GenAI.”

Huang also noted that the Asian supply chain is “really diverse and really interconnected” when asked about how Nvidia is weighing geopolitical headwinds in the region. He said Nvidia, “in the event anything were to happen, we should be able to pick up and fab it somewhere else.”

Nvidia shares have skyrocketed 136% so far this year amid continued investor enthusiasm, despite the 10% single-day plunge earlier this month that wiped out nearly $300 billion off its market value.

Read the full article here

Leave a Reply