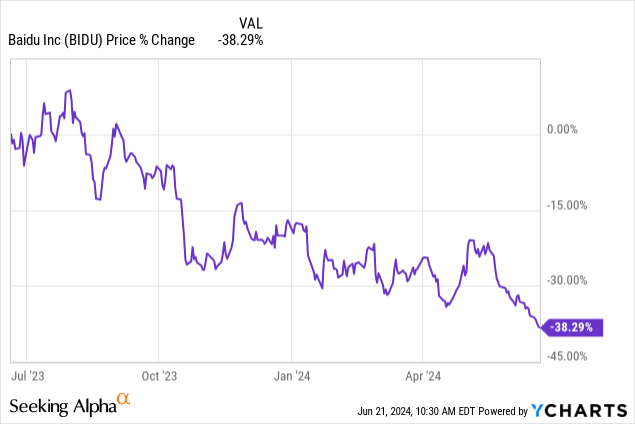

Baidu (NASDAQ:BIDU) is a highly profitable Chinese large-cap investment in the tech industry. Although Baidu delivered a decent earnings sheet for the first fiscal quarter, persistent investor skepticism with regard to Chinese tech companies continues to prevent a revaluation of Baidu’s shares. Baidu saw continual recovery gains in the digital advertising market in Q1’24 and is generating a ton of free cash flow, which in part is now being contributed by the company’s popular video streaming platform iQIYI. The company’s significant free cash flow, continual core business growth and potential for stock buybacks makes Baidu an attractive long term bet!

Previous rating

I rated shares of Baidu a strong buy in March 2024 due to a rebound in the core digital marketing business in China. Baidu continued to see slow top line growth in the first-quarter, but the technology company generated a decent amount of operating income and free cash flow. With continual strength in free cash flow, Baidu could follow into the footsteps of Alibaba (BABA) and focus more on capital returns going forward.

Digital marketing business

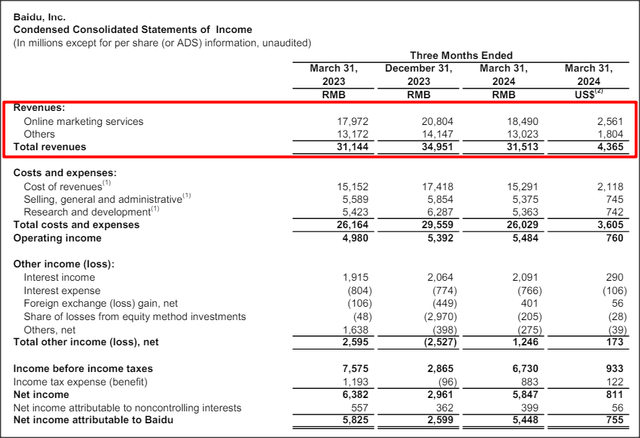

Baidu’s online marketing business, which consolidates the firm’s efforts to monetize its dominant Search market position in China, generated 18.5B Chinese Yuan ($2.56B) in revenues in the first fiscal quarter, showing a year over year growth rate of 3%. While the growth rate is in and of itself not spectacular, Baidu is making solid progress in its core business and seeing decent operating income tailwinds as well. In Q1’24, the technology company had operating income of 5.48B Chinese Yuan ($760M) which showed a Y/Y growth rate of 10%. In other words, the company’s operating income grew at 10X the rate that its revenues grew in the first-quarter.

Baidu

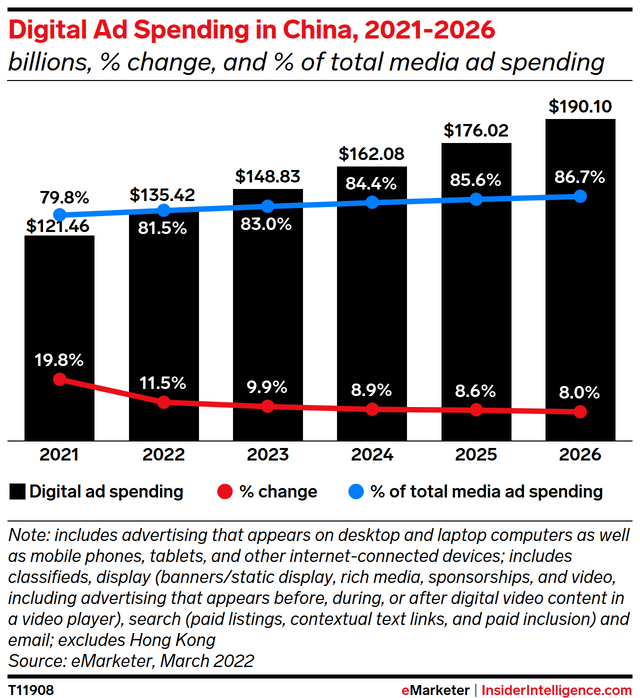

Baidu has the largest Search engine market share in China and has therefore a strong position to participate in the organic growth of the entire industry. According to eMarketer, a research firm, Chinese companies are ramping up their spending on digital marketing platforms like the one provided by Baidu. Although digital ad spending growth is expected to slow (as the market matures), the industry itself is set for sustained growth. Baidu’s AI products, which are embedded in the company’s Search results and could help merchants/advertisers achieve higher conversion rates, could further be a catalyst for digital advertising revenue growth on the company level.

eMarketer

Baidu could become a capital return play for investors

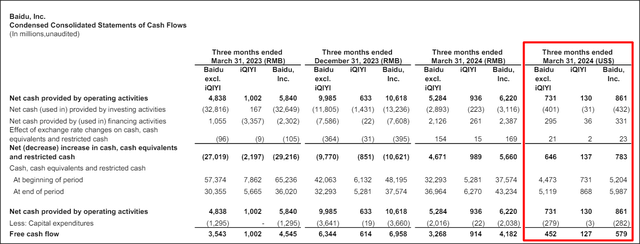

Baidu is widely free cash flow-profitable and I see upside for the company’s FCF as its digital marketing business does well. A second element that is working in favor Baidu is that its video platform iQIYI is making positive free cash flow contributions to Baidu, so the company does not only rely on its digital marketing business to generate cash.

iQIYI is a highly popular video-on-demand streaming platform with more than 500M monthly active users. As many streaming businesses, iQIYI has initially struggled with profitability — as the firm prioritized subscriber and user growth over generating earnings — but the situation has improved drastically since FY 2022.

In the most recent quarter, iQIYI made a positive free cash flow contribution of $127M to Baidu’s consolidated free cash flow. In total, Baidu achieved a free cash flow margin (including iQIYI contributions) of 13% in the first fiscal quarter compared to 15% in the year-earlier period. While the FCF margin has trended down a bit, the company is on track to achieve ~$2.5B in free cash flow this year (assuming a stable 13% FCF margin and $19B in projected full-year revenues).

Baidu

Alibaba, as an example, recently tried to make its shares more attractive to (overseas) investors — Alibaba: Top Dividend Value — by declaring a special dividend and the company repurchased almost $5.0B in shares in the U.S. and Hong Kong in the last quarter. Chinese companies can indeed be capital return plays and since Baidu is free cash flow-profitable, I could see a scenario for higher stock buybacks. Baidu repurchased $229M worth of its shares since Q1’24 and could follow into the footsteps of Alibaba to revitalize interest in the company’s shares.

Baidu’s valuation

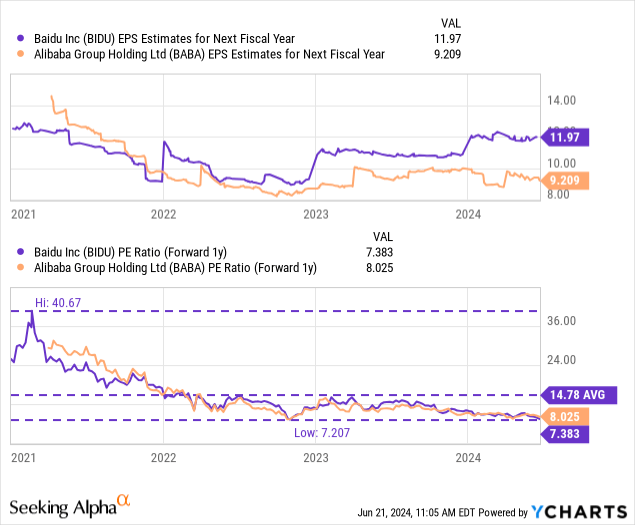

A key pillar of the bullish investment thesis for Baidu is the company’s cheap valuation based off of earnings. In this regard, Baidu is very much in the same situation as Alibaba. Both Chinese e-Commerce/tech companies are priced at very low price-to-earnings ratios of 7-8X, in large part because U.S. investors are hesitant to invest in China due to concerns about ownership and government interference.

In the past, shares of Baidu were much more highly valued, at an average 3-year P/E ratio of 14.8X, which is exactly double Baidu’s current valuation multiplier. I believe that investors will ultimately wake up to the deep earnings value provided by companies like Baidu or Alibaba and an accelerated buyback program, a dividend introduction or accelerating digital marketing growth (on the back of AI tools) could be catalysts for an upside revaluation.

I believe Baidu could, in the long term, return to its past valuation average, but this assumes that the company will continue to grow its operating income/FCF and stay out of trouble with regulatory agencies. In this case, I can see shares of Baidu revalue to their long term average of 14.5X which implies a fair value of $177. Based off of a current P/E ratio of 7.4X, shares of Baidu offer investors an earnings yield of 14%.

Risks with Baidu

There are a number of risks that affect an investment in Baidu. For one, U.S. investors are not very comfortable to invest in China-based companies which is what I believe explains the low P/E ratios of Chinese large-caps in general. Secondly, Baidu is still pretty much dependent on the online marketing business to drive its business results as the segment represented 59% of the company’s total Q1’24 revenues and it was the only segment that generated positive growth in the first-quarter as well. What would change my opinion on Baidu is if the company were to see a decline in its free cash flows or lost momentum in its vital online marketing business.

Final thoughts

Streaming platform iQIYI is making positive free cash flow contributions to Baidu and the company achieves overall healthy free cash flow (13% margins). The online marketing business will remain dominant, in my opinion, as the company is heavily reliant on online search ads and the market provides solid tailwinds for digital advertising spending growth. However, I see Baidu as an evolving capital return play that has considerable potential to follow into the footsteps of Alibaba which is making a serious effort to make its shares more appealing to investors in overseas markets through buybacks and dividend declarations (both regular and non-regular). Besides solid performance in the digital marketing business and positive FCF, I believe Baidu’s most attractive investment feature remains its low and very reasonable price-to-earnings ratio which incorporates a very deep safety margin!

Read the full article here

Leave a Reply