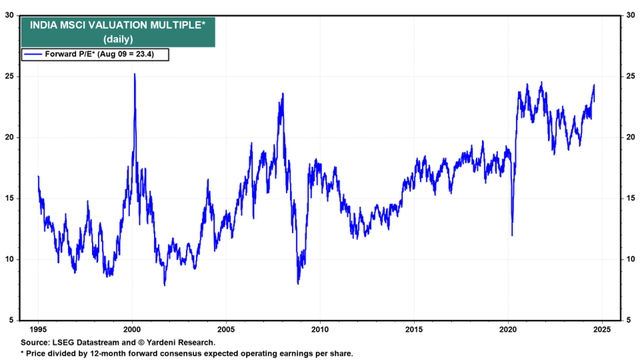

It’s been a topsy-turvy week for global equity markets and, to a greater extent, Asia, following the unwinding of a yen-denominated carry trade potentially worth trillions. In contrast to the steep drawdowns in the rest of Asia, however, India has held firm through the volatility. The relative underweight positioning of foreign investors was likely a key contributor to this resilience, though the fact that earnings season and all-India rainfall continue to pace well also counts for a lot here. As for multiples, Indian stocks are admittedly priced above historical norms but nowhere near detached from their underlying fundamentals.

Yardeni

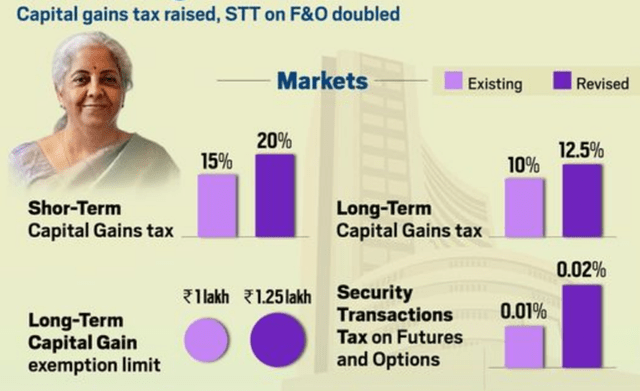

It hasn’t been all good news, though, as new tax hikes on securities transactions and capital gains offered a sobering reminder of the many challenges foreign capital continues to face in India. The latter is a particularly big deal for India funds, as unlike most other country funds, these taxes accrue in underlying net asset value calculations – hence the persistently wide tracking errors suffered by most US-listed India ETFs.

Against a backdrop of higher capital taxes, wider tracking errors, and greater difficulty tracking benchmarks, my thesis on the abrdn-managed The India Fund (NYSE:IFN) (see The India Fund: Still A Compelling Play On The ‘GDP Growth Champion’) still rings true – this is, in my view, potentially a better vehicle to track large-cap Indian indices than conventional passive alternatives. As with most other closed-end funds, there are drawbacks, though as I outline in the article, plenty of offsetting positives that more than justify an investment.

IFN Overview – Striking the Balance Between Fees and Liquidity

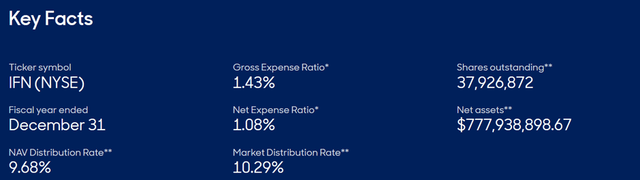

Fundamentally, not too much has changed with the closed-end India Fund. Both the manager (abrdn) and the benchmark (MSCI India Index) are intact. The most striking change, though, is the surge in net asset growth (now ~$778m) IFN has seen in recent quarters.

abrdn

Elsewhere, there’s a higher ~1.5% gross expense ratio to be mindful of – largely due to inflation of the ‘other expense’ line (think admin, director, custody, legal fees, etc) per IFN’s annual report. With no waiver offset this year either, closest active comparable, Morgan Stanley’s India Investment Fund (IIF), which charges ~1.4%, is now the marginal cost leader in the active space. Still, IFN is more liquid, so from a total cost perspective (fees + execution), it still has a slight edge here – particularly for investors moving larger volumes.

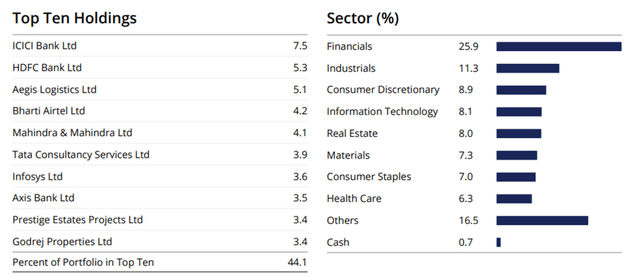

IFN Portfolio – Some Reshuffling; Still Lots in Common with MSCI India

The India Fund isn’t a particularly active fund, as the low ~22% turnover of its 50-stock portfolio shows. Nor does it deviate too far from its benchmark – a key reason for its borderline ‘closet indexer’ active share score (i.e., the portfolio composition delta vs. MSCI India). In line with this view, the Q2 factsheet shows that allocation retains a lot in common with MSCI India, with both portfolios sharing a skew toward blue-chip banking stocks like ICICI Bank (IBN) (7.5%) and HDFC Bank (HDB) (5.3).

That said, there are differences too, most notably the absence of Reliance Industries (vs. 7.2% for MSCI India) and an underweight on IT services leader Infosys (INFY) (3.6% vs 4.8% for MSCI India). This has, in turn, freed up space for relative overweights on telco Bharti Airtel, auto manufacturer Mahindra & Mahindra (OTC:MAHMF), and Tata Consultancy Services. Also notable is that IFN now features two stocks not in MSCI India – Aegis Logistics (5.1%) and Prestige Estates Projects (3.4%).

abrdn

IFN Performance #1 – Look Beyond the Headline Numbers

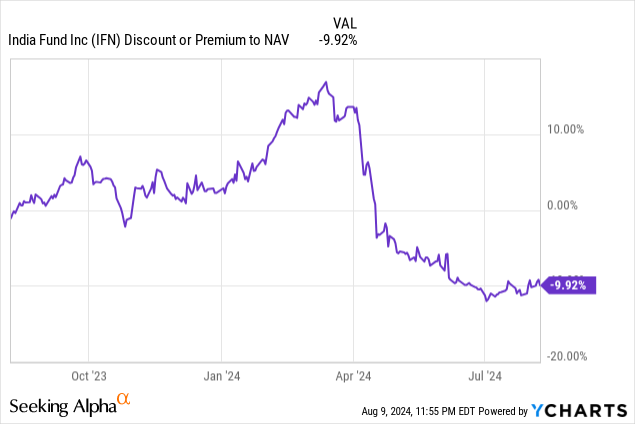

IFN ended 2023 on a clear high (+36.7%), but performance this year has been trickier to parse. As of Q2, the fund was up +17.0% in NAV terms but only +2.5% in market price terms. A key reason for this gap is the fund’s NAV discount, which reverted from a low-single-digit % premium earlier this year to a ~10% discount currently. In effect, this shift alone has canceled out the vast majority of IFN’s stellar high-teens % gain.

Unlike most other closed-end funds, though, there’s a lot more to IFN’s discount fluctuations than meets the eye. For one, the Board has a particularly shareholder-friendly “managed distribution policy” in place that keeps its yearly distribution rate elevated in the ~10% range. The second and perhaps bigger driver of IFN’s tighter discount is that the fund defaults to newly issued share distributions for its yearly payouts – per the annual report, “The Fund’s distributions will be paid in newly issued shares of common stock of the Fund to all shareholders who have not otherwise elected to receive cash.”

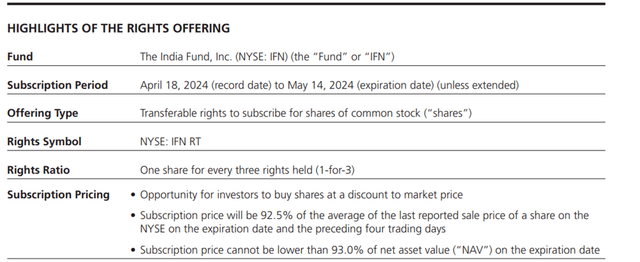

Plus, there’s the optionality, as IFN’s recent ~$110m rights offering, granting existing investors access to discounted shares (see terms below), showed. Note that headline NAV return figures don’t fully reflect the gains for investors who subscribed to this offering and thus understate the actual IFN performance this year.

abrdn

Last but not least is an open-ended commitment by the Board, reiterated more recently in the rights issue prospectus, that “the Board, in consultation with the Investment Manager, from time to time may review possible actions to reduce any such discount.” Whether this means bigger repurchases (base case) or a full open-ending (best case) is anyone’s guess; the Board’s explicit willingness to consider these options means IFN’s optionality is very much ‘in-the-money’. In any case, the forcing function posed by prospective share/rights issuances, Board optionality, and potentially above-par future returns, is a powerful one and should keep the NAV discount well-anchored.

IFN Performance #2 – A Better Tracker than a Tracker Fund

The other key thing to note about IFN’s performance is how closely the fund has tracked MSCI India through the cycles. While the fund has trailed its benchmark for the last five years, over a longer ten-year timeline, IFN’s annualized NAV return is notably within 10bps of the index. By comparison, investors in a conventional tracker fund like INDA would have trailed MSCI India by one to two percentage points per year. This gap, known as a tracking error, is down to many factors (as I highlighted in INDA: Keep Calm And Stay Long India), with the biggest one being the fact that capital gains taxes are accrued in the NAV of all US-listed India funds. If this year’s tax hikes are any indication, tracking errors will only worsen from here.

India Today

Against this backdrop, two points make IFN an increasingly attractive alternative for passive investors. Firstly, that it has very closely tracked MSCI India through the years. Secondly, that IFN has achieved these returns with a very low portfolio turnover and an index-like portfolio composition. While there are tradeoffs here, including IFN’s higher fees and NAV discount uncertainties, on balance, the case for active over passive strikes me as quite compelling here.

A Most Interesting Large-Cap India Play

At first glance, IFN’s returns haven’t quite lived up to expectations this year. A deeper dive, however, reveals quite a few mitigating factors and reasons to be optimistic about the fund’s mid to long-term outlook. With investors also getting paid quite well in the meantime, I remain upbeat on IFN.

Read the full article here

Leave a Reply