The stock market in 2024 has been rallying without any meaningful pullbacks, leaving in the back mirror any concerns about reigniting inflation, overheating economy, or decade-high interest rates impacting consumer sentiment.

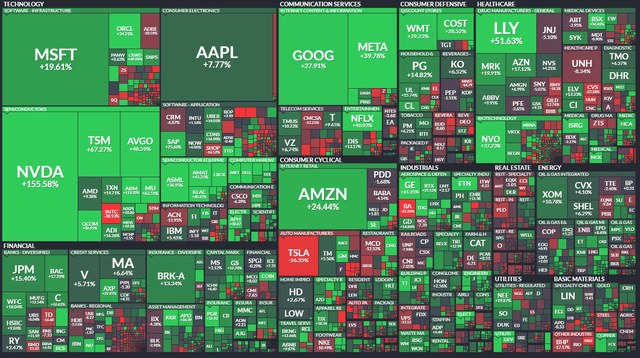

All the major indices hit their all-time highs at some point this year; however, year-to-date returns have been concentrated in a handful of companies, without any signs of the rally broadening to other sectors of the economy, outside of the AI-centric narrative, demonstrated by the lagging performance of equal-weighted S&P 500 and Dow Jones:

- S&P 500: +15.3%

- S&P 500 (Equal-weight): +5.4%

- Dow Jones: +4.8%

- Nasdaq 100: +17.4%

In fact, 10 companies in the market-weighted S&P 500 (SP500) alone are responsible for 71% of the year-to-date returns, here are the main contributors:

- NVIDIA (NVDA): +5%

- Microsoft (MSFT): +1.32%

- Meta Platforms (META): +0.85%

- Amazon.com (AMZN): +0.79%

- Broadcom (AVGO): +0.67%

To provide context, the return map below helps us visualize how concentrated the returns in 2024 are. Technology, Communication Services, and Healthcare are so far the major winners this year.

YTD Return Map (FINVIZ.com)

Back in January, I published an article on “My Top 3 Stock Picks for 2024“, expecting my picks to deliver market-beating performance driven by industry tailwinds, favorable valuations, and industry-leading EPS growth.

2 out of my 3 picks have beaten the market by a significant margin and helped to lift the overall performance of my portfolio, delivering a total return of +19.4% year-to-date, beating both S&P 500 and Nasdaq 100.

Yet, the great outperformance of my picks and portfolio in H1 warrants a caution. As the valuations enter a stretched territory with S&P 500 P/E of 24.3x compared to the 10Y average of 20.9x, instead of deploying the dry powder, I am hoarding cash, patiently waiting for market pullback or better risk-adjusted opportunities.

With that, let me show you what my top 2024 picks are and provide you with an update on my investment thesis.

1. Google (GOOGL) – Rating Downgrade from Strong Buy to Buy

Alphabet, the parent company of Google, is my single largest investment, where I am sitting on an ROI of over 40% in a span of less than 12 months, thanks to the negative sentiment back in Q3/Q4 2023 as Google was late to deliver industry-leading AI products, causing the stock price to drop and open the window of opportunity for long-term investors to load-up.

On a year-to-date basis, the stock is up 28%, compared to 15% for the S&P 500, helped by the Q1 results as the company reported 15.4% revenue growth, its fastest growth in the last 8 quarters, beating analyst expectations and pointing to further acceleration in Google Search, YouTube Ads and Google Could.

Q1 Results (GOOGL IR)

To stay competitive in the AI race, especially against the OpenAI’s Chat-GPT which could threaten Google’s Search dominant position over the long term, Google’s capital expenditure is expected to rise to $50B, compared to “only” $32B a year prior, investing in Nvidia’s H100 and latest Blackwell GPUs to build industry-leading data centers, enabling the creation of more advanced large language models or “LLMs”, to complement its generative AI product offering.

For now, Google’s dominant 90.8% internet search market share remains unchallenged, with Microsoft’s Bing coming in second with only 3.7% market share.

If we consider that the digital advertising market size in 2023 was around $626B, each 1% of the market could be worth approximately $6.26B. With such a lucrative business, Google has to invest heavily to stay ahead of the fierce competition.

Thanks to Google’s business reaching a more mature state with perhaps fewer growth opportunities to invest in, the company announced its first-ever $0.20 quarterly dividend, unlocking a new chapter of capital allocation, alongside its share buyback program which has seen a share count reduced by 7.4% in the last 10 years. The newly announced $70B buyback program could help reduce the outstanding float by another 3.5%; however, we should expect some degree of dilution given the stock-based compensation.

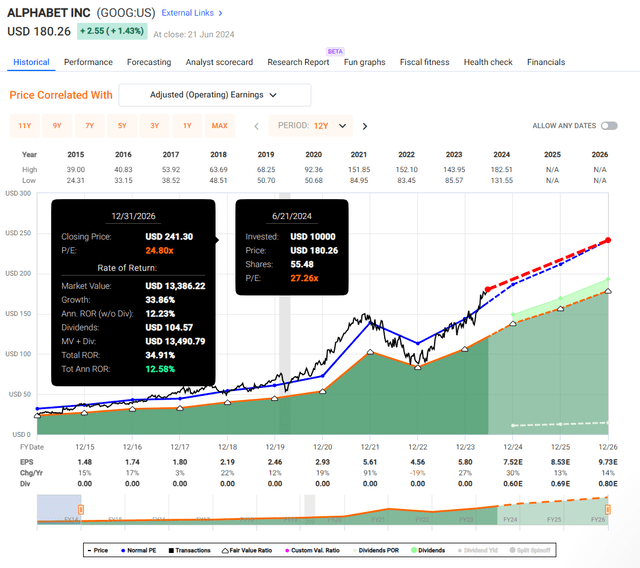

With many superlatives used, the fair question to ask is why I am downgrading Google from a “Strong Buy” to a “Buy”?

The short answer is the valuation.

Google’s stock is no longer the bargain it has been at the beginning of the year, when the shares were trading around 23x its earnings.

Thanks to the 28% year-to-date gain, the stock is now trading at a Blended P/E of 27.2x, a significant departure from the 12Y average P/E of 24.8x, implying the stock is now trading at a premium, without a major revision of the forward EPS.

Simply put, the stock price has outperformed the fundamentals.

Google is expected to deliver a sustainable double-digit growth in the following years:

- 2024: Expected EPS of $7.52, YoY growth of 30%

- 2025: Expected EPS of $8.53, YoY growth of 13%

- 2026: Expected EPS of $9.73, YoY growth of 14%

Yet, the average 19% annual EPS growth is in line with the historical 18.4% annual growth recorded since 2014, not justifying the 10% higher valuation.

Investors can expect up to 12.5% annual returns until 2027, which falls short of my 20%+ expected returns for stock that I rate “Strong Buy”, hence my downgrade, while still maintaining the bullish view.

GOOGL Valuation (Fast Graphs)

2. Nvidia – Rating Downgrade from Strong Buy to Hold

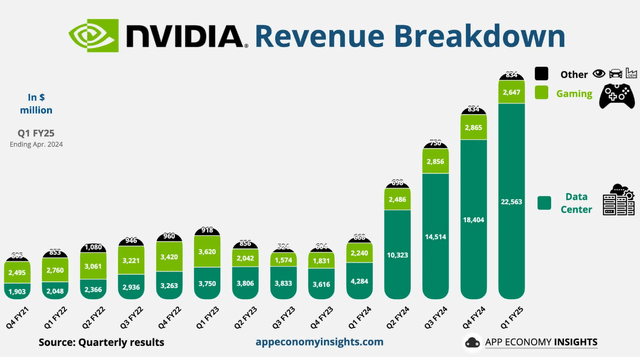

Nvidia has been the clear beneficiary of the AI-centric investment narrative of the past 2 years, having the right product at the right time.

First, in 2023 the stock soared 239%, and this year the stock is up 156%, for a brief moment becoming the most valuable company, currently sitting on a market cap of $3.11T.

Nvidia has come a long way, transitioning away from the source of revenue from gaming and crypto mining towards data centers. In fact, data centers made up 87% of its revenue in Q1 FY25, compared to less than 50% 2 years prior.

Nvidia Revenue Breakdown (App Economy Insights)

For those, who might not be familiar with the generative AI hype and what role Nvidia plays, generative AI models use neural networks to identify patterns and structures within existing datasets to generate new content.

One of the main breakthroughs of generative AI is the ability to leverage different learning approaches, such as unsupervised or semi-supervised for training, giving organizations the ability to quickly and with ease leverage large datasets to create foundational models, which in turn are used as base of AI systems performing multiple tasks.

Nvidia is the company that provides the fundamental “data center equipment”, the GPUs such as H100s, Blackwell and the recently announced “Rubin” powering the large language models.

The demand for Nvidia AI chips has skyrocketed with major companies such as Amazon, Meta Platforms, and Microsoft all competing to be the first to build industry-leading data centers and provide the most complex LLMs to their customers to build their applications.

As a result, Nvidia delivered 262% top-line growth in Q1 FY25, bringing $26B in revenue compared to only $7.2B a year prior.

Staying at the forefront of the innovation, competitors such as Advanced Micro Devices (AMD) and Intel (INTC) are falling behind Nvidia’s aggressive 1-year product cycle, allowing the company to retain its dominant 94% AI server market share and pricing power, which resulted in a staggering Gross Margin averaging around 75%.

But again…

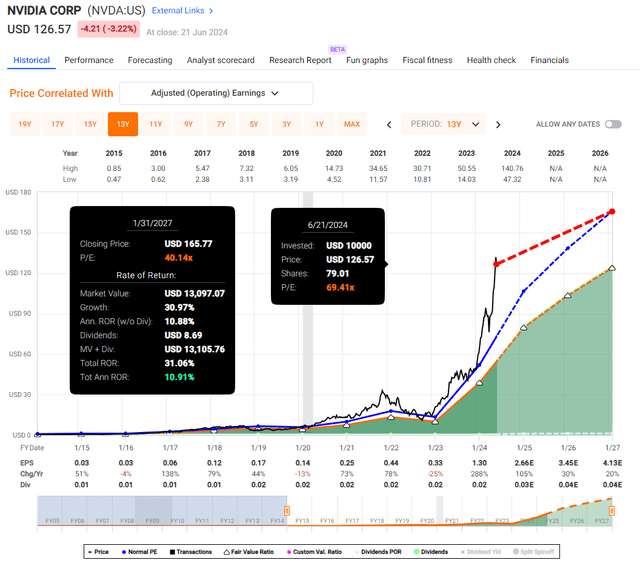

Even though I am very optimistic about Nvidia’s prospects this decade as AI becomes a common tool for organizations, improving efficiency and productivity, I have no other choice than to downgrade Nvidia’s stock due to valuation to “Hold”.

Thanks to Nvidia’s year-to-date performance, the stock became my second-largest holding in my portfolio and even though I am not selling any shares (just yet), investors should exercise caution.

The stock is currently trading at a Blended P/E of 69.4x, a significant departure from its 10Y average of 48.5x.

Of course, we need to take into consideration the unprecedented forward growth in the underlying EPS thanks to the successful AI chips, after the recent 10:1 stock split:

- 2025: Expected EPS of $2.66, YoY Growth of 105%

- 2026: Expected EPS of $3.45, YoY Growth of 30%

- 2027: Expected EPS of $4.13, YoY Growth of 20%

Even though the forecasted EPS may seem ambitious to some, Nvidia has beaten the analyst’s forecasts 58% of the time and met them 33% in the past 2 years, providing a certain level of reliability.

Even if Nvidia manages to deliver the staggering EPS growth, the forward valuation appears stretched:

- 2025 Forward PE: 47.6x

- 2026 Forward PE: 36.7x

- 2027 Forward PE: 30.6x

Keep in mind that for the first 5 months of 2024, Nvidia’s shares were not trading higher than 30x its 2025 earnings, implying the stock price is getting ahead of the analyst’s forecasts.

Even if the growth materializes and the valuation contracts to the average of the past 13 years, investors would see a lackluster 11% annual return without a margin of safety.

NVDA Valuation (FAST Graphs)

3. Lowe’s (LOW) – Buy Rating Maintained

Perhaps you might be asking why to select a home improvement retailer as a Top Pick for 2024, given the multi-decade high interest rates, which are pressuring home sales in the US.

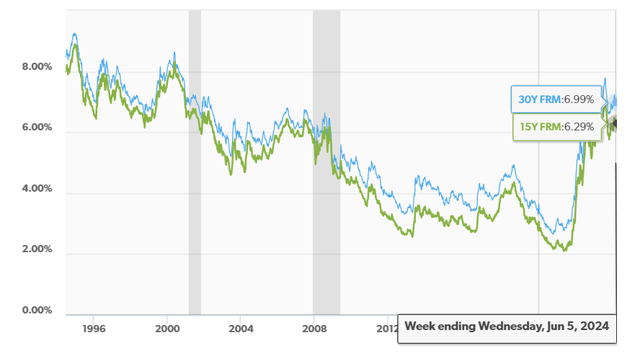

Lowe’s business specializes in selling building materials, appliances, decor, outdoor furniture, and tools for homeowners, all areas that have been consistently under pressure as mortgage rates hover around 6.99% for a 30Y fixed rate, resulting in a slowdown in existing home sales, causing one-third of homes in the US to be sold as a new construction instead, a significant departure from 17% back in 2020.

Mortgage Rates in US (Freddie Mac)

Thanks to many homeowners locking in mortgage rates below 3% during the pandemic, the incentive to switch to sell existing homes and take out a mortgage at 7% rate is very little, resulting in sluggish existing home sales, negatively impacting Lowe’s business as 75% of its sales come from “DIY” or do-it-yourself projects.

With fewer existing home sales, people are less likely to remodel their existing homes and Lowe’s is feeling the heat with comparable sales dropping 4.1% in Q1 and guiding for an $84 to $85 billion in revenue (a drop of 14% YoY) with 12.65% operating margin.

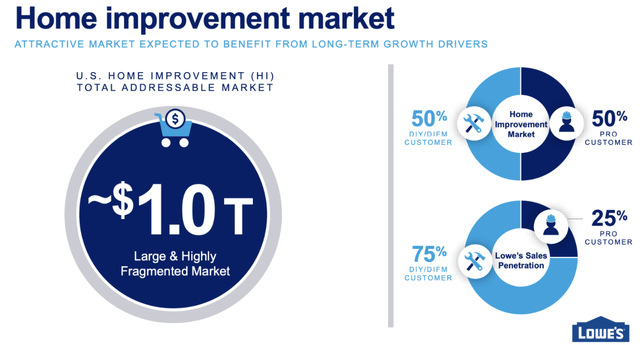

Lowe’s is actively working towards balancing its portfolio to 50% PRO and 50% DIY to better address the fragmented US Home Improvement market valued at around $1T given the average US home is 40 years.

Addressable Market (LOW IR)

The reason why I selected Lowe’s as one of my top picks is two-fold:

- One is the gargantuan opportunity with the aging US houses, which will act as a tailwind for many years to come.

- Another is that I was expecting FED to start cutting rates by June 2024, which would boost the existing home sales.

Nevertheless, due to a strong economy and CPI coming higher than expected, the rates for now remain elevated and traders are pricing a 70% chance that FED will cut in September, but we should expect the decision to be data-dependent.

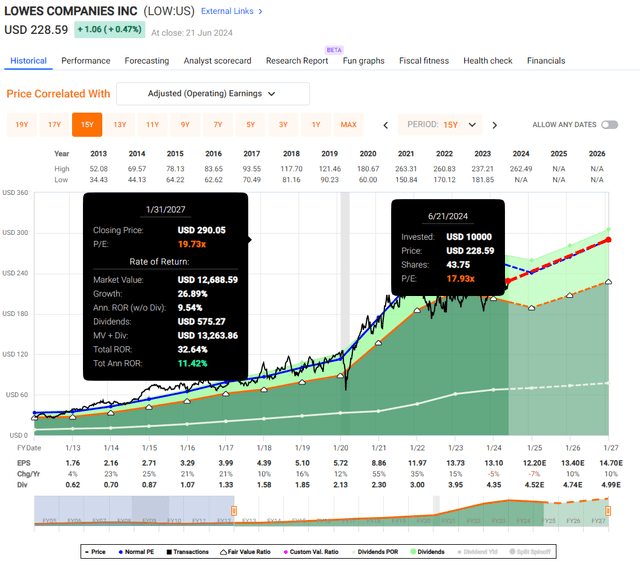

Lowe’s valuation remains favorable, trading at a Blended P/E of 17.9x, compared to its 15Y average of 19.7x, giving us some margin of safety.

However, the elevated rates will for now act as an anchor on any EPS growth, with 2025 full-year EPS expected to contract by 7%.

The growth is expected to resume in the subsequent years:

- 2026: Expected EPS of $13.4, YoY growth of 10%

- 2027: Expected EPS of $14.7, YoY growth of 10%

Keep in mind that the 15Y average EPS growth has been 15.5%.

As long as the situation in the existing home sales market does not improve considerably, I am not expecting any upward revisions to Lowe’s EPS.

In practice, this means that Lowe’s mid-term outlook is fully rate-dependent, but buying this wide-moat company provides investors with a 10% margin of safety while collecting a double-digit growing, 2% dividend yield.

For Lowe’s, it is not a question of if the stock returns to its original valuation, but when.

Investors can reasonably expect around 11.4% annual returns up until 2027 and potentially more if the market sentiment improves.

LOW Valuation (FAST Graphs)

Takeaway

All in all, 2024 year-to-date returns have been historically strong no matter whether you are investing in market-weighted indices or you are a stock picker, like me.

So far, my portfolio is up 19.4%, beating both S&P 500 and Nasdaq 100, thanks to the strong performance of Nvidia and Google, both companies which I selected as my Top Picks for 2024 at the beginning of the year, given their favorable valuation at the time, strong tailwinds and industry-leading EPS growth.

My third pick, Lowe’s, has been the laggard of the portfolio, returning less than 4% this year with existing home sales plummeting thanks to multi-decade high mortgage rates.

The H2 is around the corner, and we should be mindful of our expectations as valuations are entering stretched territory, prompting me to revise the ratings of some of my picks, while hoarding cash for potential pullbacks.

Read the full article here

Leave a Reply