Schwab High Yield Bond ETF (NYSEARCA:SCYB) has been an ETF I’ve had my eye on for a while. SCYB has been around for a little under a year and has an AUM of about $187M. SCYB tracks the ICE BofA US Cash Pay High Yield Constrained Index. This index has some special criteria that make SCYB’s holdings attractive. I have not been a fan of high-yield bonds in the past year; in fact, I have 2 high-yield ETFs with Strong Sells. However, since June of last year, I’ve been bullish on HYBB, an ETF that holds only BB bonds. If you care to read my articles on HYBB, you can find them here and here. As the data continues to come in at the Goldilocks range, I’m willing to start incorporating some slightly lower-rated high-yield bonds into my portfolio, and SCYB is my ETF to do that.

Holdings

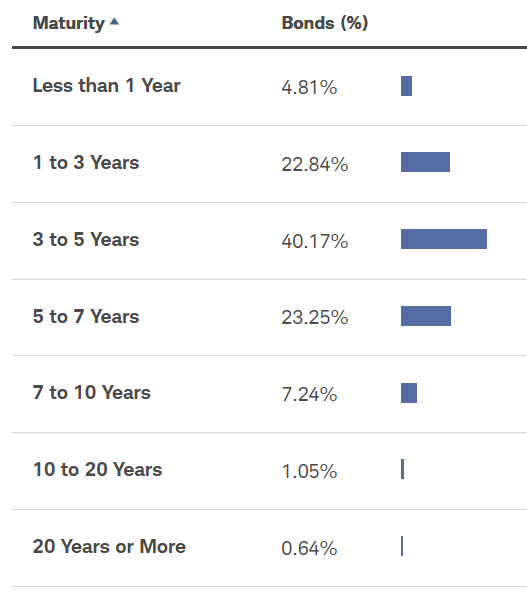

SCYB holds 1,562 high-yield bonds. The index ensures that no one issuer is responsible for more than 2% of the index’s holdings, which makes SCYB a well-diversified ETF. SCYB has an effective duration of 3.3 years, which is on the lower end. While SCYB is by no means a low-risk ETF, its lower duration does limit some interest rate volatility. Its average maturity is 4.4 years, with over 40% of its holdings falling into the 3-5 year range.

SCYB’s holdings by maturity (Schwab.com)

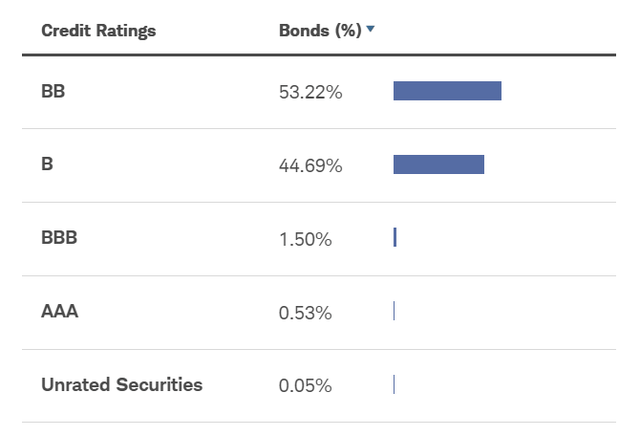

Due to index criteria, SCYB only holds bonds rated B or better. Approximately 53% of the ETF is in BB-rated bonds, and 45% in B-rated bonds.

SCYB’s holdings by credit rating (Schwab.com)

This makeup of higher-rated high-yield bonds is what makes SCYB attractive.

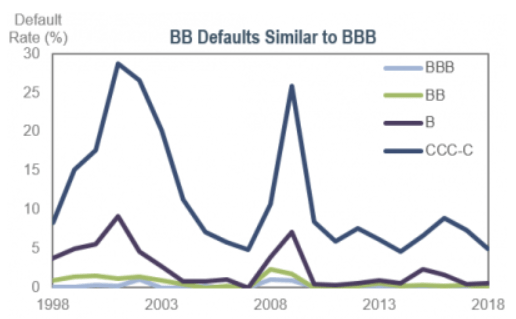

BB and B bonds are risky, but based on the current economic environment, I don’t see any reason to expect a rise in default rates. Many other high-yield ETFs own large amounts of CCC and below-rated bonds. These are the junk bonds I’m really worried about. Not only have CCC bonds had far higher default rates than B and BB bonds, but there are also current technical factors that make me even more bearish about CCC bonds.

Defaults

It’s not a surprise that CCC bonds have more defaults than B bonds, but it might be surprising to some how big of a difference one notch can make. From 1994 to 2015, B-rated bonds averaged a default rate of 2.8%. During that same time period, CCC bond default rates were over 11%, almost 4 times higher than that of B’s! The following chart is from one of my past articles, where I argued BB bonds were “in a league of their own”. While I still believe that lower-risk investors can use BB bonds to add yield for only a little more risk compared to BBB bonds, for more risk-tolerant investors, B-rated bonds look good too.

Default rates of bonds by credit rating (www.incomeresearch.com)

The only thing that looks awful is CCC bonds. And I think things are getting even worse for them.

CCC bonds

CCC issuance has been down dramatically. In 2023 CCC rated bonds accounted for less than 1% of high-yield issuance. Before 2023, the previous low was 3.7% in 2009. The low issuance is due to a variety of reasons. First, CCC companies would have to issue new debt at rates far higher than they are used to. With the risk-free SOFR rate at 5.33%, these companies have to add quite a bit of yield to entice investors. CCC-rated companies are trying to wait out the high rates so they can issue after rate cuts in order to have lower interest expenses. Another reason is that CCC-rated companies are turning to private credit to get lower rates. The last reason is that interest expense is too high for companies to issue debt to participate in M&As. While this issue affects all of the bond market, it hits the already struggling CCC bond market harder.

All these factors that cause lower supply also artificially raise prices and cause spreads to be tight. Spreads across the entire fixed-income sector are tight, but because of the technical factors I discussed, CCCs valuation is hit even harder.

B and BB bonds

Now that I’ve discussed why CCC bonds shouldn’t be in your portfolio, let’s address why I’m willing to add some risky B and BB bonds. SCYB’s 30-day SEC yield is 7.7%. The chart below shows SCYB’s yield compared to HYBB and BND.

| ETF | 30-Day SEC Yield | SCYB Yield Spread to ETF |

| SCYB | 7.7% | — |

| BND | 4.69% | +301 bps |

| HYBB | 6.47% | +123 bps |

The yield is high because of the risk of its holdings. But based on the recent economic data, I think defaults will stay to a minimum. Inflation is coming down, giving hope of a rate cut in the not-too-distant future. While interest expense is far higher than it has been, corporate earnings have also been growing. Payrolls grew by 206,000 in June and while unemployment did rise a bit, it wasn’t enough to cause worry that consumer spending will decrease causing lower corporate earnings.

As inflation keeps falling and unemployment slowly rises, the Fed will cut rates and relieve some pressure on these lower-rated companies. For the record, I expect one or zero rate cuts in 2024. 2025 is when I forecast the real decline in rates to start. I also believe that the neutral interest rate is going to be higher in the coming decade than it has been in the past, so I don’t expect SCYB’s yield to fall all that much in the future.

Right now is a good time to lock in these yields and then experience the capital appreciation that’s to come from falling rates.

Takeaways

SCYB offers exposure to higher-rated high-yield bonds. While this ETF is risky, it limits what I believe to be the intolerable risk that currently comes with CCC bonds. CCC bonds are not only historically far riskier, but technical factors are driving prices up and spreads tighter. For those who can tolerate the risk, SCYB is a great way to gain exposure to the high-yield bond market. I rate SCYB a buy.

Read the full article here

Leave a Reply