On 12/06/2024, Legal & General Group Plc (OTCPK:LGGNF)(OTCPK:LGGNY) released its capital market day update. As a reminder, the company is one of the UK’s leading financial services players, selling pensions, life insurance products, and investments across geographies. L&G’s strategy is primarily concentrated on UK life insurance, with a leading position in the area of annuities and protection. Looking at recent years, annuities have become the largest source of cash for the company and are essential to earnings and dividend momentum sustainability. In addition, the company has a solid asset management business called LGIM. This well support business diversification and L&G’s highly cash-generative business model.

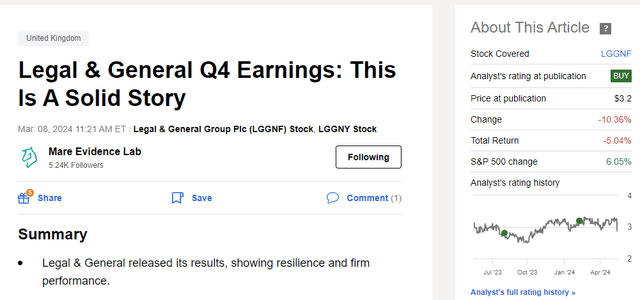

The company’s shares have underperformed the FTSE 100 and the sector since the 2024 start. This is potentially explained by the evolution of the higher bond yield and uncertainties related to the CEO change. After CMD, we believe the CEO had a positive impression on investors and sell-side analysts and refreshed the L&G strategy with continuity. We see positive catalysts due to falling bond yields and a supportive valuation with a double-digit free cash flow yield. Here at the Lab, we are optimistic about the L&G estimate and have decided to update our model following its release. L&G’s current stock price presents a solid opportunity to enter a resilient company. For this reason, we are doubling down our position.

Mare Ev. Lab Rating Update

Estimate Post CMD

In our previous indication, in the period between 2020-2024, we forecasted the following: 1) A cumulative Solvency II capital between £8 and £9 billion, 2) a cumulative dividend payment between £5.6 and 5.9 billion, 3) a net surplus generation over a dividend payment of £0.8 billion and 4) a plus 5% in the 2024 DPS evolution.

Following the update, in the period between 2024-2027, L&G targets: 1) a 6-9% core operating earnings per share growth with an ROE above 20%, 2) a £5-6 billion of operational capital surplus generation and 3) a DPS growth higher than 2% beyond 2027 supported by an ongoing buyback. L&G board intends to return more to shareholders over the period using a combination of dividends and share buyback. The first buyback tranche is expected at £200 million in 2024, and here at the Lab, we positively view this move given the company’s stock price. On capital allocation priorities, we usually prefer a growing DPS policy; however, this time, we support the new buyback story, given the strong solvency position.

Businesswise, four areas mention a follow-up comment:

- The company reported potential disinvestment in non-strategic assets, most materially L&G, including Cala. Cala disposal aims to maximize shareholder value and simplify L&G’s cost structure. Here at the Lab, we consider Cala non-core, and there are rumors of a £750 million and £1 billion valuation. This disinvestment represents almost 6% of the total company’s valuation;

- With the aim of creating a linear structure, L&G will create a single Asset Management division, bringing LGIM and LGC together. This means the unification of public and private markets. This will likely leverage L&G’s existing strengths and new potential synergies to drive growth and higher returns. In FY23, LGIM reported a loss of £38 billion in net outflows driven by UK DB schemes, resulting in a 19% fall in profit. We believe LGIM could potentially accelerate its internationalization efforts, and with the private/real asset offers, the company now aims to deliver an operating profit between £500 and £600 million by 2028;

-

Our team does not forecast numbers until 2027. In the upcoming period (2024-2026), we believe there will be at least £200-400 million per year in capital net surplus generation over the ordinary dividend payment. Here at the Lab, we do not forecast large-scale M&A. £200 million in 2024 buyback is now already forecasted. Therefore, we do not foresee investment in additional avenues of growth (organically and inorganically);

- In our last update, we reported how our buy “was backed by UK PRT’s new volumes and Contractual Service Margin performance. There is ongoing momentum in the UK with approximately £12 billion of PRT. There was a record in institutional annuities“. Looking at the CMD release, L&G confirmed our previous estimate. Indeed, the company is well placed to seize the significant Institutional Retirement opportunity in the UK and internationally. In the home market, volume is expected to average £45 billion per year over the next decade.

Earnings Changes and Valuation

L&G looks attractive on an FCF basis, and considering the DPS growth in the medium term, the company valuation must be noticed. Updating our numbers, we estimate a core operating profit of £1.86 billion in 2024, with a plus 12% compared to the 2023 results. This result is mainly supported by a retirement institutional solution for almost £1 billion profit. Considering an ongoing outflow, we project lower operating profit in the AuM division with a result of £290 million. That said, L&G has two additional arms: 1) L&G Capital and 2) its Retail division. We anticipate a positive capital of £1.57 billion for the FCF generation that fully supports L&G dividend payment (£1.2 billion) and the new share buyback announcement. On the year, we also believe the L&G solvency ratio might benefit from an interest rate evolution. That said, it is already above the regulatory requirements.

Here at the Lab, we believe the valuation remains undemanding. There are two considerations: on a 12-month forward dividend yield, the company is above 9% compared to a five-year average of 7.9%. On an EPS basis, considering our forecast at 29 cents and sector median P/E of 10x, we confirm our previous valuation set at £2.9 per share. Here at the Lab, there was no significant change in L&G’s growth drivers on a twelve month target price, with most of the company’s growth driven by existing businesses.

SA Valuation data

Risks

L&G is subject to regulatory and investment risk. Downside risks include 1) AuM outflows and negative performance fees and 2) volatility in governments, corporate bonds, and equity markets. In addition, we should report that L&G’s protection and annuity business is exposed to credit risk and longevity risk.

Conclusion

We positively view the CMD and believe this new information will reassure L&G investors. Our target price and dividend forecast are unchanged. Regarding short-term momentum, we support the buyback, while we believe shareholder capital returns in excess of the dividend could be promised over the medium-long term. This confirms a buy rating status.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply