The American public is really having difficulty in dealing with inflation.

In April 2024, the Fed’s preferred measure of consumer prices was up by 2.7 percent from a year earlier.

According to Justin Lahart, writing in the Wall Street Journal,

“That marks an improvement from April 2023, when it was up 4.4 percent, but still doesn’t show the kind of progress investors were hoping for at the beginning of the year….”

His subtitle, “Inflation Spooks Public.”

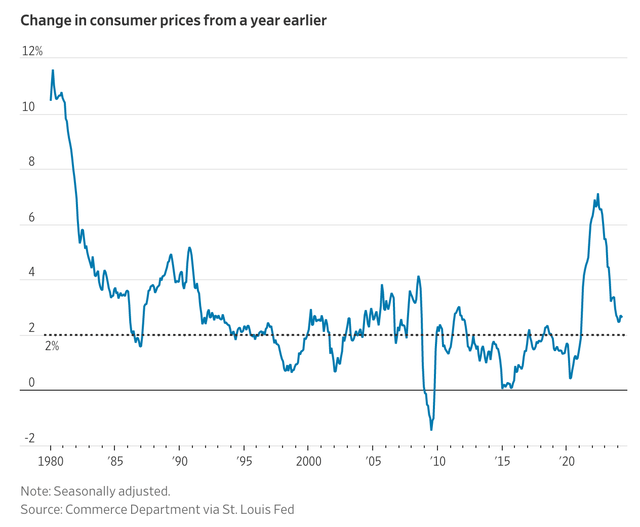

Here is the picture of consumer prices going back to 1980.

Change in Consumer Prices (St. Louis Fed)

Note that since the early 1980s when Fed Chair Paul Volcker really put the squeeze on inflation, that inflation has been relatively tame up until the 2020s.

Note especially the U.S. experience with inflation since 2009 and the ending of the Great Recession.

Ben Bernanke, Fed Chair from 2006 to 2014 really changed the game plan. His restructuring of monetary policy into runs of either quantitative easing or quantitative tightening created a wholly different world of government policy.

Note that for most of the 2010s, the rate of inflation, using this measure, was below 2.0 percent.

It was only the dislocation created by the Covid-19 pandemic and subsequent recession that distorted the economic picture.

Inflation shot up to more than 7.0 percent before dropping back to the current level.

By, continuing to keep monetary policy focused upon quantitative tightening to combat this inflationary splurge, the Federal Reserve hopes to bring inflation back into a range of outcomes similar to that of the 2010s.

But, something else has happened to the U.S. economy.

This “something else” is picked up in the article, “Economic Data Paint a Picture of Two Americas,” also appearing in the Wall Street Journal.

Aaron Back writes,

“The U.S. economy keeps throwing up surprises, making it difficult to get a read on what’s happening….”

“A growing disconnect between the fortunes of upper- and lower-income Americans could account for some of the crossed signals.”

Going further,

“The upper cohort in the U.S. mostly own their homes and the lion’s share are likely sitting pretty with ultralow mortgage rates taken out or refinanced during the pandemic. They are also benefiting from an effervescent stock market, including downright euphoric valuations for anything associated with the promise of artificial intelligence.”

“They also aren’t struggling with high interest on credit cards or auto loans.”

“Instead, high interest rates are actually applying them with record levels of investment income, as the Wall Street Journal recently reported.”

Two points here. First, there have been many micro-changes that have been taking place that have hit the less-wealthy more than the wealthy.

For example, the lead editorial in the Wall Street Journal discusses how insurance rates, both for homes and for autos, are skyrocketing and having a much more damaging impact on the less-well-off.

There have been many other stories about how changes in the health market have fallen much more heavily on lower-wealth individuals.

And, this has been true in several other markets in the U.S. One grabbing some headlines is the rise in the price of certain vegetables.

The bottom line here is that there is a lot going on below the “macro” level of the economy that is producing narratives about how “inflation” is hurting a large number of Americans and that this discontent is filling the news with evidence that appears to be contradictory to other information that is coming out in the news.

The second point…changes in wealth distribution.

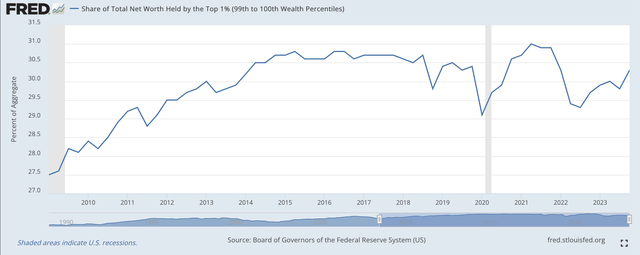

Share of Total Wealth: Top 1 % (Federal Reserve )

In the first quarter of 2009 (the Great Recession ended in the second quarter of 2009) the top one percent of the wealth holders in the United States held 27.5 percent of the country’s wealth.

In the fourth quarter of 2023, the top one percent held 30.3 percent of the country’s wealth.

And, this pattern followed on down through the economy.

Wealthier Americans benefitted, since the end of the Great Recession, from the rising stock market, the rising prices of housing, and the rising prices found in other asset classes.

And, it seems as if this wealth pattern is carrying on as the U.S. economy moves on out of the relapse of the market connected with the spread of the Covid-19 pandemic.

It seems as if the Fed’s policy stance of “quantitative” easing or “quantitative” tightening has resulted in wealthy people putting their money into “assets” rather than into physical goods.

Thus, the “assets” are experiencing price inflation.

The “old” version of monetary policy had the monies flowing into goods and services so that the inflation was experienced in terms of rising consumer prices.

Thus, as the period of quantitative tightening continues, the Fed’s target for consumer price inflation should continue to decline as the stock market and other asset prices continue to rise.

However, this will result in the changes to the wealth distribution in the United States will continue so that discontent will rise further in certain segments of the economy.

Read the full article here

Leave a Reply