Investment overview

I give a buy rating for Shake Shack Inc. (NYSE:SHAK) as the growth outlook is solid. I expect SHAK to grow at a mid-teen percentage level for the next two years, supported by strong same-store sales growth and the opening of new stores. Combined with an expanding adj EBITDA margin, SHAK should achieve ~$250 million of adj EBITDA by FY26.

Business description

SHAK is a fast food business that sells burgers, fries, milkshakes, and other menu items. The business operates on two main models: self-operated stores and a licensing model. In the US (SHAK’s main market), it operates via both models, whereas for international markets, it operates through a licensed model. As of 2Q24, SHAK has 317 self-operated units and 247 franchised units.

SHAK reported its 2Q24 earnings a few weeks ago, and they were solid. Total revenue saw $316 million; restaurant level margins [RLM] saw 22%; consolidated EBIT margin saw 4.2%. Total revenue grew 16.4% y/y, an acceleration from the 14.7% y/y growth seen in 1Q24. Notably, this came with an expanding RLM, 250 bps higher than 1Q24 and 100 bps higher than 2Q23. This translated well into a consolidated EBIT margin expansion of 180 bps vs. 2Q23 and 310 bps vs. 1Q24. Consequently, adj EPS grew 53% vs. 2Q23 to $0.27.

Solid growth performance that should continue

2Q24 growth performance was absolutely solid considering the consumer spending environment, and this convinced me to a huge extent that growth can sustain at this mid-teen level as the macro backdrop gets better. The way I assess SHAK’s growth is by dissecting it into two parts: same store sales growth [SSSG] and store growth.

In the quarter, SHAK saw SSSG of 4%, driven by a 4.8% price/mix contribution and a 0.8% decline in y/y traffic. The notable aspect was that traffic growth saw sequential improvement from -2.1% in 1Q24 to 0.8% this quarter, and that all regions saw positive SSSG. More importantly, management noted that on a quarter-to-date basis (for 3Q24), SSSG strength continued into the quarter at 4.1%, driven by positive traffic growth. These are impressive feats when we consider that McDonald’s (a key benchmark I used for the fast food industry) saw poor performance and the overall consumer spending backdrop was weak (the consumer sentiment index also points to a weak spending environment). Here is one good way of framing SHAK growth potential: If SHAK can perform at this level in this macro backdrop, it should sustain this level of growth when the situation gets better.

Furthermore, SHAK is stepping up on its marketing initiatives to drive brand awareness by increasing advertising spend. This is a massive opportunity for SHAK to drive growth, as the business has been underinvesting in marketing compared to its peers. For reference, SHAK spends ~1% of revenue on sales, while peers generally spend 3-6%. So far, the results are promising. For instance, in April, the brand leaned into messaging emphasizing its premium ingredients, which materially boosted Chicken Shack sandwich demand. I also think management is approaching this with the right mindset-marketing ROI is more important than just driving top-line growth. The strategy ahead is to focus on delivering value through strategic promotions and unique limited-time offerings, rather than relying heavily on outright price discounts.

Look, I think there is, as we’ve said now for a little while, we’ve really been a brand that has done most of our work for 20 years on just being a great brand. And we’ve spent little to no advertising over those years. And it’s new for us to be ramping up. Company 1Q24 earnings

Our advertising spend at roughly 1% of sales is a fraction of many of our peers. We know we can and will invest with success here moving forward.” Company 4Q23 earnings

Another driver for SSSG that I am monitoring is improvement in drive-through services (currently a relatively small portion of the SHAK’s less than 10% of the US store fleet). This is an area that SHAK should definitely invest capital in because of the consumer culture in the US, and hence, it was positive to learn that management is going to significantly speed up the service and improve the guest experience at the drive-throughs. That said, this is probably not going to be a major growth driver in the near term, as management seems to still be in the planning stage of acquiring the right equipment and optimizing kitchen operations.

Finally, the second attribute to revenue growth is new store openings, which appear to be on the right track as well. Management reiterated that it remains on track to reach its FY24 unit growth target of 40 self-operated stores and 40 licensed stores, which implies a 15% y/y store. As of 1H24, SHAK has opened 16 self-operated stores and 15 franchised stores. Assuming the same historical seasonality where 1H is ~38% of the full-year store opening, it implies FY24 should see a total of 80 store openings.

Margin expansion

I am also positive about SHAK’s RLM outlook, as it benefits from reducing business costs. Labor costs should trend downwards due to wage inflation easing and also the ramp-up of the new labor deployment model, which yielded positive results when management tested it in 1H24. Food and paper cost inflation also shifts downward from 1.5% in 1Q24 to 0.5% in 2Q24, which I expect to continue moving in a favorable direction as overall inflation continues to taper. Moreover, with the business growing at a mid-teens percentage, it should also see fixed cost leverage that helps to expand profit margins.

We may redistribute that labor from taking orders once the kiosks have proven to be the optimal way to making sure that those folks are out in the dining room taking care of our guests or contributing to the team in the kitchen. Company 2Q24 earnings

Valuation

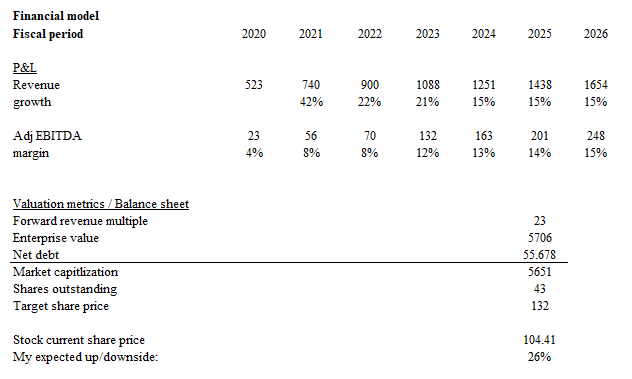

May Investing Ideas

Based on my research and analysis, my expected target price for SHAK is $132.

- Revenue should grow at a mid-teens percentage for the next two years, driven by a positive SSSG (mid-single-digit contribution) and a similar level of new store openings (low-teens contribution). The improving macro-conditions as well as the fed-cut rates should also support mid-teen growth.

- EBITDA should reach ~$250 million in FY26 as SHAK experiences expanding its EBITDA margin on the back of lower labor costs and food & paper costs as a percentage of revenue, along with fixed cost leverage. I modeled adj EBITDA margin to be 15% in FY26, which I don’t see as a high hurdle considering 2Q24 already reported 14.9% adj EBITDA margin.

- The stock should continue to trade at 23x forward EBITDA (the past 3-year average) as growth sustains at mid-teen levels. I don’t think SHAK will re-rate to its previous average multiple of 30x because growth is no longer in the >20% range. Compared to Chipotle Mexican Grill, which is trading at 27x forward EBITDA with an expected growth of 15%, I think SHAK is trading near where it should be today.

Risk

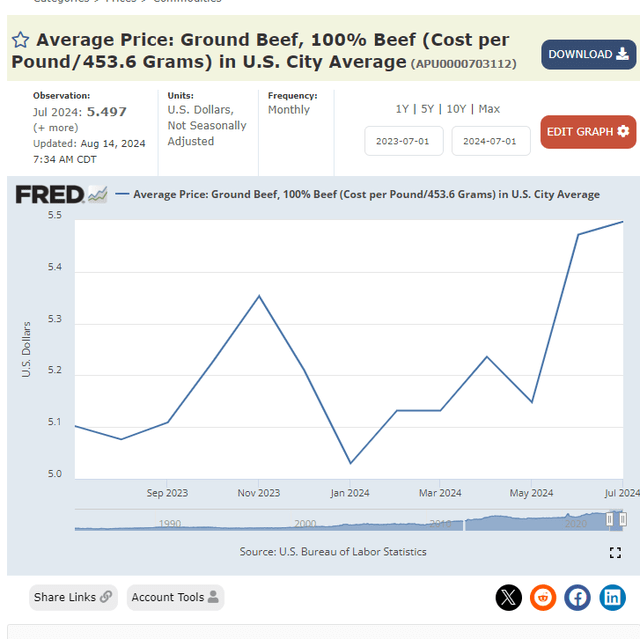

Rising beef prices are the main risk for SHAK, as it is a key ingredient in its menu items. Based on the latest data available, beef prices continued to trend up in July. Depending on how much this increases, it may pressure SHAK’s ability to expand its adj EBITDA margins.

FRED

Conclusion

I give a buy rating for SHAK as the growth outlook looks solid. 2Q24 performance proved my point as revenue grew 16% despite the poor macro backdrop. The combination of mid-teen revenue growth, driven by both same-store sales and new store openings, coupled with expanding profit margins, should enable SHAK to generate $250 million of adj EBITDA in FY26. And at the current valuation of 23x forward EBITDA, the upside is quite attractive.

Read the full article here

Leave a Reply