While consumer staples is not among the most prominent sectors in the equity market, the recent swings seen in the last few weeks serve as a reminder of the benefit of maintaining exposure to relatively more stable areas, such as consumer staples, as the sector outperformed the broader market during this period, much like it has historically done in more risk-averse environments.

The iShares US Consumer Staples ETF (NYSEARCA:IYK) is one of the funds covering the sector. This fund draws attention due to its relatively higher profitability measures compared to other consumer staples ETFs and its lower valuation multiples. Thus, despite a more benign outlook for stocks in general, I view IYK as well-positioned as a value, lower volatility investment option, offering an additional cushion of safety in a diversified portfolio.

ETF Description & Highlights

IYK is an exchange-traded fund that offers exposure to U.S. large and mid-cap companies in the consumer staples sector, tracking the investment results of the Russell 1000 Consumer Staples RIC 22.5 / 45 Capped Index.

This index is a representation of the consumer staples sector from the Russell 1000 index, which comprises the largest 1,000 U.S. companies. According to the index provider, companies classified in this sector are defined as those operating in areas less sensitive to economic cycles, where customers’ habits are typically non-cyclical.

Companies are weighted based on market capitalization and are rebalanced quarterly. The index also adopts a capping mechanism designed to reduce concentration risk, where no more than 22.5% of the index weight can be allocated to a single constituent, and the combined weight of all constituents representing more than 4.5% of the index should not exceed 45% of the total index weight.

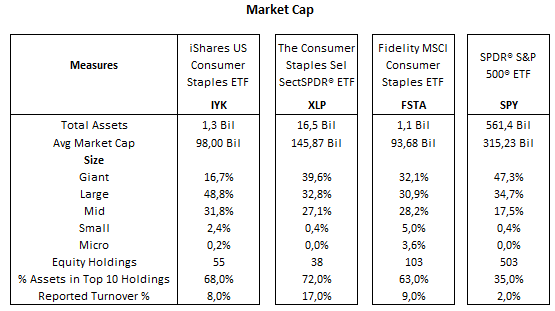

With $1.3 billion in AUM, IYK is a much smaller fund compared to the Consumer Staples Select Sector SPDR ETF (XLP), the largest ETF covering this sector, with $16.5 billion in AUM. IYK is a fund with a focus on mid and large caps, where mega caps represent nearly 17% of total assets compared to 40% for the XLP. Still, while IYK tracks an index derived from the Russell 1000 index, nearly 95% of the assets also belong to the S&P 500. The other consumer staples ETF used in this analysis, the Fidelity MSCI Consumer Staples ETF (FSTA), has a well-balanced distribution across mid, large, and mega caps, but as much as the other two funds, it has little exposure to small caps.

The fund’s top ten holdings: P&G (PG) (16.7%), Coca-Cola (KO) (11.3%), PepsiCo (PEP) (10.1%), Philip Morris (PM) (7.8%), Mondelez (MDLZ) (4.7%), Altria Group (MO) (4.2%), Colgate-Palmolive (CL) (4.0%), McKesson (MCK) (3.5%), CVS Health (CVS) (3.4%), and Kimberly-Clark (KMB) (2.1%), make up 68% of the fund, and are composed primarily by large players in the household products, beverage, and tobacco industries. There are also two original health care names in the distribution and retail industries, McKesson and CVS Health, as they can also be considered essential goods and service providers.

Morningstar, consolidated by the author

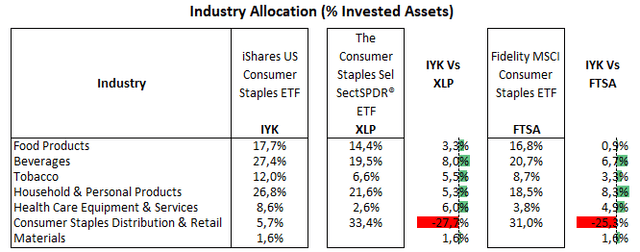

From an industry perspective, IYK’s largest allocation is to the Beverages with 27.4% of total equities, followed by Household & Personal Products with 26.8%, Food Products with 17.7%, Tobacco with 12.0%, Health Care Equipment & Services with 8.6%, Consumer Staples Distribution & Retail with 5.7%, and Materials with 1.6%. Relative to XLP and FTSA, IYK is heavily underweight in Consumer Staples Distribution & Retail and overweight in other industries, as IYK holds no shares in large retailers such as Costco, Walmart, and Target. This is offset by overweight positions in other major players like P&G, Coca-Cola, PepsiCo, and Philip Morrison.

iShares, State Street, and Fidelity websites, consolidated by the author

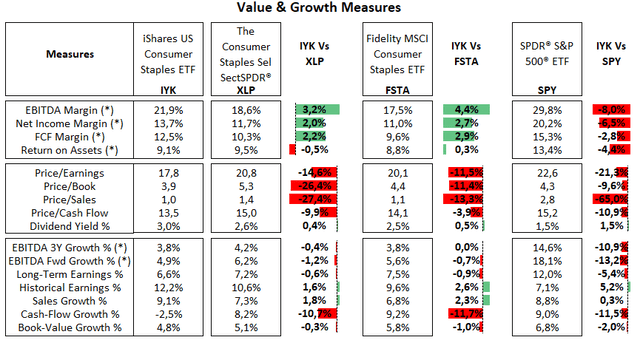

Low Valuation, Higher Profitability

The absence of Costco, Walmart, and Target in IYK’s holdings has driven up the average profitability of the fund in comparison with XLP and FTSA, as these companies’ EBITDA margins are below 8%. This effect is exacerbated by IYK’s heavier allocation to names with higher EBITDA margins, like P&G (28%), Coca-Cola (33%), Philip Morris (39%), and Altria (59%). As a result, based on my calculations, IYK’s average EBITDA margin is nearly 21.9%, three percentage points higher than XLP. The same applies to net income and FCF margins, where IYK is roughly two percentage points higher than XLP.

Meanwhile, this sector has seen only modest growth in EBITDA over the past few years, lagging behind the broader market, as companies have faced cost pressures on several fronts, such as raw material, labor, and logistics.

On the valuation side, IYK has a relatively low price/earnings ratio of 17.8x. This is achieved due to a number of low-valuation players in its holdings, such as Altria Group (10.1x), CVS Health (8.9x), Kroger (11.7x), Archer Daniel (10.9x), and Kraft Heinz (11.6x), which more than compensate for higher valuation in some of its core positions like P&G (24.5x), Coca-Cola (24.3x) and Colgate-Palmolive (29.9x). Meanwhile, XLP has a price/earnings ratio of nearly 20.8x, 15% above IYK and just 8% lower than the S&P 500 index, driven in large part by XLP’s core holdings in Costco (54.6x) and Walmart (30.5x).

Morningstar, Seeking Alpha, and author estimates (*)

Outperforming The Peer Group In The Long Run

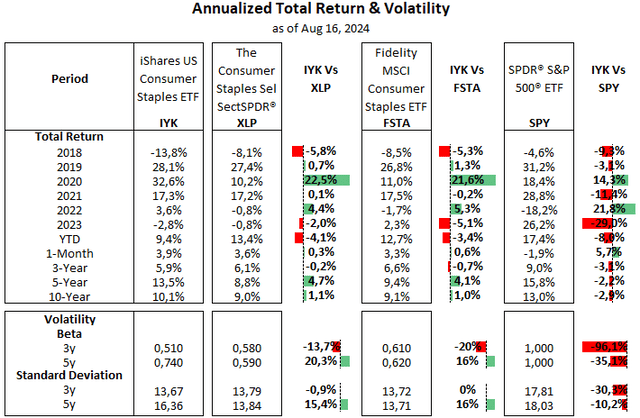

The consumer staples sector is typically a special case in the equity market, as it tends to be much less volatile than the broader market and is likely to outperform in risk-averse environments. That has been no different for IYK. This fund delivered positive returns during the market correction in 2022, outperforming the broader market, and also during the past one-month period, when the broader market experienced a selloff.

In the long haul, however, IYK has lagged the S&P 500 index, driven by the strong outperformance of the broader index during years of more risk on sentiment, like 2021 and 2023. Meanwhile, despite the underperformance year-to-date, IYK’s total returns have generally been above those of peers XLP and FSTA.

IYK has delivered what we expected in terms of volatility, with a beta as low as 0.51 over the past three years and generally in line with XLP and FSTA over time, as all of them show significantly lower measures compared to the S&P 500 index.

Morningstar, consolidated by the author

Looking ahead, we can expect more of the same for IYK and the consumer staples sector as a whole, as the probability that the U.S. economy averts a recession seems stronger after better-than-feared economic indicators released in the past week. This is likely to maintain a positive market sentiment, while shifts in expectations on the interest rate path may cause some short-term selloffs. Thus, the overall market may continue to perform well, although it remains to be seen whether the case of a broadening market leadership can play out.

This naturally poses a challenge for more stable and lower-growth sectors, such as consumer staples. Still, my view is that there is a place for consumer staples stocks in a diversified portfolio, driven by the resilience of this sector in more adverse macroeconomic scenarios. This strength is especially true for a fund like IYK, where we can see a portfolio with higher profitability measures like EBITDA compared to the sector and relatively low valuation multiples.

Read the full article here

Leave a Reply