Investment Thesis

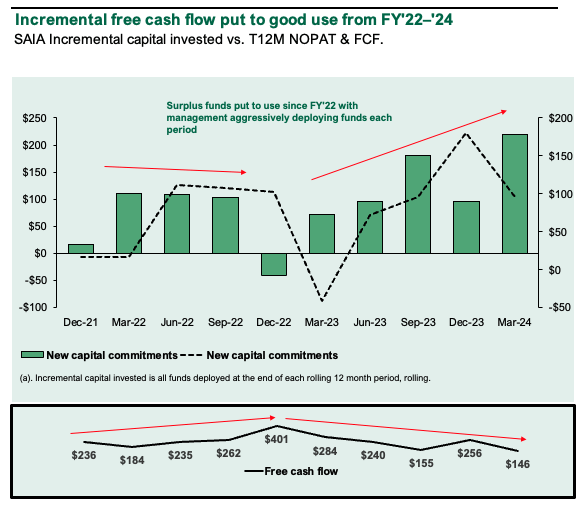

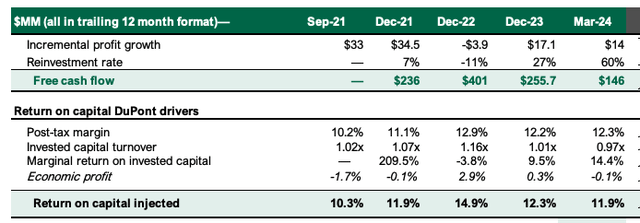

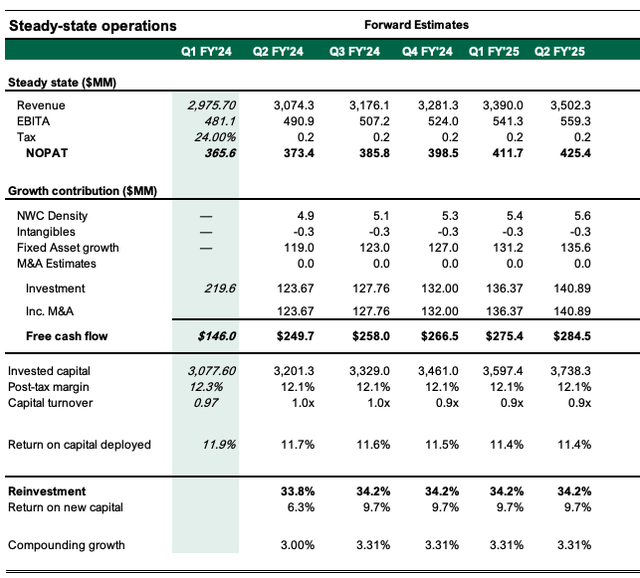

Saia, Inc. (NASDAQ:SAIA), headquartered in Johns Creek, Georgia, is a leading transportation company specializing in less-than-truckload (“LTL”) services through its wholly-owned subsidiary, Saia LTL Freight. Established in 1924, SAIA operates a network of ~200 facilities across 45 states, including relationships with third-party interline carriers for service in Canada and Mexico. With a fleet of ~6,500 tractors and ~22,100 trailers, management has ploughed running FCFs back into this business at a rate of >$2Bn in the last 3yrs on a rolling 12-month basis [it rolled back in 60% of NOPAT in the TTM for instance].

Operating earnings of ~$ 85mm in FY’14 were produced on sales of $1.2Bn, and ~$530mm of investor capital had been put into the business by this stage. In FY’18 this stretched to $1.6Bn in sales on operating earnings of $141mm, and management had reinvested an additional ~$390mm to produce these figures, ~15% pre-tax ROIC. In the last 3yrs, its capital budgeting programs have borne fruit. FY’23 sales were $2.8n on $461mm, but had invested another $962mm back into the business to engender this growth, and had a total of $2.8Bn at work in its operations [16% pre-tax ROIC].

Critically, it’s compounded sales at ~8-9% since FY’14 – but, both earnings + invested capital have compounded ~19% p.a. – indicating 1) the economic leverage produced on its investments is ~1x, 2) pre-tax ROICs are ~15-16% [even in the last 3yrs, the incremental ROIC post-tax is ~15%], and 3) that this is a good business.

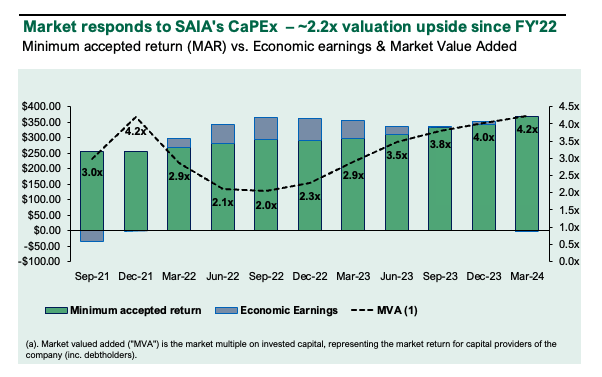

The market has appreciated SAIA’s CapEx growth + corresponding returns, and it now trades ~2.2x higher than it did in in FY’22 at ~4.2x EV/IC as I write. If investors value it as a ‘new company’ then the value of its profits must get higher with each $1 of capital invested (as they have done over this time). But the embedded expectations are exquisitely high for this company, and investors must maintain the high valuation multiples for this stock to trade meaningfully higher on its implied fundamentals.

Based on this, I am hold on SAIA due to 1) its impressive fundamentals, that are 2) well reflected at current valuations. My view is ~12% value gap is underexplored and could be harvested in this name. I am after more selective opportunities with more asymmetrical upside reward. Rate hold.

Figure 1.

Company earnings

Key investment findings

The questions now are – 1) what’s in store, 2) what are the value drivers + economics, and 3) is there any headroom left after this tremendous re-rating from FY’22–’24?

Q1 sales were $754mm on 85% operating ratio with (i) ~15.7% growth in LTL shipments/day, and (ii) +620bps growth in LT tonnage/day. This added ~140bps revenue per shipment ex-fuel surcharge revenue. Critically, management expects ~150-200bps operating margin decompression this year as a possibility, but also acknowledges the tough macro + industry environment. Per the CEO on the Q1 earnings call:

[A]s we move forward through 2024, we continue to see macro uncertainty. At the same time, we continue to sit — continue to see widespread customer acceptance of Saia’s now national network.

I should highlight that this is a national network that will be poised to scale as customers seek to grow with a trusted partner as the macro-environment becomes more certain.

My findings include the following:

1. Aggressively reinvesting

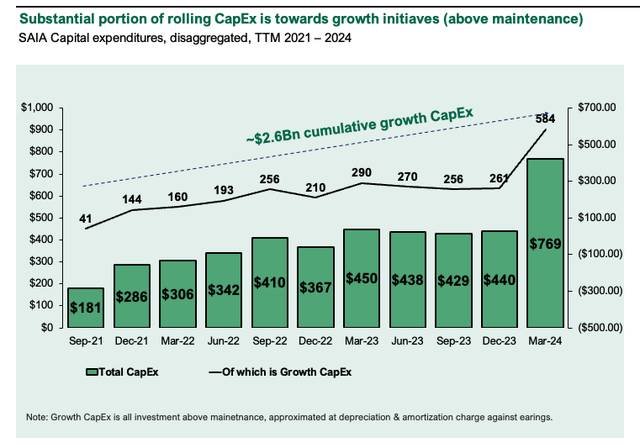

- Management’s efforts in ploughed ~$2.6Bn of cumulative growth CapEx since FY’21 (on a TTM basis). This is taken as all CapEx above the maintenance capital charge, approximated at the level of rolling depreciation + amortization (Figure 2). Total CapEx in the 12mo to Q1 ’24 was ~$770mm, of which ~$585mm I consider toward growth.

- The actual change in capital invested [adj. for all NWC work through] is ~$962mm since FY’21 vs. $6.7Bn EV delta.

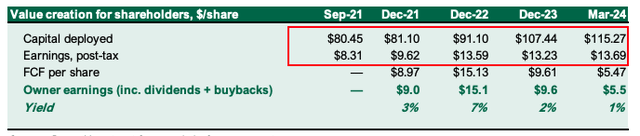

- Investors valued these incremental investments at ~7x [each $1 of new capital invested produced ~$7 in new market value]. With NOPAT + $5.40/share from ~$35/share investment, this = 15% return on new capital (Figure 4). Thus, investors valued the NOPAT delta at ~46x.

Figure 2.

Company filings

Figure 3.

Company filings

Figure 4.

Company filings, author

2. The business advantage is operating margins

- The company enjoys consumer advantages in its highly commoditized industry – pre-tax margins are ~16.15% [3rd in cargo ground transport industry behind (UHAL) and (ODFL), respectively], and ~12% post-tax margins. I’m obtusely aware the company has benefitted from a pandemic-era boost and that +200bps margin growth from FY’21 could be from this. It prints these on ~1x capital turns with ~12% ROIC [also +200bps].

- In my view, a large part of the advantage is its maturity [founded in 1924] and earnings per employee at ~26K net profit/employee [4th vs. industry behind (YMM), (ODFL) and (LSTR). Hence, it has (a) 3rd highest industry margins with (b) 4th highest profit per employee. This tells me both its operating and human capital is profitable.

Figure 5.

Company filings, author

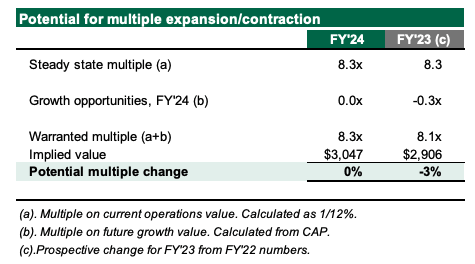

3. Most of the valuation is tied up in the current business vs. the future value of its growth opportunities

- Critically SAIA has gained ~200bps ROIC from its capital investments since FY’21 [this inc. ~17 freight terminals in January this year]. The market has valued these advancements highly [~2.2x extra EV/IC multiple and >2x NOPAT multiple] and thus my questions are 1) has it overextended the multiple, and 2) what’s the propensity for expansion/contraction?

- Returns are a function of earnings + expansions [or at least no contractions]. One way to examine this is to assign SAIA a commodity p/e multiple and compare this to the present value of its future growth opportunities to observe if there’s scope for any LT multiple change.

- On the combination of 1) its current valuations, 2) ROICs ~12%, which is the LT market average return, and 3) its competitive advantages, my view is it can trade roughly in line with its current multiples. What this tells me, most of the valuation is tied up to the current business, which is very handy given all the investment management has made. I’ll allow +/- 10% deviation in multiple and still call this ‘no statistical change’, given the day-to-day machinations of the market.

- Two things immediately change this – 1) ROICs <10%, and/or 2) post-tax margins also <10% at 1x capital turnover.

Figure 6.

Author’s estimates

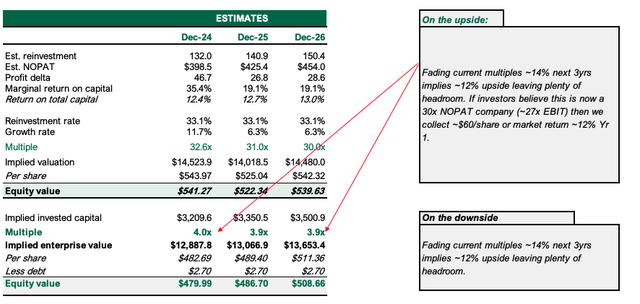

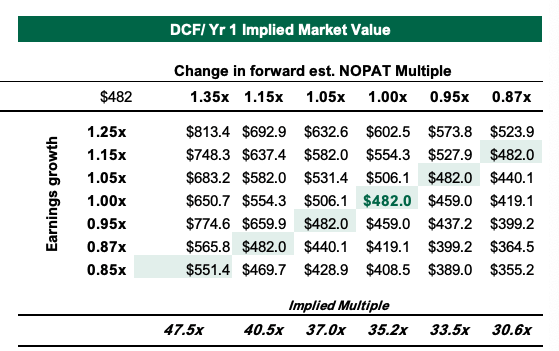

Running conservative multiples ~14% lower than today gets us to ~$541 implied value of ~12% value gap.

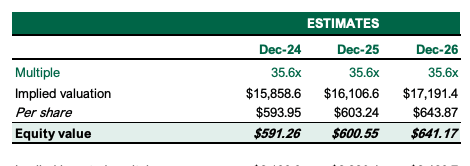

- At 32x my FY’24E estimates [see: Appendix 1] this implies ~$541/share market value today. On the upside, if investors believe this is a >30x NOPAT company (~27x EBIT) then we collect ~$60/share or market return ~12% Yr1 (Figure 7). If it continues this then you’re looking at a highly, highly valuable company of ~$591/share [~22% value gap] with implied CAGR ~10% to FY’26E. On the downside, fading the multiple ~14% over the next 3yrs implies ~12% upside, which leaves a bit of headroom if it were to contract (Figure 8). My view is the probability of maintaining >30x NOPAT is high, as mentioned earlier.

- The risk/reward calculus is balanced as 5% multiple contraction needs >5% earnings growth for breakeven, and +15% gets us to $527/share with this 5% contraction (Figure 9).

Figure 7.

Author’s estimates

Figure 8. At current multiple to FY’26E.

Author’s assumptions

Figure 9.

Author

Risks to thesis

Upside risks to the thesis include 1) >15% revenue growth which sports the higher multiple of ~35x NOPAT, 2) major reduction in fuel and operating costs for the business, and 3) rates coming off earlier than expected in a tailwind for broad equities.

On the downside, risks are 1) compression of ROICs <10%, 2) NOPAT margins <10%, 3) NOPAT margin contraction <30x, and 4) rapid jump in fuel and industry operating costs thus clamping margins + FCFs.

In short

SAIA’s incremental CapEx + NOPAT growth since FY’21 is commendable and has resulted in a more economically valuable business in my view. The issue I see is the market has already well reflected this with sharp multiple re-ratings in the same time, potentially clamping investment returns. Moreover, the margin of safety is low, as a contraction <30x nullifies my valuations (it currently trades ~35x). In that vein, the risk/reward calculus is balanced, supporting a hold rating.

Appendix 1.

Author

Read the full article here

Leave a Reply