I’ve been watching Nike (NYSE:NKE) shares for quite a while, but I could never get interested enough to buy any shares because of the valuation. I am still not crazy about the valuation, but I finally did decide to start buying some shares thanks to the big recent decline. The valuation is still not cheap, but Nike historically is not an inexpensive stock. However, I do see some strategic plans being implemented by Nike that could end up making this stock look inexpensive in hindsight, but it is too early to tell. I think it makes sense to start averaging into this stock now and build up a position over time. It is hard to say where the exact bottom might be when a stock plunges, and there are challenges remaining for Nike, so that is why I am planning to scale into this stock. Let’s take a closer look at Nike, which also owns Converse and Jordan brands:

The Chart

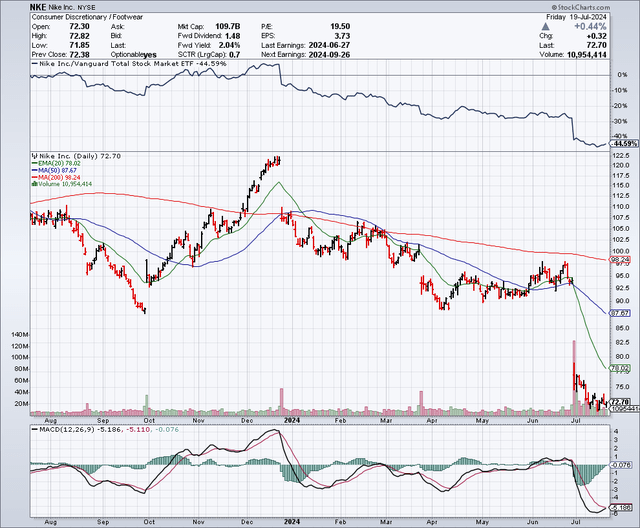

As the chart below shows, Nike shares rallied up to around $120, late last year. But the stock trended lower for most of 2024, and more recently it plunged down to the low $70 level. The 50-day moving average is around $88 and the 200-day moving average is just over $98. It looks like Nike shares are starting to bottom out in the low $70 range, and this is one reason why I have started to accumulate shares.

StockCharts.com

Earnings Estimates And The Balance Sheet

The consensus earnings and sales estimates shown below are sourced from Seeking Alpha, and it shows solid earnings growth potential in the next couple of years. Nike shares often trade for about 30 times earnings, so it appears that the stock is currently undervalued when considering historical averages.

Earnings Estimates

|

FY |

EPS |

YoY |

PE |

Sales |

YoY |

|---|---|---|---|---|---|

| 2025 |

3.16 |

-20.09% |

23.15 |

$49.01B |

-4.57% |

| 2026 |

3.61 |

+14.42% |

20.23 |

$51.85B |

+5.79% |

| 2027 |

3.97 |

+9.82% |

18.42 |

$54.04B |

+4.22% |

Nike has a very strong balance sheet with around $11.95 billion in debt and $11.58 billion in cash. I see this balance sheet strength as a huge resource for the company which allows it to increase the R&D budget so that it can innovate, and it could also use some of the cash on the balance sheet to acquire promising companies.

The Dividend

Nike pays a dividend of $0.37 per share on a quarterly basis, and this totals $1.48 per share in dividends on an annual basis. This offers a yield of just over 2% and the payout ratio is about 36%, so it appears very secure and there is plenty of room to increase it. Nike has been consistently raising the dividend each year for many years, and I believe it will continue to do so.

Everyone Is Wearing Hoka

When I go out, I notice that everyone seems to be wearing Hoka shoes, which is owned by Deckers (DECK). Whether I am at the local mall or during a recent trip to Disneyland with my family I see Hoka shoes everywhere and I see them on a complete range of people from young to old and in between. I actually bought a pair of Hoka shoes and at first I did not like them as I felt they were too squishy, but I tried them again after they sat around for a few months, and now I wear them often.

On Holding (ONON) is also making popular shoes and this is yet another example whereby Nike seems to be falling behind newer brands that are innovative. I am now feeling like Nike is the Intel (INTC) of the sportswear and shoe business since Intel has been falling behind newer and smaller companies that have now leapfrogged Intel in many ways. But, Intel and Nike have a chance to turn around, and this could lead to big gains, although it will likely take patience for investors to reap potential rewards.

The China Problem

China is an important market for Nike because it generated about $7.5 billion from that country in fiscal 2024, and this represents an area with long-term growth prospects, as do other emerging market nations. Nike is competing with other brands in China including “Li Ning” and “Anta” which are Chinese sportswear companies. In addition to being challenged with strong competition from more local Chinese companies, it is also experiencing challenges in China because that country is facing a slower economy.

Another potential problem is the growing trade tensions between China and the U.S., which might get even worse going forward. If additional tariffs and protectionist measures are implemented by China and the U.S., it could impact Nike’s financial results. This could also encourage Chinese consumers to buy the aforementioned local brands. A recent CNBC article states that President Biden is said to be considering more restrictions on technology exports to China and Donald Trump has said he would put a 60% tariff on Chinese goods. This could lead to China retaliating with tariffs on goods from U.S. companies like Nike.

I See Women’s Sports As A Big Potential Growth Driver For Nike

Nike is expanding sponsorships and endorsement deals, which has been very important and successful for the company in the past. The deal with Michael Jordan has been a huge success and I see Nike is now pursuing deals with young emerging athletes. For example, Nike recently announced that it signed women’s basketball star Caitlin Clark. Women’s sports is getting more popular and I see this as a smart move that could pay off big for Nike in the future. Many people are noticing this surge in popularity for women’s sports and that includes Bob Iger, the CEO of Disney (DIS), who recently made a large investment in the Angel City Football Club, which is the most valuable women’s professional sports team. I see women’s sports as a huge potential growth driver for Nike going forward, in particular because this segment of the sports world is growing and more money than ever is being invested to promote and expand women’s sports.

Here Are Some Positives I See For Nike

1) The Paris Olympics: This global sporting event will commence in just a matter of days, and a major global sports event like this tends to bring out the athlete in all of us. Watching amazing athletic abilities on television will be inspiring for many fans around the world and that could lead to strong sales of sportswear items in the coming weeks and months. Nike is sponsoring many athletes in the Paris Olympics, so there will be the potential for a significant amount of screen time showing medal winners wearing Nike gear.

I can see that Nike is going “big” with the Paris Olympic games and there’s a couple of reasons why I believe they will see a boost in revenues from this event. Nike is sponsoring key athletes including U.S. sprinter Sha’Carri Richardson and a Kenyan marathoner named Eliud Kipchoge, and it recently introduced 13 shoe prototypes that were developed by athletes. Nike management is spending a lot of money on the Paris games, and I think this makes sense because this is the first Summer Olympic games to occur after the peak of Covid. The 2020 Tokyo games were deeply impacted by Covid, so companies like Nike are much more hopeful for the Paris games. A recent article points out the big media spend by Nike and it states:

“This Olympics will be our biggest…it will be our largest media spend,” Heidi O’Neill, president of consumer, product and brand at Nike said in an interview. “This will be the most investment and the biggest moment for Nike in years,” she added, without putting a figure on the amount of spending planned.

2) Nike Has A Turnaround Strategy: I have been reading through Nike’s press releases and financial reports and I see signs of renewed focus on the brand, as well as innovation and cost cutting. This shows me that management recognizes that they have a problem and have fallen behind in some areas. I think this is good to see because it looks like company management is no longer resting on the laurels of the Nike brand and it is no longer in denial that some competitors have made big strides. I think the mistake some investors are making now is that they are selling this stock at or near 52-week lows because recent financial results and guidance were not exciting. But this could be the point whereby management has made and is making the moves it needs to reignite growth and excitement around the brand. However, it is just too early for it to show up in the results.

When reading the most recent earnings call transcripts, I see that Nike is using its strong balance sheet to increase investment in a few areas in order to accelerate new product cycles and to innovate as well. Nike is using advanced digital tools to accelerate the design of new products and they are asking key product suppliers to speed up product testing and production times. The company states it has kicked off a multi-year innovation cycle.

It’s clearly not a given that management will succeed, but I see it as an attractive risk/reward ratio because you can buy the stock near 52-week lows right now and accumulate it on additional weakness in the coming months. The current price level suggests expectations are low, and I believe patient investors who accumulate now could be rewarded if any of the management initiatives are successful and start to show up in the financial results. I think we could see some excitement in the Nike brand and stronger sales this summer, since the Paris Olympics will showcase so many Nike products, but we will have to wait until next quarter to see the impact, if any.

Beyond the Olympics, there are other catalysts and growth drivers I see for Nike that might take a couple of quarters before really showing up in the financial results. For example:

Nike recently rehired a senior executive named Tom Peddie in order to improve and increase relationships with retailers. I believe it could take one or two quarters for the rehiring of this top executive to produce results.

Nike is implementing a multi-year plan to reduce expenses by $2 billion. This plan includes layoffs and other cost-cutting measures. I see this as having significant potential to boost earnings in the next year or two. Here’s why: Nike has just over 1.5 billion shares outstanding, so if management is successful at cutting costs by $2 billion, this would potentially be equivalent to adding about $1.33 to earnings, if these cost cuts successfully drop down to the bottom line. That would potentially be a significant additional source of earnings growth, especially since the earnings estimates for fiscal year 2025 are just over $3 per share.

3) Nike Investor Day This Fall: Nike hasn’t had an investor day for several years, but it is planning one for this Fall. I think this is another sign that management is stepping up and wants to get the company back to its former glory. I believe the CEO will want to prove skeptics wrong by introducing some innovative new products this Fall, which will be a great way to follow up on the new product launches that are coinciding with the Paris Olympics. In a recent article an analyst named Lorraine Hutchinson summed up this event which the CEO of Nike also seems to be excited about; the article states:

“Hutchinson also notes that Nike’s autumn Investor Day, the first in seven years, should generate excitement and demand for its new products, part of what CEO John Donahoe called “a robust pipeline of innovation.”

Why The Current Valuation Metrics Intrigue Me

Historically, Nike shares have often traded for about 30 times earnings, but it currently trades for a price to earnings ratio that is in the very low 20 range. Furthermore, I see current earnings estimates as being depressed compared to what I expect in the coming quarters and beyond. I also expect Nike to see a boost in earnings due to the $2 billion cost savings plan, which as I calculated, could bring about $1.33 per share to the bottom line. Based on my calculations, if Nike can bring $1.33 per share to the bottom line (through the $2 billion in cost savings), and get back to a 30 times price to earnings ratio, this alone could tack on nearly $40 per share to the stock price ($1.33 in additional potential earnings multiplied by a 30 price to earnings ratio). I also believe that Nike has a big opportunity with emerging women’s sports stars like Caitlin Clark, and the surging popularity in women’s sports.

I do expect a boost in revenues to occur during and after the Paris Olympics, which will be the first in several years to not be impacted significantly by Covid. Historically, Nike sees a significant boost in revenues from the Olympic Games and I believe that will be the case here as well. I believe Nike is going all out now to reclaim its throne. It has recently introduced a line of sneakers that will retail for less than $100, and this should appeal to many consumers. As one recent article states, Nike typically sees a nearly 10% sales increase during an Olympic quarter, and it also said that Nike is going to bring back a red, white and blue Air Jordan shoe at the end of the Olympics, which has not been sold since 2000. I believe this and other recent product launches will have a very positive impact and that is why the current valuation of this stock intrigues me.

Potential Downside Risks

I see a number of company-specific risks as well as macro risks that could lead to potential downside for Nike shares. Management might not succeed in fighting off a growing number of younger and very innovative companies. I think it is too early to say if shoe brands like Hoka will stand the test of time. Perhaps the popularity of these newer brands will diminish and then could be viewed as a fad. But if these brands continue to grow, they will take more market share away from Nike and that could lead to lower earnings and a lower price to earnings multiple.

I am concerned that the Federal Reserve is going to miss the chance to lower rates before causing a recession. There are already major warning signs that the economy is slowing down. Some consumers are clearly strapped now and this can be seen by looking at the rising delinquencies with auto loans as well as record levels of credit card debt. These consumers could be cutting back on expenses, just as Nike is doing and that could result in further downside, especially if a full-blown recession develops in the coming months.

Also, China remains a potential downside risk because the economy is not as robust as it has been in the past and because of a potential trade war.

In Summary

I believe Nike has an incredibly strong brand that is known around the world. I also believe that this stock might have experienced the type of capitulation that marks the bottom in a stock as well as a buying opportunity. However, it is never easy to get the exact bottom and challenges lie ahead for Nike, so I am just accumulating shares over time. By doing so I can take advantage of any further weakness.

I am excited about a number of catalysts for Nike and its stock, which includes the Paris Olympics, as well as other major sporting events in 2024, and the Fall Investor Day, which I see as an event that the CEO will want to use to prove skeptics wrong. I am also happy to be investing in a company with such a great balance sheet, which I think gives management plenty of resources to get innovation and other growth drivers back on track.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor

Read the full article here

Leave a Reply