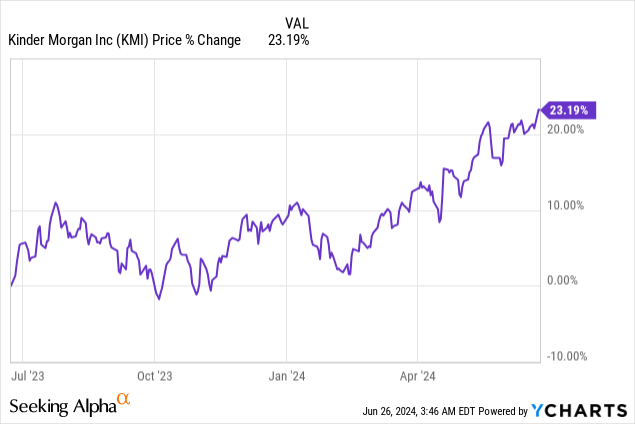

Kinder Morgan (NYSE:KMI) is a well-run midstream enterprise that delivers consistently good dividend coverage and is growing its distributable cash flow. Shares of Kinder Morgan have revalued to 1-year highs lately, but the energy company still makes a decent value offer for those investors that are mainly concerned with generating recurring income from the shares. From a valuation perspective, Kinder Morgan is moderately valued, leaving room for a re-pricing to the upside, especially with demand for artificial intelligence products driving energy demand going forward!

Previous rating

I rated shares of Kinder Morgan a buy in November 2023 as the midstream firm provided strong distributable cash flow and a well-supported dividend: A 6.7% Yield And Acquisition Potential. The midstream company further relies heavily on contracts that stipulate prices well in advance, leading to cash flow certainty. Additionally, energy demand, especially for natural gas, Kinder Morgan’s core business, is projected to rise over the next decade and the growth of AI workloads in the Data Center segment could be a catalyst for accelerating energy demand.

Premier energy infrastructure company with a natural gas-focus

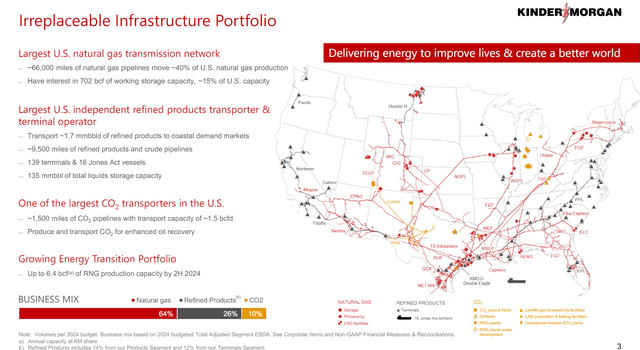

Kinder Morgan is the largest energy infrastructure company in the S&P 500 and the midstream firm operates a considerable amount of energy assets in the U.S. Kinder Morgan owns 66,000 miles of natural gas pipelines (as well as almost 10,000 miles of refined product pipelines), energy storage facilities and terminals. Kinder Morgan is therefore a critical link between producers and consumers that make sure that energy products are transported to consumer end-markets in a reliable and efficient manner.

Kinder Morgan

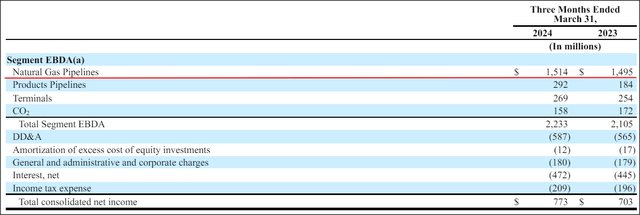

Kinder Morgan is focused mainly on natural gas services (transport and storage). The firm’s natural gas pipelines generated $1,514M in segment earnings in the first fiscal quarter, showing 1.3% year over growth, and natural gas is by far the largest segment in terms of earnings contribution for Kinder Morgan. Natural gas had a total earnings share of 68% in Q1’24, followed by Products pipelines which contributed 13% of consolidated segment earnings.

Kinder Morgan

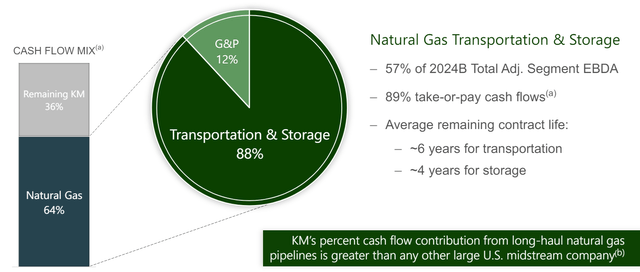

Natural gas further contributed 64% of the midstream firm’s cash flows. The majority of cash flows (89%) in the natural gas segment are also contracted in advance, through what are called ‘take-or-pay provisions’. These provisions pre-determine how much energy product customers have to take off of Kinder Morgan at a specified time in the future and they serve to reduce cash flow risks for midstream firms.

Kinder Morgan

Demand outlook and AI-related upside

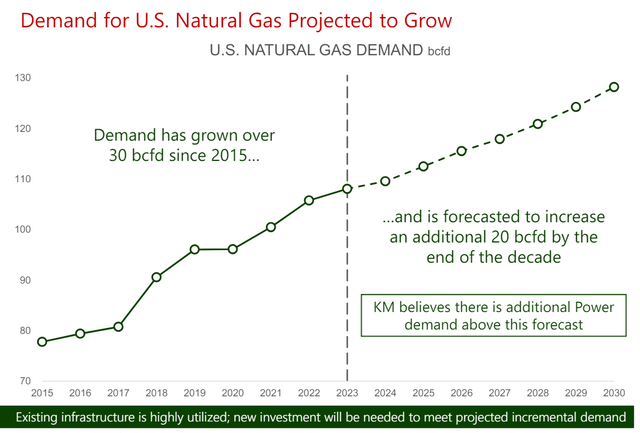

The outlook for the U.S. natural gas industry is favorable as well, indicating a need for incremental capacity investments as natural gas demand is projected to grow. This outlook is critical for long term investors especially as it indicates potential for sustained distributable cash flow and dividend growth in Kinder Morgan’s core business. A driver of demand for energy more broadly could be the accelerating adoption of artificial intelligence which is expected to be increasingly deployed in and leveraged by Data Centers.

Kinder Morgan

According to a report by investment company Schroders that evaluated the impact of artificial intelligence on energy demand, AI could be a powerful catalyst for the energy sector in the next decade, and therefore benefit companies like Kinder Morgan as a premier, large-scale midstream enterprise. According to Schroders, between 2010 and 2023, AI and Data Center-related electricity demand grew 14% annually, outstripping total global electricity demand growth of 2.5% annually by a wide margin.

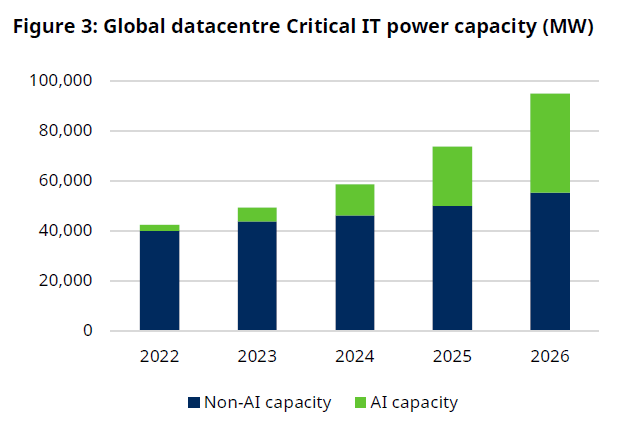

Generative AI is very computing and energy-intensive and a growing Data Center footprint is going to be a driver of energy demand. The chart below shows that global Data Center power capacity is set to grow rapidly, at an average annual rate of 25% between FY 2023 and FY 2026 (almost twice the CAGR, 13%, since FY 2014), driven mainly by AI workloads. These AI workloads are set to become a significant driver of energy demand and therefore ultimately benefit the energy sector and the largest midstream energy companies that operate in it.

Schroders

Coverage profile

Kinder Morgan is a dividend growth play for investors that delivers consistently good dividend coverage. In fact, Kinder Morgan’s dividend coverage has improved since Q3’23 and most recently, in Q1’24, stood at 2.23X, meaning the midstream firm supports its dividend very well with distributable cash flow. What I don’t like too much about Kinder Morgan is that the midstream enterprise grows its dividend only very slowly: in the last year, Kinder Morgan just barely grew its dividend by less than 2%.

| KMI | Q1’23 | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Y/Y Growth |

| Distributable Cash Flow | $0.61 | $0.48 | $0.49 | $0.52 | $0.64 | 4.9% |

| Declared Dividends | $0.2825 | $0.2825 | $0.2825 | $0.2825 | $0.2875 | 1.8% |

| Coverage | 2.16X | 1.70X | 1.73X | 1.84X | 2.23X | – |

(Source: Author)

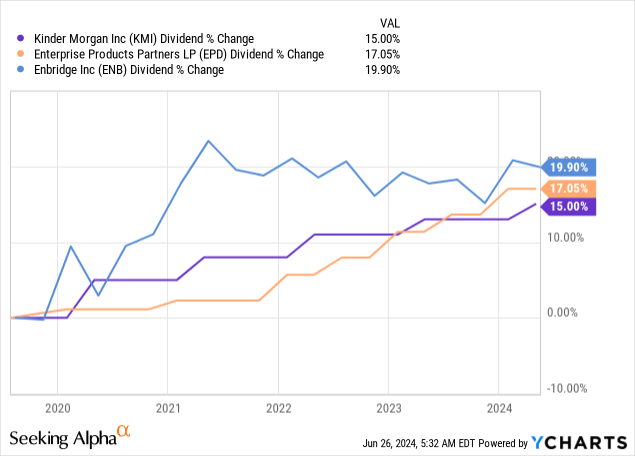

As you can see in the chart below, Kinder Morgan has underperformed its closest rivals in the space — Enterprise Products Partners (EPD) and Enridge (ENB) — in terms of dividend growth in the last 5 years. Enterprise Products Partners offers by far the fastest distribution growth and it is the main reason why I continue to recommend EPD as a yield and top income play to dividend investors. Enbridge is also a deep value investment, despite its high valuation multiplier based off EBITDA.

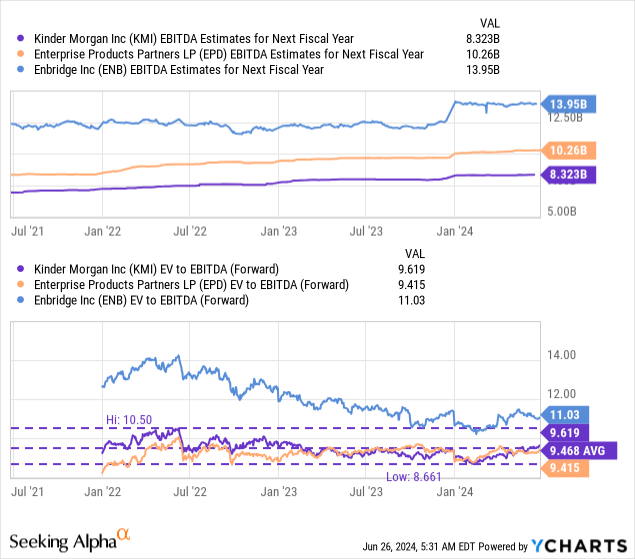

Kinder Morgan’s valuation

To value Kinder Morgan I am using an enterprise-value-to-EBITDA approach as midstream companies typically have to deal with a lot of capital expenditures and depreciation which can skew earnings results. Kinder Morgan’s shares are currently trading at 9.6X enterprise-value-to-forward EBITDA, and therefore are priced slightly above the 3-year average ratio of 9.5X. Enterprise Products Partners and Enbridge, two rival midstream firms, are trading at enterprise-value-to-forward EBITDA ratios of 9.4X and 11.0X. The industry group average enterprise-value-to-forward EBITDA ratio is about 10.0X.

I believe Kinder Morgan could trade at least at 11-12X EV-to-EBITDA, and potentially even at a higher ratio, if the use of AI workloads in Data Centers accelerates energy demand. An 11-12X EV-to-EBITDA ratio implies 14-25% upside revaluation potential and calculates to a fair value range of $23 to $25.

Risks with Kinder Morgan

The biggest risk for Kinder Morgan, as I see, relates to the company’s exposure to regulation that limits the development of fossil fuels which could negatively impact the firm’s EBITDA, distributable cash flow and dividend growth. Another risk is that projections about growing natural gas demand are too optimistic and that Kinder Morgan may not be able to realize significant natural gas-driven growth in its portfolio. What would change my mind about KMI is if the company failed to leverage AI-related upside in its energy portfolio or saw a decline in its dividend coverage profile.

Final thoughts

Kinder Morgan owns mission-critical energy infrastructure and is heavily focused on its natural gas operations. The long term outlook for U.S. natural gas demand is positive, indicating potential for durable DCF and dividend growth. A catalyst for distributable cash flow growth could be accelerating development of large Data Centers in order to accommodate energy-intensive AI workloads… which would benefit the energy sector as a whole, but especially those companies that have large energy transportation networks, like Kinder Morgan. I consider the dividend to be very safe, although I have to admit that I don’t necessarily like Kinder Morgan’s low dividend growth rate!

Read the full article here

Leave a Reply