Meta Platforms (NASDAQ:META) (NEOE:META:CA) is set to report earnings for the June quarter on July 24th, and I expect shares to jump on revenue and earnings coming in at the higher end of consensus estimates. My confidence in Meta’s upcoming earnings report is anchored on strong consumer engagement thanks to the company’s AI efforts, paired with exceptionally strong advertising momentum. Specifically, I see revenues coming in at $39-40 billion, compared to guidance at $36.5-39 billion. On profitability, I project operating income for Q2 at around $15 billion to $16 billion, compared to $14.5 billion estimated by consensus. On that note, Meta strong monetization should offset investor concerns relating CAPEX/AI spending, as long as spending remains in line with Q1 guidance. On the backdrop of strong earnings, I updated my residual earnings model for Meta and now calculate a fair implied share price equal to $549.

Providing a note on share price momentum, I point out that Meta stock has strongly outperformed the market YTD. Since the start of the year, META shares are up approximately 35%, compared to a gain of about 15% for the S&P 500 (SP500).

Seeking Alpha

Strong User Engagement in Q2 …

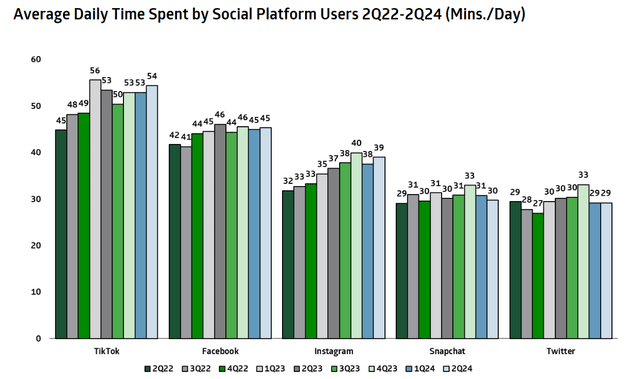

Meta’s social media empire has seen strong user engagement through the June quarter, building on trends seen in Q1. According to research conducted by TD Cowen, in 2Q24, Facebook users spent an average of 45 minutes per day (flat QoQ), while Instagram users averaged 39 minutes, up from 38 minutes in 2Q23. On that note, engagement among the youngest age cohort (18-24) increased significantly, with Instagram users in this group spending 54 minutes per day, up from 46 minutes the previous year. While TikTok still leads in average daily usage for the 18-24 age group, Meta is catching up and it looks like Instagram is winning some market share, as AI efforts are bearing fruits: AI recommendations now account for 30% of Facebook feed posts and over 50% of Instagram content. (Source: TD Cowen, Research note on Meta, dated July 12th)

TD Cowen

… Building A Backdrop For Strong Business Monetization

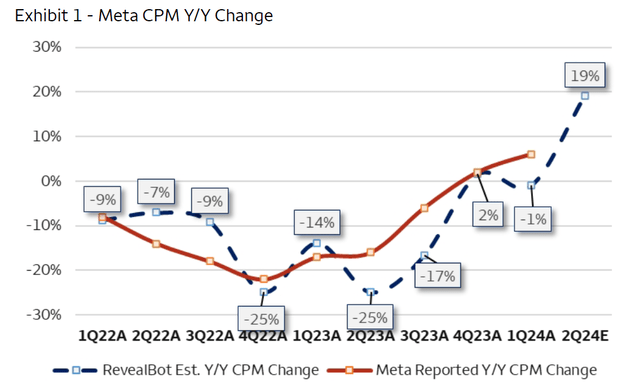

Building on the strong engagement backdrop, paired with healthy consumer spending (read about Amazon’s Prime Day record sales – here), I expect Meta to report strong revenue in Q2, expecting $39-40 billion of sales, compared to guidance at $36.5-39 billion. Providing support to my projection, I highlight that Revealbot estimates a 19% YoY surge for Meta’s CPM in Q2 (Source: Wells Fargo, Research note on Meta dated July 7th). If we assume the number of ad impression flat vs. Q1 2024, but apply the 2Q CPM at 19% YoY vs. the 6% YoY seen in Q1, then we can calculate Meta’s Q2 revenue at about $40.3 billion (vs. $38.3 billion consensus). I am also encouraged by positive feedback through industry channel checks: Having spoken with six market participants who have discretionary spending power over advertising budgets, primarily from SME businesses, I estimate that YoY advertising spend on a macro level in Q2 2024 may increase by 15-20%. Moreover, I highlight that within this favorable environment, Meta is gaining market share. A Jefferies research report projects that in 2024, Meta will capture a 25% share of the digital ad market and an impressive 50% share of incremental industry advertising dollars, a significant increase from 33% in 2023 (Source: Jefferies research note dated April 4, 2024: Rising Above Ad Peers with a Mega Moat).

Wells Fargo, Revealbot

On profitability, I expect a slight 100-150 bps increase in Meta’s operating margin vs. Q1, mostly as a consequence of operating leverage on higher topline. In line with this, I project Meta’s operating income for Q2 at around $15 billion to $16 billion (compared to $14.5 billion estimated by consensus, according to data collected by Refinitiv).

Capital Allocation In Focus

Meta Platforms’ engagement and monetization engines appear to be firing from all cylinders. But after a negative CAPEX surprise with Q1 supporting, investors are looking for further capital allocation guidance in Q2. In my view, another increase in CAPEX guidance would be a major downside surprise for market participants, and it would likely pressure the share price, despite strong revenue and earnings momentum. At the same time, Investors will likely expect that Meta’s Q1 buybacks pace of $15 billion per quarter has been maintained in Q2. If these two conditions are met, flat CAPEX guidance and buyback pace, then shares should have room for upside.

Valuation Update: Raise TP To $549

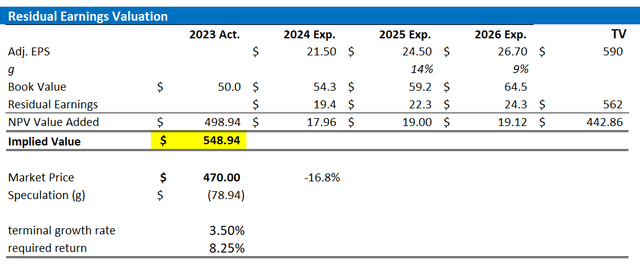

In line with my projections for stronger than expected revenue and earnings momentum for Meta, I update my residual earnings model for the social media empire’s stock: For FY 2024, 2025 and 2026, I now expect EPS at around $21.5, $24.5 and $26.7, respectively. Notably, my EPS estimates are about 10%-15% ahead of consensus, mostly as a consequence of lagging expectations relating to Meta’s advertising momentum. At the same time, I continue to project a 3.5% terminal growth rate post-2026, while I lower my cost of equity assumption by 50 bps., to 8.5%, in line with equity costs for the broader Magnificent Seven group. Considering the updated EPS, I now calculate a fair implied share price for Meta equal to $549.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price a more fundamental upside compared to my estimates.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

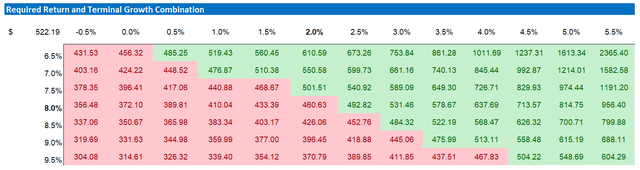

Below you can also find the updated sensitivity table.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

Investor Takeaway

Meta Platforms is set to report earnings for Q2 on July 24th, and I expect shares to rise as revenue and earnings to top the higher end of consensus estimates. This optimism is based on strong consumer engagement driven by the company’s AI efforts and robust advertising momentum. In fact, I anticipate revenues of $39-40 billion, exceeding the guidance of $36.5-39 billion, and project Q2 operating income at around $15-16 billion, above the consensus estimate of $14.5 billion. With capital allocation likely being another focus point for Q2, I argue that Meta’s strong monetization should alleviate investor concerns about CAPEX and AI spending, provided these expenses align with Q1 guidance. I reiterate my “Buy” rating on Meta and set my target price at $549.

Read the full article here

Leave a Reply