Investment Overview

I am initiating coverage on Kinross Gold (NYSE:KGC)(TSX:K:CA) stock with a “Hold” rating. The gold miner has surged by 76% in the last 12 months. This has been on the back of strong fundamentals and a good operational performance.

I further believe that Kinross stock remains attractively valued and there is potential for further upside. However, I would refrain from fresh exposure to the gold miner. This initiating coverage on Kinross discusses the positives and the concerns.

An important point related to the thesis is that I remain bullish on gold trending higher. That’s the trigger for revenue and cash flow growth. However, my concern relates to the company’s ability to boost production in the next 24 to 36 months. This coverage will elaborate on the fundamental and asset perspective to underscore my broad view on Kinross.

With Kinross stock having surged by 76%, let’s start with the valuations. Kinross trades at a forward EV/EBITDA of 5.55 as compared to the industry average of 8.71. This is a clear indicator of the point that a valuation gap still exists. I would therefore not be surprised with another 30% to 40% rally from current levels. I would further be betting on this upside in the next 12 to 18 months as the precious metal trends higher.

Gold Will Continue to Make New Highs

It’s been a good year for gold with a rally of 21.5%. There are two factors that have supported upside in the precious metal.

First, it’s likely that central banks globally will pursue aggressive expansionary policies in the next 12 to 15 months. Gold has been discounting this factor as easy money policies translate into weaker fiat currencies.

Further, geopolitical tensions have been high and several central banks have continued to accumulate gold. Net buying by central banks in the first half of 2024 amounted to 483 tonnes, which was 5% above the previous record of 460 tonnes in the first half of 2023.

In April 2024, Citi opined that gold is likely to trade at $3,000 an ounce in the next 6 to 18 months. With aggressive rate cuts on the cards, I see this target as realistic. Kinross Gold will therefore be positioned to benefit from higher realized prices. This strengthens the case for an upside of 30% to 40% by the end of 2025.

I must add here that KGC stock offers a dividend yield of 1.34%. There is a strong possibility of robust upside in dividends in the coming quarters.

Investment Grade Fundamentals

Strong fundamentals and credit metrics is another important reason to like Kinross stock. There are three important points to note from a financial perspective.

First, as of Q2 2024, Kinross reported a cash buffer of $480 million. Further, if the undrawn credit facility is included, the company’s liquidity buffer stands at $2.1 billion. Therefore, financial flexibility remains high for aggressive investments.

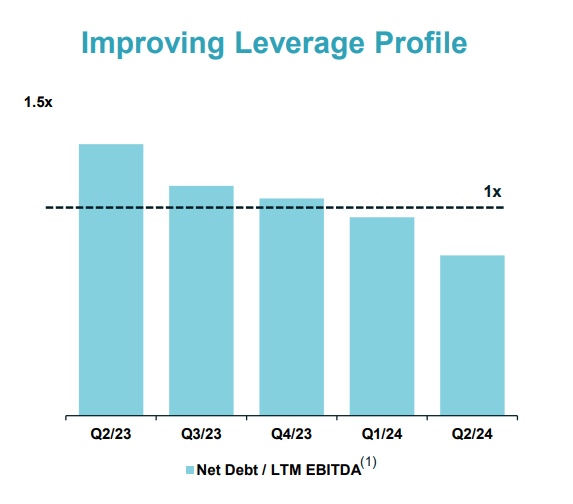

Second, Kinross reported total debt of $2 billion as of Q2 2024. However, the company’s net-debt to LTM EBITDA was less than 1x. With low leverage and robust EBITDA margin, credit metrics are healthy.

Investor Presentation August 2024

It’s worth noting that in Q2, the company repaid $200 million debt. Considering the cash flow visibility, I expect deleveraging to continue. This will support further improvement in key credit metrics.

Third, Kinross reported adjusted operating cash flow of $478 million during the quarter. The realized gold price during this period was $2,342 an ounce. With gold trading above $2,500 an ounce, the annual OCF potential is more than $2 billion. Further, if gold trades at $3,000 an ounce, the annual OCF is likely to be close to $3 billion. Free cash flows will therefore be robust and will add to the financial flexibility.

Another important point to note is that Kinross expects attributable capital expenditure of $1 billion for 2024. However, for 2025 and 2026, the capital investments are likely to decline to $850 million and $650 million, respectively. If gold trades in the range of $2,500 to $3,000 an ounce, the annual free cash flow visibility will be over $1.5 billion to $2 billion. Strong fundamentals and robust free cash flow visibility make Kinross stock attractive and backs the potential for further upside.

Why I Would Refrain from Buying Kinross Stock?

The EV/EBITDA metric discussed earlier indicates a valuation gap for Kinross stock. For an investor who is holding the gold miner from lower levels, it makes sense to hold. However, I am not recommending fresh exposure to the stock.

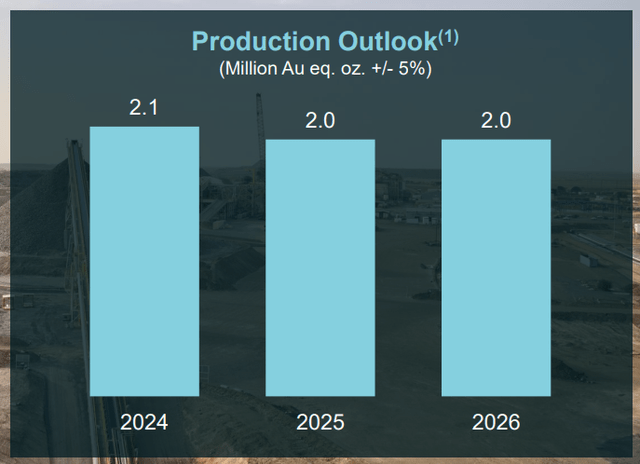

The key reason for this view is explained by the production outlook chart below.

Investor Presentation August 2024

The management has therefore guided for stable production through 2026. If gold gradually trends higher during this period, Kinross will benefit from higher realized price. This will translate into revenue and cash flow growth. However, there will be no incremental impact of production growth.

Iamgold (NYSE:IAG) is a case where the company is likely to witness healthy production growth in addition to the benefit from higher realized prices. Recently, I opined that IAG stock has 50% upside potential.

The risk therefore with Kinross is gold trading sideways. In this scenario, revenue and cash flows will remain flat on a year-on-year basis. Of course, operating cash flow of $2 billion with gold at $2,500 an ounce is a positive. However, the markets would have priced in this factor.

Kinross stock will trend higher on two conditions. First, gold trends higher, as anticipated, to $3,000 an ounce. Further, Kinross delivers production growth in the next 24 to 36 months. The first situation is likely, but there is no clarity on the second. I would therefore wait-and-watch.

To Acquire or to be Acquired?

It’s clear from the above discussion that Kinross needs to boost production to create value. One way to achieve that is asset acquisition. I elaborated earlier on the fundamentals and Kinross has high financial flexibility. Therefore, there is a possibility to Kinross acquiring assets or a company to boost its reserves and production.

However, the challenge is likely to be valuations. With gold trading at $2,500 an ounce, it’s not easy to identify the right acquisition target that delivers value. Overpaying for an acquisition just to boost production growth can be counterproductive. Therefore, even with high financial flexibility, Kinross faces the industry valuation headwind.

The second option is to be acquired, and I believe Kinross might be exploring this option. Back in June 2023, it was reported that Kinross rejected a takeover approach from Endeavour Mining (OTCQX:EDVMF). However, discussions “didn’t proceed beyond the initial stage due to differences over valuation and other issues.”

If we consider the forward EV/EBITDA metric, a 30% to 40% premium to the current price might be a good acquisition price. From the perspective of the buyer, the advantage would be reserves addition coupled with robust free cash flow visibility. Kinross reported an attractive all-in-sustaining-cost of $1,387 an ounce for Q2 2024. Further, 70% of the company’s assets are in Americas and exposure to geopolitical risk is low.

Of course, the likelihood of Kinross being acquired is a personal view. It remains to be seen which path the management pursues. However, there is no doubt that some action needs to be taken on the reserves and production front. My significant concern is underscored by the point that Kinross reported proven and probable reserves of 25.5 million ounces in 2022. However, 2P reserves has declined to 22.8 million ounces as of December 2023.

Concluding Views

From the perspective of fundamentals, cash flow potential, and operational efficiency, Kinross is a quality bet. Also, with a bullish outlook for gold, it’s likely that Kinross stock will trend higher.

While existing assets have a good cost profile and will continue to deliver robust cash flows, there is no production growth visibility. I would therefore prefer to remain in the sidelines. For existing Kinross investors, dividend growth would be a bonus in addition to stock upside if gold trends higher.

On the downside, the risk relates to potential correction in the precious metal. However, for the next 12 to 18 months, I see the probability of this scenario playing out as low. In the worst case, gold is likely to remain in the range of $2,400 to $2,600 an ounce. With an attractive AISC, Kinross will continue to report healthy cash flows.

Read the full article here

Leave a Reply