Shares of Pool Corporation (NASDAQ:POOL) have been a weak performer over the past year, losing 5% during a significant bull market. Lower construction activity, high rates, and modest disposable income growth have caused consumers to pull back on large home projects, like pool construction. This concern led me to rate shares as a “sell” last October. Since then, they have significantly underperformed, gaining just 6% vs the market’s 29% rally. On Monday, POOL significantly cut guidance, which sent shares down over 10% after hours, adding to their underperformance and below my sell price. That makes now a good time to determine if POOL has even more downside or if an attractive entry point could be near. I remain negative.

Seeking Alpha

Monday afternoon’s guidance revision was particularly concerning. The company now expects to earn $11.04-$11.44 this year rather than the $13.19-$14.19 it previously saw. This is now well below the $13.50 I had expected the company to earn last year. Q2 is the most important quarter for the company as households get their pools ready for the start of the year, and earnings will be just $4.85-$4.95. Unfortunately, Q2 has been trending weaker than expected, and it now expects full year sales to be down about 6.5%. After Q1, it expected sales to be “flat to slightly up.” This is a dramatic shift in guidance.

POOL Corp operates a less cyclical maintenance business, selling cleaners, chemicals, etc. This unit is fairly stable, given much of the spending is nondiscretionary. If you own a pool and plan to use it, there is some essential maintenance. Still, there is definitely some deferral activity, as sales are expected to be down 2% this year, though this is a bit better than the 3% decline registered in Q1.

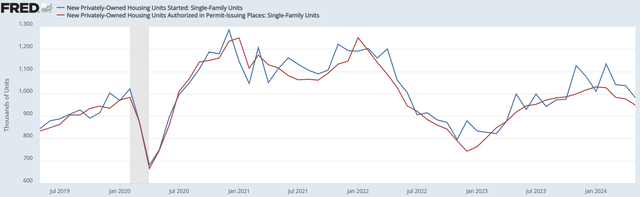

The bigger challenge is on newbuild and remodeling work where POOL has been forced to cut guidance. It expects new units to be down 15-20% and remodeling to be down 15% vs a prior guide of flat to down 10%. Now in Q1, management saw permits down 15-20% but believed there would be improvement, which simply has not materialized.

In hindsight, this guidance was clearly aggressive. On the same earnings call, management noted it takes about 60 days for permit trends to impact their construction orders. As such, Q1 permitting should be a fairly good indicator of Q2 activity, and with Q2 the most important quarter, this weak permitting should have set off more concerns that any rebound would come after its most critical selling season. Moreover, with rates staying elevated, an acceleration in construction-related activity does feel ambitious.

Ultimately, while about 60% of its business is ongoing, nearly 40% is tied to construction and is simply too much of a headwind to overcome. In the company’s first quarter, POOL EPS fell by 21% to $2.04 as sales fell by 7% and the company lost operating leverage. Adjusted EBITDA fell by 22% to $125 million, and gross margins fell by 40bp to 30.2%, despite a one-time 110bp tax benefit. Beyond lower gross margins, operating expenses rose to 20.5% of sales from 18.6% as it spreads the same fixed cost (like rent for stores) across a slower sales base.

With Q1 typically representing less than 20% of the year, these pressures can be manageable, similar to how a retailer can afford a slow February more than a slow December. Unfortunately, we are not likely to see margin recapture given weaker sales in its peak season. Indeed, its ~7% slower sales outlook led to an 18% decline in its EPS guidance. I would expect margins to stay under pressure, and POOL will need to begin reducing SG&A where possible to preserve margin.

The lone positive is that POOL had cut inventory by 11% to $1.5 billion over the past year, a sharper decrease than its sales drop, which should allow it to maintain pricing. It also has a pristine balance sheet with just $979 million of debt. Thanks to working capital releases, it generated $145 million of cash from operations in Q1, and even at guidance, it should generate over $450 million in free cash flow.

In May, POOL increased its dividend by 9% to $1.20 and also boosted its buyback authorization from $284 million to $600 million. Given its strong balance sheet and solid cash flow, even in a downturn, I view its dividend as secure, though it only provides about a 1.5% yield for shareholders. Moreover, I would note its buyback program is open-ended, and its share count is down a modest 1.5% over the past year. I would not expect a share count reduction of more than 2% over the next year.

POOL management increasingly faces a credibility challenge, given the sharp change in guidance after offering a fairly optimistic picture of Q2 acceleration, despite weaker permits in Q1. Indeed, I see ongoing pressures that will limit recovery. First, at a high level, new home construction and permits have been falling in recent months as builders react to interest rates staying higher for longer. This weaker pace of construction activity is likely to lead to less new potential pool construction all else equal. Indeed, with building permits at a multi-month low, we are likely to see increase weakness, not improvement in the near-term.

St. Louis Federal Reserve

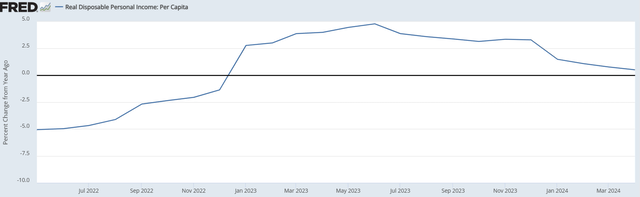

On top of this, a trend I am increasingly focused on is the slowdown in real disposable per capita income. The inflation shock of 2022 pushed incomes lower, and then they recovered in 2023 as inflation began to moderate and wages stayed strong. However, with inflation proving a bit stickier than hoped and the job market normalizing, we are seeing real disposable income growth slow below 1%. This is likely a reason why even in Q1 POOL noted weakness below the luxury-end of the market.

St. Louis Federal Reserve

Now, incomes are still rising, so a recession is unlikely. However, slow income growth and a relatively low savings rate means we are unlikely to see a burst of activity either. Positive income growth means customers should continue with nondiscretionary maintenance. However, slow income growth and elevated rates is not a recipe for a new wave of construction of pools. Increasingly, the 2024 summer season appears lost for POOL, but this does not bode particularly well for 2025 either.

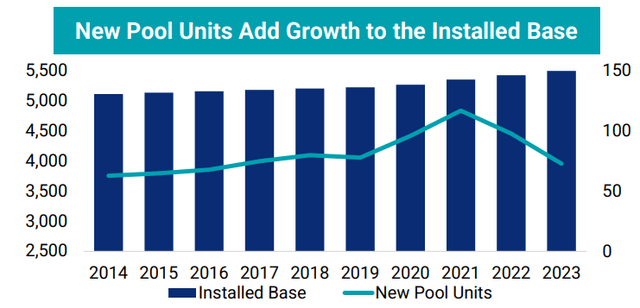

Finally, there is the bigger question of how much demand for pools remains. As you can see below, pool construction spiked post-COVID, and now we are only slightly below pre-COVID levels. It could be that 2021-2022 represented a tremendous pull-forward in demand and that 2024-2026 will have to run below long-term trend until we normalize back to the pre-COVID trend. In other words, COVID did not permanently increase the number of people who want pools; rather time at home led people who would eventually have built a pool to do so sooner, and now there is limited demand.

Pool Corporation

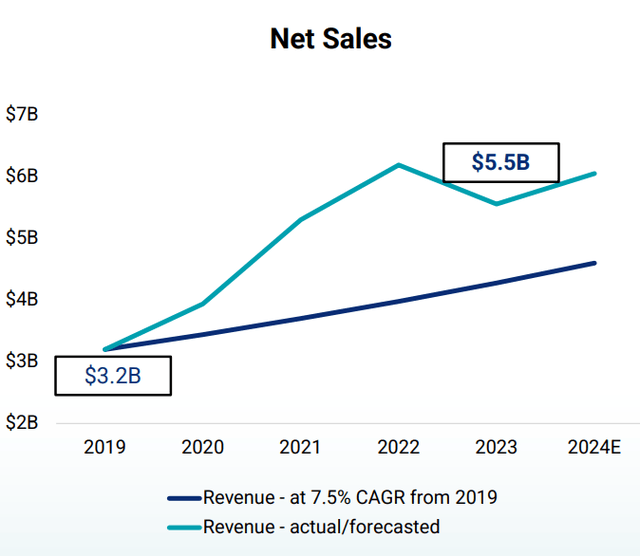

Indeed, as you can see, POOL has been a fantastic growth story. However, it may be that sales are running too far above trend, and that the level of consumption seen in 2022 just is not sustainable. Even down 6%, sales are still more than 10% above trend. This would argue for another flattish 12-18 months after this year. Absent a recession, I am not sure we will see a further downturn in sales, rather POOL may just see results “bounce around the bottom” for some time.

Pool Corporation

Finally, POOL shares still do not appear cheap. Its record year of 2022 resulted in $18.70 in EPS. At today’s share count, that is about $19.18 per share. However, as discussed, 2022 results were likely unsustainably strong, given COVID-related demand, government stimulus, and extremely low rates. Even at ~$300 after hours, shares are 15.6x peak earnings, which it will not likely return to for years. That is not a cheap “peak multiple.” At the mid-point of guidance, shares are 26.6x.

For a company not likely to see a quick recovery in shares, that is expensive. Additionally, its results are proving more interest rate sensitive than its 60% maintenance-related mix would suggest. Plus, there is the risk the pool market become a bit over-supplied. I would rather own a homebuilder like Toll Brothers (TOL) at 10x earnings in what is an under-supplied market, if an investor is going to take interest rate risk.

Now with some maintenance work, POOL can trade at a higher multiple than a homebuilder, but I still believe about 20x maintenance and 10x construction is more appropriate or a blended multiple of 16-17x, leaving shares with a fair value closer to $190. With its strong market share and clean balance sheet, shares may not fall that far. Still, at $300, POOL is expensive, given demand is unlikely to recover in the near future. I would still sell shares and see them moving toward $200-225, or about 20x earnings.

Read the full article here

Leave a Reply