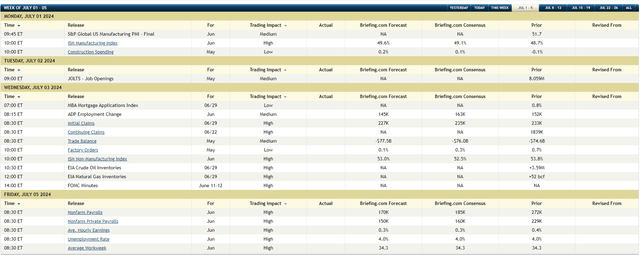

Thanks to the above table from Briefing.com, it’s labor force data week, with JOLTS due out Tuesday morning, ADP Wednesday morning, jobless claims due out Thursday morning and then the all-important June nonfarm payroll report will be out Friday morning, July 5th at 7:30 am.

Readers can see that expectations for June nonfarm payroll results in the above table. The unemployment report has risen from a low of 3.2% post-pandemic to 4% as of last month.

While the nonfarm payroll number is the business survey and thus more closely followed by investors, the unemployment rate matters greatly to politicians since that one single number can sum up the political environment in one single digit.

The Fed has gotten inflation down as low as it can, without labor market weakness dropping it further. The constant talk about rate cuts by the Fed will likely be just that – talk – until labor market weakness surfaces. Hard to say when that happens.

The fact is the economy remains in very good shape. The Core PCE data for May, reported this morning, fell to +2.6%, versus +2.8% last month. The Fed’s almost there.

S&P 500 data:

- The forward 4-quarter estimate slipped a little this week to $252.85 from last week’s $253.84.

- The P/E ratio on the forward estimate is now 21.6x versus 21.55x last week.

- The S&P 500 earnings yield slipped to 4.63% from last week’s 4.64% even though the S&P 500 fell slightly on the week.

- With this being the last week of reporting for Q1 ’24, the S&P 500 EPS rose +8.2% (after bottoming at 5% on April 5th) while S&P 500 revenue rose +3.95%, after bottoming at 3% on April 5th, ’24.

- Expect Q2 ’24 revisions to be negative next week, but the strength in expected Q2 ’24 EPS and revenue growth has been unusually solid at +10.6% expected EPS growth and +4.2% revenue growth.

Summary/conclusion: The holiday shortened week will likely mean lean trading desks the morning of the nonfarm payroll report on July 5th, ’24.

Have a wonderful holiday weekend.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply