Townsquare Media (NYSE:TSQ) is an “old media” stock offering the appealing combination of a low valuation, high dividend yield, and much stronger long-term prospects than it seems on the surface.

That is, at current prices, TSQ stock sports a forward dividend yield of 7.32%. The stock also trades at a discounted valuation relative to its underlying assets. To top it all off, while known mainly as a radio broadcasting company, Townsquare’s main business is now digital, not terrestrial radio.

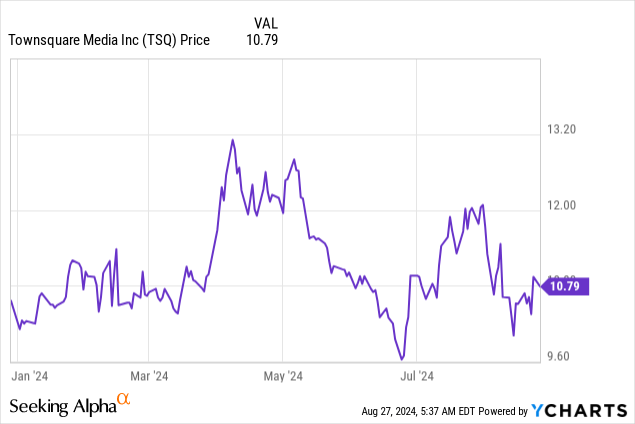

Admittedly, that’s not to say that Townsquare is a perfect, problem-free enterprise. There’s a good reason why TSQ stock, after a strong run between late 2023 and early 2024, has delivered sideways price performance in more recent months.

However, considering both company-specific and macro factors, you may want to consider it yet another solid buy among undervalued microcap stocks. Here’s why.

Townsquare Media Stock: Background and Recent Performance

Headquartered in Purchase, New York, Townsquare Media consists of three main business units:

- Townsquare Interactive (a digital marketing services provider).

- Townsquare IGNITE (a programmatic advertising technology platform operator).

- Townsquare Media (Townsquare’s portfolio of 349 local radio stations, as well as its portfolio of digital media properties).

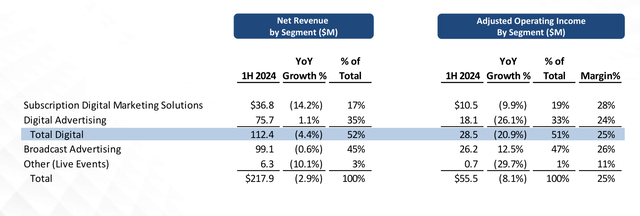

As mentioned above, Interactive and IGNITE provide are both larger contributors to the top and bottom line than the company media properties. According to Townsquare’s latest investor presentation, during the first half of 2024, the digital segments made up 52% and 51% of the company’s overall revenue and adjusted operating income, respectively.

Digital, not terrestrial radio, now makes up a majority of Townsquare Media’s (TSQ) revenue and operating income (Townsquare Media Investor Presentation, August 2024)

That said, while digital revenue has grown substantially since the mid-2010s, more recently the digital segment has also contended with declining revenue. Last quarter, for instance, Townsquare Interactive’s revenue declined 14.2% compared to the prior year’s quarter. IGNITE reported year-over-year revenue growth of just 1.1%.

With this, again, it’s not surprising that investors have taken a more mixed stance on TSQ stock. As seen in the chart below, shares made a strong move higher during the early spring, but recent operating results have weighed on performance.

Nevertheless, the recent slump with Townsquare’s digital segment could prove to be short-lived. At least, when one compares Q2 results to that of Q1, and takes into account the prospect of macro challenges like high inflation and high interest rates easing in the quarters ahead.

Undervalued Compared to Peers, With a Path to Bridge the Gap

Although Townsquare Media last quarter reported year-over-year declines in overall revenue and adjusted operating income, it’s important to note that, on a sequential, or quarter-over-quarter basis, Townsquare’s operating performance improved during Q2 2024.

As discussed in the company’s Q2 earnings press release, the company’s Interactive segment is growing again. Townsquare’s management did make some slight adjustments to guidance, but it’s more or less where it was when the company last updated it.

In the Q1 2024 earnings release, Townsquare guided for full-year 2024 revenue of between $440 million and $460 million, and adjusted EBITDA of between $100 million and $110 million. Now, guidance calls for revenue of between $440 million and $455 million, and adjusted EBITDA of between $100 million and $105 million. Meeting this guidance may be within reach, as macro conditions continue to normalize.

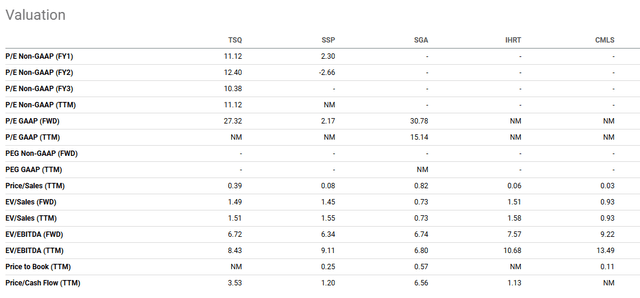

Speaking of EBITDA, the aforementioned guidance suggests that TSQ stock is undervalued. At current prices, shares trade at a forward EV-to-EBITDA ratio of between 6.5 and 6.7 (based on Townsquare’s enterprise value of around $677.2 million).

While this valuation is in line with the forward EBITDA multiple of another micro-cap radio stock, Saga Communications (SGA), this represents a premium to other radio stocks, such as iHeartMedia (IHRT) and Cumulus Media (CMLS).

On a forward EV/EBITDA basis, TSQ stock trades at a discount to most of its peers (Seeking Alpha TSQ stock key stats comparison)

Even if we were to value TSQ at an EBITDA multiple on par with IHRT rather than the more richly priced CMLS, using the low end of forecasted 2024 EBITDA, Townsquare’s true enterprise value may be closer to around $750 million to $760 million. Subtracting $536.6 million in total debt, and adding back $28.5 million in cash, brings us to a net valuation of around $251.9 million, or $16.36 per share.

For now, it may prove challenging for shares to bridge this valuation gap. Impairment charges in recent quarters have masked the company’s profitability. However, given sell-side consensus calling for TSQ to report annual GAAP earnings of $1.01 per share in 2025, pretty soon market participants could become more aware of the company’s underlying value, and re-rate the stock accordingly.

Additional Upside May Also be Within Reach

Even better than the prospect of this stock climbing back up to prices just over 50% above present price levels, is the fact that there may be even greater upside potential with TSQ stock.

It may take time, but in the years ahead, the company’s shareholder-friendly approach could unlock significant value. Besides paying out a large quarterly dividend to investors, the company has, and intends to continue to, use its free cash flow to repurchase shares. In just the last two quarters alone, Townsquare Media has reduced its share count by 7.23%, from 16.6 million to 15.4 million.

As Boyar Research, which is also bullish on TSQ due to its low valuation and aggressive return-of-capital efforts, noted in its March 2023 write-up on the stock, Townsquare is also using free cash flow to pare down debt. Over a multi-year time frame, this deleveraging, coupled with the reduced share count, could provide an additional boost to long-term upside.

In Boyar’s view, these factors, plus greater awareness by the market of TSQ’s digital transformation, could eventually lead to the stock trading for as much as $25 per share. I wouldn’t necessarily buy TSQ with the expectation that it eventually hits $25 per share, but a move to $15-$20 per share could be within reach if additional catalysts emerge.

Namely, something major such as an asset sale, or an outright sale of the company. Given how much Townsquare IGNITE is tied into the legacy radio business, it’s hard to see this segment being split off or sold off. However, Townsquare Interactive may be a salable business unit.

Per the investor presentation, 58% of its overall revenue comes from subscribers outside markets in which Townsquare owns radio stations. Hence, selling it may not have a substantial impact on the performance of the rest of the company.

Based on the above-mentioned segment data, Townsquare Interactive has an annual EBITDA of around $21 million. Furthermore, this segment may be worthy of a higher EBITDA multiple.

Thryv Holdings (THRY) is a publicly-traded company also operating in the small-to-medium sized business (SMB) cloud-based marketing solutions business. Although THRY currently trades at a similar forward EV/EBITDA ratio as TSQ, a company like Thryv may be willing to pay up for Townsquare Interactive, given potential growth and cost synergies.

As for the prospects of TSQ being acquired outright, numerous strategic and financial buyers may be interested, given the value proposition, and the potential with Townsquare’s digital assets.

Who knows, maybe Entravision (EVC), another “old school” media company that has made a pivot towards digital advertising/media that I have written about recently, could make for a solid merger partner.

Risks to Consider

Beyond the obvious possible macro risk (“soft landing” fails to occur, digital and radio advertising markets remain under pressure) that could impact the bull case. An unexpected worsening of operating performance could also severely affect the stock in another way.

Worsening results could call into question the sustainability of TSQ’s high dividend. Chances are, a full-on dividend cut or suspension would likely severely affect the stock price.

As Boyar pointed out in its analysis, while seemingly manageable, Townsquare is high-levered, and its outstanding debt comes due in 2026. The company does plan to refinance next year, but multiple potential factors, like worsening performance, an unexpected economic downturn, or even the potential for interest rates not to come down as much as currently expected, may re-heighten debt-related concerns about TSQ.

Atop these more explicitly financial-related risks, there’s another factor that may or may not affect future performance. Townsquare Media’s co-founders, Executive Chairman Steven Price, and CFO Stuart Rosenstein, control 98.9% of TSQ’s outstanding Class B super-voting shares.

While these super-voting shares do not give them majority voting control, and super-voting shares are par for the course with broadcasting stocks, this factor could limit the chances a shareholder activist emerges to help speed up the value-unlocking process.

Still, given the dividend and buyback policies, plus the fact that Townsquare hasn’t engaged in “empire-building,” or pricey, questionable acquisitions, the fact that TSQ’s founders remain at the helm isn’t necessarily something that could get in the way of the bull case playing out.

Bottom Line on TSQ Stock

It’s likely going to take some time, but in the years ahead, TSQ stock may eventually bridge the valuation gap. Strategic alternatives like an asset sale or buyout could get it there. So, too, could slow-and-steady moves, like the company’s return-of-capital and debt reduction efforts.

Admittedly, TSQ was an even stronger deep value opportunity late last year when it traded for sub-$10 per share prices. However, even at current levels, and even after Boyar, along with other analysts and commentators, have made the market somewhat aware of the value opportunity here, it’s not too late to buy.

Read the full article here

Leave a Reply