One of the more interesting companies I have come across in recent years is Oil-Dri Corporation of America (NYSE:ODC). The company describes itself as a producer and seller of sorbent products, including of those types of products that can be used in the agricultural and horticultural space. A lot of its offerings also go into the production of cat litter. Late last year, in December to be precise, I wrote an article about the company wherein I reaffirmed the ‘buy’ rating that I had on the stock. From the time I had first written about it in August of 2022 until I wrote about it again last December, shares had seen upside of 157.2%, handily surpassing the 16.8% increase seen by the S&P 500 over the same window of time.

Despite this monumental upside, I felt as though shares warranted additional appreciation. So far, however, the market has disagreed with me. The stock is actually down 9.3% since then. By comparison, the S&P 500 is up a whopping 15.4%. Despite this disparity, shares are still up 145.7% compared to when I first wrote about the company. And the S&P 500 is up only 35.2% over that same window of time. This pullback has come at a time when overall financial performance for the company has improved. Shares look attractively priced at this point in time, and it is difficult to imagine the stock not rising over the long run. So even though the market has disagreed with me as of late, I still think that rating the company a ‘buy’ is wise at this time.

A look at recent results

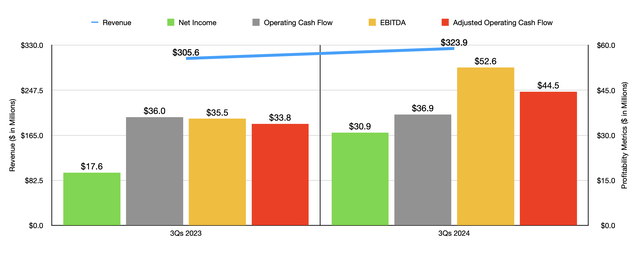

In my last article about Oil-Dri Corporation of America, we only had data covering through the first quarter of the company’s 2024 fiscal year. Today, we now have results covering through the third quarter. For the first nine months of the 2024 fiscal year, revenue for the company came in at $323.9 million. That’s a respectful 6% increase over the $305.6 million the company generated one year earlier. According to management, this is due not only to higher prices on the firm’s products, but also because of improved product mix. This is not to say that there wasn’t any weakness. Management did, unfortunately, revealed that overall volumes declined.

Author – SEC EDGAR Data

The strongest growth for the company came from its Business to Business Products Group. During this window of time, revenue for the segment totaled $111.6 million. That happens to be 7% above the $104.3 million generated at the same time of the 2023 fiscal year. Management chalked this up, creating a couple of factors. For starters, the firm’s fluid purification products reported a 23% sales increase, with revenue jumping $12.4 million year over year. This was really because of new customers in the renewable diesel business, and because of strong demand for the firm’s products used in the filtration of edible oil and jet fuel products.

Higher prices also contributed to this upside to some extent. Unfortunately, this was offset by weakness elsewhere. Sales involving animal health and nutrition products, for instance, dropped by roughly 12% year over year, while sales of agricultural and horticultural chemical carrier products dropped 9%. Softer volumes more than offset higher prices in these areas. The Retail and Wholesale Products Group of the company also grew year over year, with revenue climbing by $10.9 million from $201.4 million to $212.3 million. Once again, higher prices, this time on cat litter products, helped push revenue higher. A favorable product mix also contributed to some strength for the firm.

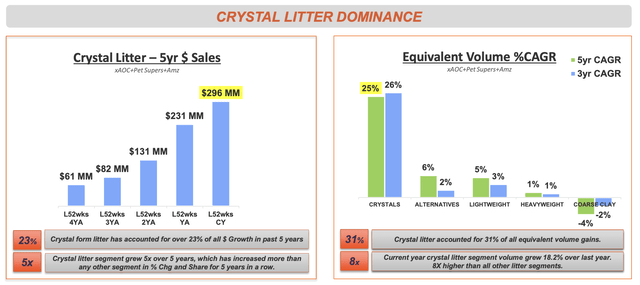

Oil-Dri Corporation of America

While these areas might seem unappealing to those accustomed to strong growth, management is skilled when it comes to finding attractive opportunities. On May 1st of this year, for instance, the company acquired all of the stock of a company called Ultra Pet in exchange for $46 million. With this, the company is able to get into the crystal cat litter segment. Supposedly, this type of cat litter not only absorbs moisture quickly, it also supposedly stops odor significantly better than clay litter does. Regardless of whether or not cats love it, the market certainly does. In the trailing 12-month window leading up to this purchase, industry sales involving these types of products totaled $296 million. That’s up materially from only $61 million reported four years earlier. That happens to be an annualized growth rate of 48.4%. So impressive is the product in consumers’ eyes that 23% of all litter sales growth over the last five years has come from crystal litter products. Overall volume growth has also been strong, with crystal litter accounting for 31% of all equivalent volume gains.

This certainly bodes well for the future of the company. It’s unclear, unfortunately, what this will mean for the firm’s bottom line. But when you look at the first nine months of the 2024 fiscal year as a whole, profitability has already been on the incline. Net income of $30.9 million dwarfed the $17.6 million reported one year earlier. Operating cash flow did inch up only slightly from $36 million to $36.9 million. But if we adjust for changes in working capital, we get an increase from $33.8 million to $44.5 million. Over that same window of time, EBITDA for the company managed to grow from $35.5 million to $52.6 million.

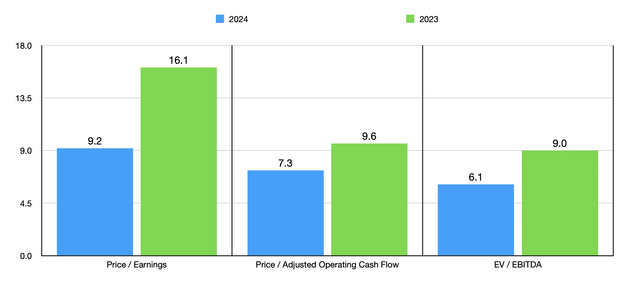

To be perfectly honest, we have no idea what the rest of 2024 will look like, since management has not provided detailed guidance. But if we annualize results experienced so far, we would expect net income of $52 million. That would be up nicely from the $29.6 million reported one year earlier. Adjusted operating cash flow would climb from $49.9 million to $65.7 million, while EBITDA would expand from $52.7 million to $78.1 million.

Author – SEC EDGAR Data

If we take these estimates and if we take historical results from the 2023 fiscal year, we can see how shares of the company are priced as shown in the chart above. Clearly, the stock does look quite a bit cheaper on a forward basis. But even if we use the 2023 figures, I don’t think anybody could argue that the stock is anything worse than fairly valued. In fact, I would say it’s still perhaps slightly undervalued in that case. Using the 2024 estimates, meanwhile, I then compared Oil-Dri Corporation of America to five similar firms as shown in the table below. On a price to earnings basis, only one of the five companies was cheaper than it. This number increases to two of the five when looking at the picture through the lens of the price to operating cash flow multiple. But when it comes to the EV to EBITDA scenario, we find that our candidate is the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Oil-Dri Corporation of America | 9.2 | 7.3 | 6.1 |

| Energizer Holdings (ENR) | 24.4 | 5.3 | 13.0 |

| Central Garden & Pet Company (CENT) | 17.4 | 6.7 | 10.2 |

| Spectrum Brands (SPB) | 1.8 | 16.9 | 16.0 |

| WD-40 Company (WDFC) | 44.8 | 24.9 | 30.0 |

| Reynolds Consumer Products (REYN) | 18.1 | 9.1 | 10.9 |

Takeaway

While this may not seem like all that exciting a space to play in, I find it fascinating. It is an interesting business that is trading on the cheap, both on an absolute basis and relative to similar firms. It’s great to see management make investments like the aforementioned acquisition. Given these factors, I find no reason to become bearish or even neutral on the business. In fact, I cannot in good conscience do anything other than reaffirm the ‘buy’ rating that I had on the stock previously.

Read the full article here

Leave a Reply