Cannae Holdings (NYSE:CNNE) is a holding company that was founded by Bill Foley, a billionaire and West Point graduate with a long term history of creating value for shareholders.CNNE gives you the opportunity to “tag along” with Bill Foley. It usually trades at a big discount to the “sum of the parts” or mark-to market valuation of the underlying portfolio. Management has recently increased efforts to reduce the discount.

What Can Close the CNNE discount valuation gap?

There are several things that can help to close the gap. CNNE management has already implemented some of them:

- Share buybacks: CNNE has already done a significant amount of share buybacks at significant discounts since 2021.

- Share distributions: CNNE recently introduced a $0.12 quarterly dividend. They plan to maintain and gradually increase the dividend over time.

- Revival in the IPO market for new issues.

- Better NAV performance of the underlying portfolio.

- CNNE can consider doing spin-offs of some of their holdings to their shareholders.

- An acquirer may decide to buy some of Cannae’s larger holdings or perhaps even “take out” the entire company. Bill Foley owns about 8% of the shares and may even consider taking it private himself.

In the last earnings call, Cannae’s President Ryan Caswell commented on the company’s plans to grow NAV and shrink the discount to NAV:

“We continue to focus on executing our strategic plan designed to grow both the net asset value or NAV of our portfolio while also working to close our share price discount to NAV. Our strategy has three main levers, including: improving the performance and valuation of our portfolio companies; making new investments, primarily in private businesses that will produce cash flows and grow NAV; and providing capital returns to our shareholders through either our recently introduced cash dividend or share repurchases. We believe the combination of these three strategic pillars will close the value gap between our stock price and NAV.”

Cannae History

Cannae began as a holding company in 2017 when it was spun off from Fidelity National Financial (FNF). Bill Foley did a good job for shareholders at FNF. He generally used the following strategy:

- Identified undervalued assets

- Implemented operational efficiencies

- Used growth strategies to deliver shareholder value.

Mr. Foley has led several different multi-billion dollar public market platforms with over 100 acquisitions across diverse platforms. Some examples are Fidelity National Financial (FNF), Fidelity National Information Services (FIS), Black Knight (BKI), Ceridian (CDAY), FGL Holdings (FG) and Dun & Bradstreet(DNB).

Market Performance

The most recent three and five year performance for CNNE has been quite poor, largely because of the meltdown in SPAC companies and other venture-style companies since the bubble period in 2021. I have shown the total return performance for various periods compared to stocks in Morningstar’s US Market Total Return benchmark.

|

Time Period |

CNNE Return |

US Market Return |

|

5 years annualized |

– 9.16% |

14.28% |

|

3 Years annualized |

-18.42% |

6.48% |

|

1 Year |

– 5.42% |

20.73% |

|

YTD |

– 6.00% |

11.86% |

|

3 Months |

-10.75% |

2.16% |

Source: Morningstar as of August 12, 2024

The returns from Morningstar above are for a passive buy and hold investor.

But an active trader could have done much better during these time periods by actively trading the March 2024 Modified Dutch Auction tender offer. Cannae purchased $200 million worth of stock using a Dutch auction with a price range of $20.75- $23.75.

The auction price was eventually determined as $22.95. CNNE shares were readily available in late 2023 at much lower prices in the $16 to $20 range and around $20 in the first few months of 2024.

The amazing thing about this Dutch auction is that there was 100% proration. This means that all of the shares tendered in the auction received the $22.95 price. Active traders could have loaded up in the months prior to the Dutch Auction and earned significant profits by tendering their shares.

What About Distributions?

During most of its existence, Cannae has not paid out any distributions. It was similar to Berkshire Hathaway, and primarily used share buybacks to return value to shareholders.

But in order to address the persistent discount to NAV since inception, Cannae management has recently started to pay quarterly distributions. They will also continue to do some share buybacks when the discount to NAV is large.

Here is how management described the new dividend policy in the last earnings call:

“Today we announced a dividend of $0.12 per share, per quarter payable on June 28th to provide an additional return of capital to our long-term shareholders.

We initially will fund the dividends including the one next month through the sale of assets but overtime are looking to make cash flow generative acquisitions. There will be a source of cash to fund the dividend. In the first quarter we sold 10 million shares of D&B for approximately $101 million and 2.55 million shares of Dayforce for total proceeds of $177 million.

We used the proceeds from these sales to fund the Tender Offer as well as for general corporate purposes. Going forward, when we need capital to fund potential business share buybacks and the dividend we expect to sell portions of our public holdings.”

During the earnings call, an analyst asked how long the dividend policy would be in place. Bill Foley answered by saying the new dividend policy would be permanent:

“It’s going to be in place for as long as we’re around. The goal, of course, is to start modestly with a $0.12 per share per quarter dividend. Then as we’ve done with FNF, as you know, increase that dividend as cash flow allows. We’re committed to the dividend going forward on a consistent basis”

Share Repurchases

The CNNE management has consistently done share repurchases when the shares trade at a significant discount to NAV or the sum of the parts fair value. A total of $31.4 million shares or about 34% of outstanding shares in March 2021 have been repurchased for $733 million.

Cannae Share Repurchase Activity

|

Year |

Repurchase Amt |

Avg. Discount |

|

2021 |

$167 Million |

28% |

|

2022 |

$225 Million |

44% |

|

2023 |

$119 Million |

45% |

|

2024 |

$222 Million |

31% |

Given the recent weakness in the CNNE stock price and fairly high discount, I believe we can expect to see management continue to use share buybacks as a tool to help narrow the discount to fair value. But they have also added the quarterly distribution as another tool.

Insider Ownership and Recent Insider Buying

There is considerable ownership of CNNE stock by the management team. Here is a list of executive officers and directors of CNNE who own more than 30,000 shares of the stock. The data is taken from a recent proxy statement as of April 22, 2024:

|

Name |

Shares Owned |

Percentage |

|

William P. Foley, II |

4,834,113 |

7.6% |

|

Frank P. Willey |

438.768 |

* |

|

Ryan R. Caswell |

424,791 |

* |

|

Frank R. Martire |

322,712 |

* |

|

Richard N. Massey |

274,367 |

* |

|

Michael L. Gravelle |

155,521 |

* |

|

Peter T. Sadowski |

140,461 |

* |

|

Erika Meinhardt |

124,685 |

* |

|

Bryan D. Coy |

99,589 |

* |

|

Hugh R. Harris |

47,793 |

* |

|

C. Malcolm Holland |

30,796 |

* |

* Under 1%

Portfolio Holdings

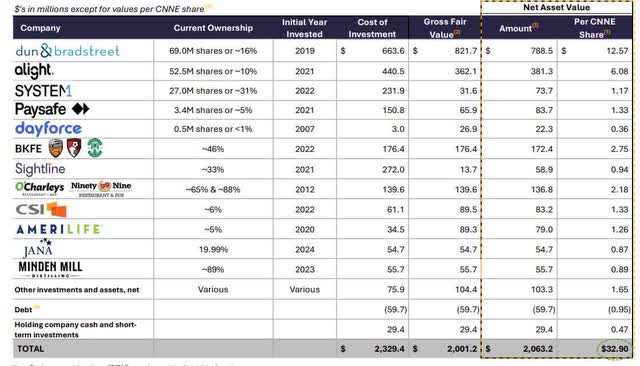

CNNE runs a highly concentrated portfolio. The first five positions listed below are publicly traded. The other issues are private where % ownership is listed instead of number of shares owned.

CNNE Sum of The Parts (CNNE Web Site)

Cannae provides both a Gross Fair Value and a Net Asset Value. The Net Asset Value represents the Gross Fair Value less taxes (21% corporate rate). For the Dayforce holding (DAY), ISIP fees are applied (10% of gain on DAY above $29.58 per share). This approach may result in a tax benefit when an investment’s cost exceeds gross fair value.

The Debt includes $59.7M outstanding on the 7.0% FNF note maturing in November 2025. Cannae also has a $150M margin loan (with interest cost of 3-month adjusted SOFR + 3.10%) maturing March 2027. There is a $500M incremental debt feature which allows Cannae to increase the loan commitment under certain conditions.

The fair value per share was $32.90 as of August 8, 2024 compared to the closing share price of $19.95 or a 39% discount to NAV.

Cannae usually provides their Sum of the Parts analysis at the end of each month, but they sometimes provides an additional update like they did on August 8. I keep a watch list of the five publicly traded Cannae issues. For publicly traded issues, Cannae uses the closing price in their NAV calculation. The watch list provides a way to estimate changes in the NAV from the last reported value.

Portfolio Updates From CNNE Quarterly Report

1) Dun & Bradstreet (DNB):

- On August 5, 2024, D&B issued a statement noting that it has received inbound interest from third parties and retained Bank of America to assist with those inquiries

- Reported second quarter 2024 total revenue of $576 Million with organic constant currency revenue growth of 4.3% over the second quarter 2023

- Adjusted EBITDA growth continued to exhibit strength, growing 5.8% to $218 Million in the second quarter of 2024, up from $206 Million in the prior year second quarter

- The company repurchased approximately 961,000 shares of D&B stock, nearly 10% of their 10 Million share authorization, while maintaining their net leverage ratio at 3.7 times

2) Alight (ALIT):

- Announced CEO succession plan.

- Closed on the sale of its Professional Services segment and its Payroll & HCM Outsourcing businesses for up to $1.2 Billion.

- Used $740 Million of the proceeds to reduce debt, reducing leverage to 2.8 times

- Repurchased $80 Million of Alight shares and commenced a $75 Million accelerated share repurchase plan

- Second quarter 2024 revenue from continuing operations was $538 Million, down 4% from 2023

- Adjusted EBITDA from continuing operations was $105 Million in Q2 2024, compared to $119 Million in Q2 2023, down 12%.

- The company has 97% of 2024 revenue under contract

3) Dayforce (DAY):

- Continued its growth story in the second quarter of 2024, reporting double digit increases across all revenue metrics, adjusted EBITDA and cash flow from operations

- Announced $500 Million share repurchase program

- Raised full year 2024 guidance for revenue and adjusted EBITDA

- Since the end of the first quarter, Cannae has sold 1 Million DAY shares for combined proceeds of $57 Million, marking $2.43 Billion in gross proceeds from dispositions since DAY’s IPO in 2018.

4) Paysafe (PSFE):

- First quarter 2024 payment volume and total revenue both increased 8% while Adjusted EBITDA increased 4% year-over-year

- Management reaffirmed its 2024 revenue and adjusted EBITDA guidance forecasting revenue growth of 5.5% to 7.0% and Adjusted EBITDA margins of 28.0% to 28.5%

- Paysafe will report its second quarter results on Tuesday, August 13, 2024, before market open

5) System1 (SYS):

- Continued to reduce leverage, repaying $155 Million of debt since November 2023

- Reported first quarter 2024 total revenue of $85 Million, ahead of consensus analyst estimates

- Adjusted EBITDA was $0.4 Million for the first quarter 2024, exceeding the top end of the company’s guidance

- System1 reported its second quarter results on Thursday, August 8, 2024 after the market close. All key financial results were above the high-end of guidance range.

6) Black Knight Football:

• AFC Bournemouth completed the Premier League season in 12th place (out of 20 teams). The club’s 48 points is the most the Cherries have ever earned in the Premier League.

• Driven by the Cherries success on the pitch, revenues increased 19% over the prior year to $203 Million in the year ended June 30, 2024.

• The club resigned several key players and acquired several young and promising players, including Dean Huijsen from Juventus.

7) Other News

• In the second quarter 2024, Cannae made its first investment with Jana Partners, which announced an investment stake and engagement campaign around Rapid7 (Nasdaq: RPD), a cybersecurity company specializing in vulnerability management.

• In light of negative operational cash flows, uncertainty in forecasts and a challenged liquidity position, Cannae impaired the value of its investment in Sightline Payments by $141 Million.

• Minden Mill Distillery expects to launch rye, whiskey and single malt brands in the third quarter 2024, following the successful release of High Ground Vodka in the second quarter of 2024.

• Computer Services, Inc. announced a partnership with TruStage Compliance Solutions, a regulatory technology company whose warranted documents and compliance technology are used by more than 5,000 financial institutions nationwide.

• Restaurant Group reported Adjusted EBITDA of $5.4 Million in the second quarter of 2024, more than double the $2.5 Million achieved in the second quarter of 2023.

• As of August 7, 2024, Cannae had $30 Million in corporate cash and short-term investments and $150 Million of margin loan undrawn capacity, offset by $60 Million in outstanding revolver debt.

Conclusion

A non-accredited retail investor often finds it hard to participate in private equity and venture capital investing. Even accredited investors who invest directly in private equity/venture capital funds often sacrifice liquidity and have to tie up their money for years.

CNNE is publicly traded, has a strong management team which is fairly shareholder friendly, and gives you access to some private companies not normally available to retail investors. It currently trades at a bargain price, well below a “sum of the parts” fair value.

CNNE also provides daily liquidity which is not available to most alternative private equity/venture capital investors. There are also tradable put and call options which can be used for hedging purposes.

CNNE has been quite liquid lately and has an average trading volume of 466,000 shares a day. The shares can be quite volatile, and it may be worthwhile to start with a small starter position and then add more shares opportunistically. A watch list of the publicly traded issues can be tracked and additional lots can be purchased when the watch list stocks are up more than the CNNE share price on a percentage basis.

Read the full article here

Leave a Reply