At the start of this year, we wrote our first-ever article on Robinhood (NASDAQ:HOOD), where we highlighted 3 key catalysts that we thought could prove transformational for the business and investors’ perception of the stock over time.

These catalysts included the launch of the credit card, international expansion into the UK and EU, and an (as yet unlaunched) futures offering.

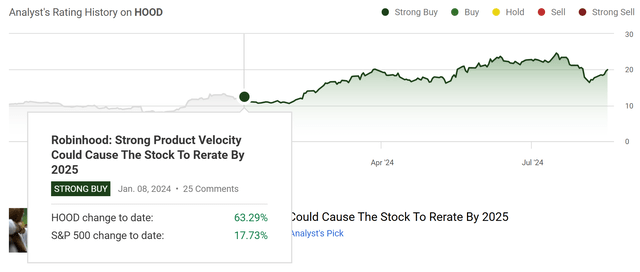

For the price that the market was asking, HOOD’s stock appeared to be a steal, and in January we rated shares a ‘Strong Buy‘.

Since then, HOOD has been lapping the market, up more than 3x the return of the S&P 500 over that time:

Seeking Alpha

As an update, the rollout of the Credit Card has been promising, and the equities / crypto offering in the UK and EU respectively has gone according to plan, with lots of potential green shoots to report.

While we’re still waiting on the futures offering, we continue to be impressed by the shipping velocity and integrity that HOOD management has shown over time.

In short, HOOD say that they’re going to do something, and then they do it.

Thus, with the futures offering still in the pipeline and with continued financial strength in results and margins, we think the company looks as compelling as ever when it comes to an investment of your hard-earned capital.

While shares are a bit more expensive than they were in January, today, in this article, we’re explaining why we think the company still has considerable upside over the short, medium, and long term.

Sound good?

Let’s dive in.

Robinhood’s Financials

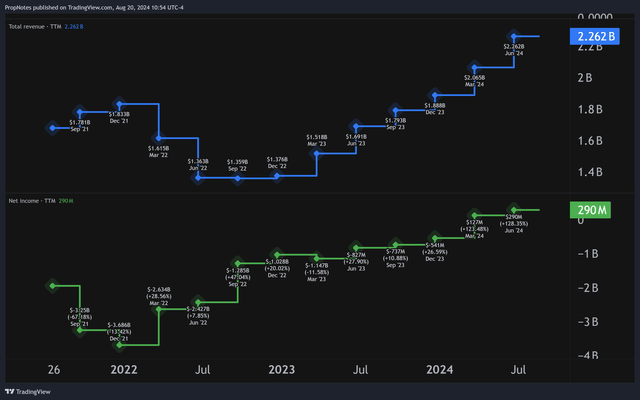

As we just mentioned, HOOD’s financials are as strong as they’ve ever been.

Interest revenues are up, trading volumes have proven stable, and net income has continued trending in the right direction.

TTM Sales keep hitting all-time highs, and net income has been in the black for two quarters now, which is encouraging from a ‘have profits finally inflected?’ standpoint:

TradingView

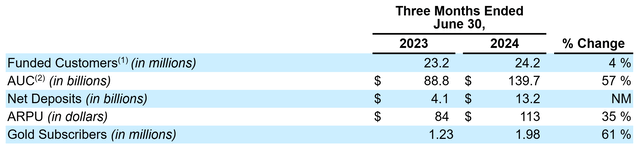

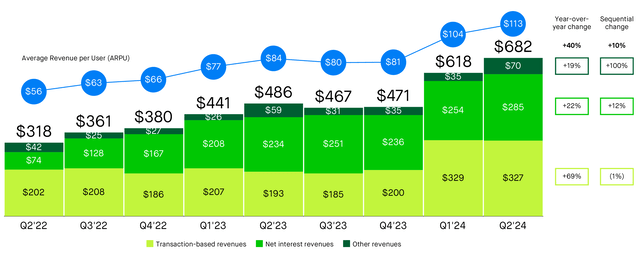

These results (especially in Q2, which was just released) have been powered by strong ARPU growth, which has been driven by a surge in Robinhood Gold signups, along with huge increases in AUC.

This AUC growth has largely been responsible for higher interest revenues and stable trading activity:

10Q Investor Presentation

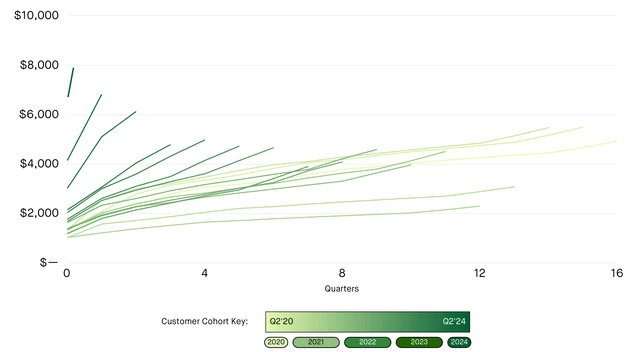

Not only that, but HOOD has also seen very positive signs around AUC when it comes to customer cohorts over time, with new funded customers investing more and more with the platform over time:

Earnings Presentation

As an investor looking to get into a growth company with a long runway of opportunity, this is exactly what you would want to see:

- More customers

- Larger wallet share per customer

- Higher engagement with the platform

On the catalyst front, we’re also happy to report that things have been going well.

Since our first article, the credit card and European offerings have both launched, bringing additional revenue flows into the picture.

With the credit card, Vlad had the following to say on the recent earnings call:

So we started rolling out the credit card a few months ago, and we recently announced that we have crossed 50,000 cardholders. And we recognize the demand for the credit card is high. And the feedback that we’ve gotten so far from customers is also very, very positive. People love the card, customers love the rewards. They love everything about it, the in-app experience, the digital experience, the card itself. The app so far has a 5.0 Rating on the App Store with over 7,000 reviews. So there is a lot of demand to roll it out faster.

In our view, this lines up with our anecdotal experience with the card, in that it is an incredible value for cardholders and a somewhat ego-driven statement piece to have in a physical wallet. Both should drive demand.

All in all, we expect strong growth here to continue.

On the international front, all signs are also pointing in the right direction. On the recent call, Vlad mentioned that balances were smaller than in the US, but trading activity was similar and demand for HOOD’s other unlaunched products (like options in the UK) was strong:

So far, account balances overseas are a little bit smaller than the US on average, but the trading characteristics are pretty similar. And what we really like is as we hear from customers, both in the UK for brokerage and in the EU for crypto, they want things that we offer in the U.S. So UK customers are requesting margin and options and EU customers are requesting the ability to trade stocks.

So that I think, validates in part our strategy of expanding with one unified platform internationally.

Again, for us as investors, this shows that there’s incredible revenue potential for HOOD over time across jurisdictions, as the company gets more experience in launching integrated offerings globally.

Finally, management is looking forward to an active trader event that they’ll be running in October:

And we’ve got an event for our active traders in October, where we are going to unveil some new products. And I think we are getting very, very excited about it. So those results that you are seeing, I mean there — they’re good results. We’re proud of them, but I think we have plenty of room to run on the active trader side, and that includes margin, but it also includes new product innovations that we’ve been [baking] for the majority of the year.

Not to read through the lines, but we anticipate the company potentially announcing the futures offering here, with a big group of active traders in attendance.

At the very least, we expect that the company will announce improvements to its web trading functionality, which has lagged behind other brokers up to this point.

Either way, we’re expecting the announcement should address an Achilles heel to HOOD’s current offering, which is a positive.

All in all, we’re very happy with HOOD’s progress, and see more reasons than ever to expect solid continued growth in the future.

Robinhood’s Valuation

All if this is great, but what is the company actually worth?

Right now, the company is trading at a ~$17 billion market cap, and TTM net income is still only at $290 million.

This puts the multiple at a stratospheric 60x, which is WAY more expensive than most financial services companies.

However, as is the case with all growth stories, you need to look into the future somewhat to capture all of the required context.

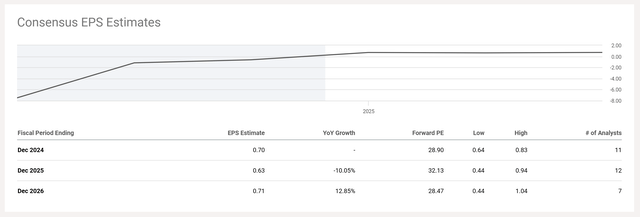

This this way, it’s easy for us to see HOOD’s EPS growing to $1.00 by the end of 2026, which is ahead of analyst estimates:

Seeking Alpha

This would put the company’s P/E at around 19x given today’s price, which seems a LOT more reasonable. Granted, some of our bullishness is based on the fact that we see less risk from rate cuts than most (as we’ll talk about in the risks section), but even if we’re a little ahead, 2026 isn’t that far away, and getting a price even close to 20x 2026 seems highly reasonable to us given the strong growth story.

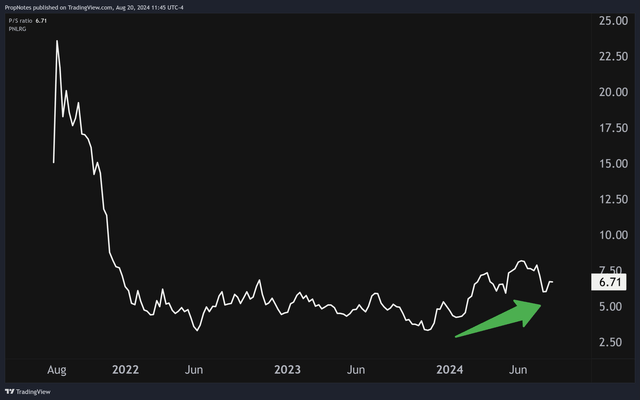

Additionally, this year, the top line revenue multiple has moved up somewhat (as we expected), but not overly so, which means that we think there’s more room to move higher, or at the very least stay where it’s trading at the moment over time:

TradingView

Combine the EPS calculations from earlier and this sales multiple, and we think Fair Value for HOOD shares right now is somewhere between $25 – $27, with the ability to grow further in line with organic growth of 20%+ if multiples remain constant.

Sure, the stock isn’t as cheap as it was when we first wrote about it, but it’s still a solid bargain if you zoom out a bit and take a longer-term view.

Risks

There are two risks that people commonly talk about when it comes to HOOD – Stock-based compensation, and interest rates.

Let’s start with SBC, as it’s easier to dismantle.

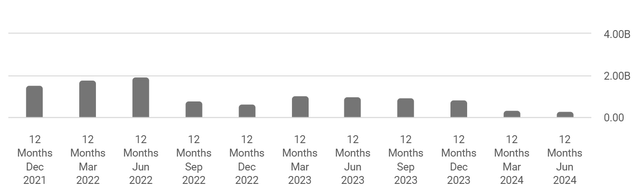

In short, HOOD pays employees with a lot of SBC. TTM SBC expenses were $385 million, which is well above market averages on a percentage basis.

However, this doesn’t matter than much for two reasons.

First, this SBC expense has been coming down over time, from nearly $2 billion in 2022 (as a result of a one-time founders’ allocation), to only $385 million today:

Seeking Alpha

Second, HOOD has actually broached profitability on the net income front. This means that the SBC is no longer technically limiting profitability, like you see with other companies like SNAP.

With revenue growth set to continue apace against a largely fixed cost base, it’s easy to see how SBC should have a smaller and smaller impact on shareholder returns going forward.

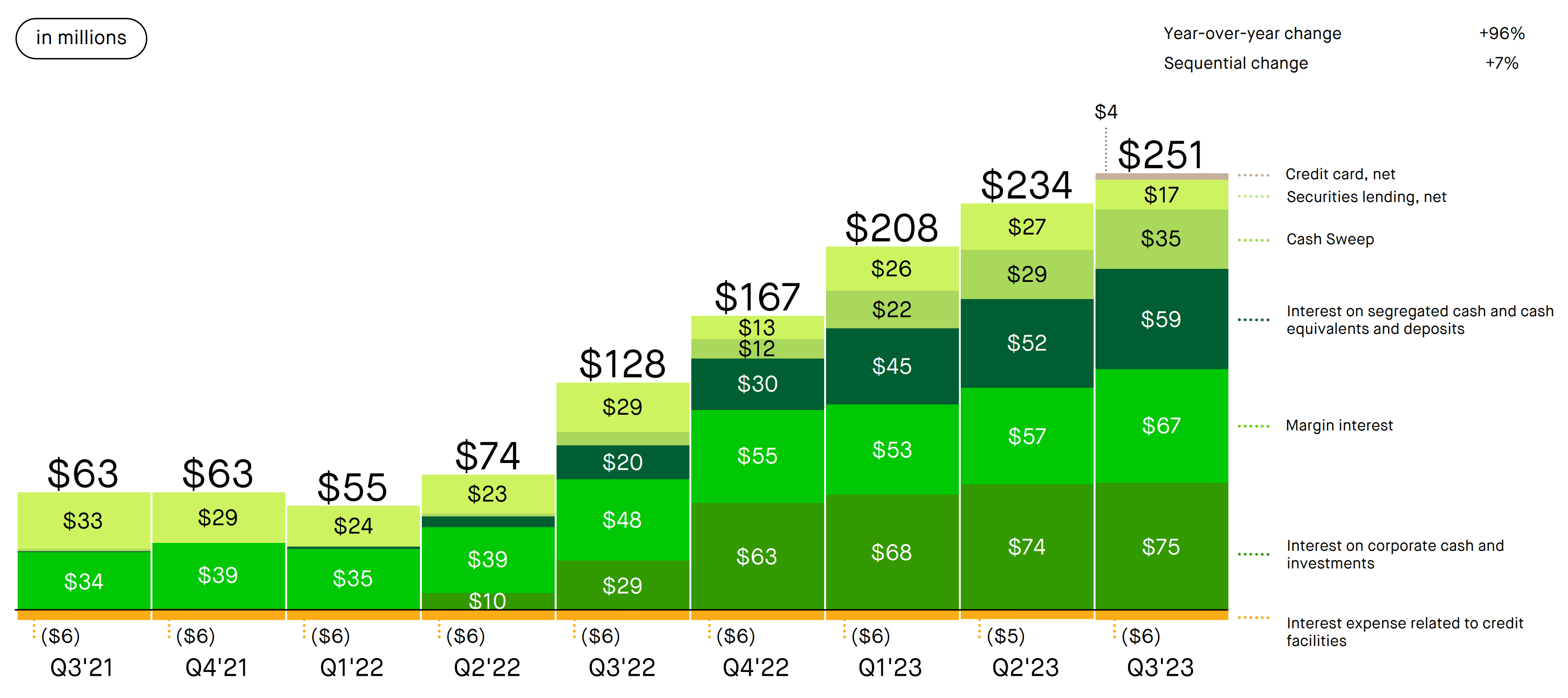

The second main risk that people frequently talk about is interest rates, mostly due to the following graph:

Investor Presentation

This chart was taken from our earlier article, where you can see how much interest on corporate cash, margins, and sweeps has contributed to revenue growth for HOOD since 2021.

If rates go down, will this impact growth going forward?

We don’t see this as a risk for a couple of reasons. First off, competitive margin rates reduce a lot of volatility from rate changes and increase loan volumes, which should ameliorate the impact on that interest segment going forward:

Until recently, one area where candidly our progress has not been so great is margin. And this is a huge opportunity for us as brokerage incumbents generate far more revenue on margin than even trading. In particular, we were not getting much adoption from customers with larger margin balances because our rates were not very competitive.

So we introduced industry leading rates for active traders in May. And this, coupled with the continued improvements we are making to the accounts transfers flow, led margin balances to grow by over 20% in the last five weeks of the quarter to a two-year high of $5 billion. Now 75% of that growth came from customers with margin balances over $100,000.

This is highly bullish and should reduce the impact of lowering rates here.

Secondly, only a small percentage of the company’s assets are variable interest rate, which means that the ride down on the backside of the rate cycle shouldn’t be that bumpy:

First, we’ve been growing our interest-earning assets at a really nice pace. But not all of our interest earning assets are sensitive to rate changes. So actually, over half of the balance of interest earning assets relates to our cash sweep and the spread we earn there is relatively fixed, which minimizes the impact of changes in rates.

Specific to the question you asked about what the rate impact is, so assuming a 25-basis point change or decline that would affect [annual] NIM by $40 million. And hard to predict the exact timing, but we feel good about the natural hedge. We have $1 billion of transaction-based revenue, and it takes a relatively small uptick in trading activity to offset that decline in interest.

This is what management means when they say they have a self-hedging business.

Plus, lower rates should mean a higher multiple for HOOD’s growth.

Summary

All in all, we think there are risks to investing in HOOD, but they’re potentially smaller than most think.

With best-in-class growth, continued product improvement, and a promising AUC runway with higher monetization opportunities in the future, we’re bullish on HOOD over the short, medium, and long term.

Thus, we re-iterate our ‘Strong Buy’ rating.

Good luck out there!

Read the full article here

Leave a Reply